Introduction

As homeowners increasingly seek sustainable solutions, the Colorado Solar Panel Tax Credit emerges as a beacon of opportunity. With the chance to deduct a remarkable 26% of installation costs from state income taxes, this credit not only makes solar energy more accessible but also supports a growing community of eco-conscious individuals. In 2023 alone, millions of families have capitalized on this incentive, showcasing the profound impact it has on reducing energy bills and carbon footprints.

Navigating the application process may seem daunting, but with a clear understanding of eligibility requirements, common pitfalls to avoid, and strategies to maximize benefits, homeowners can confidently embrace the shift to renewable energy. This guide will illuminate the path to harnessing the full potential of the Colorado Solar Panel Tax Credit, turning a commitment to sustainability into tangible savings.

Understanding the Colorado Solar Panel Tax Credit

acts as a fantastic financial incentive for homeowners eager to adopt renewable energy systems. As of 2023, this incentive allows you to deduct an impressive 26% of the total installation costs from your state income taxes, paving the way for substantial savings. To take full advantage of this opportunity, it’s important to own your energy system and have it installed by a qualified contractor.

In 2023, over 1.2 million households claimed more than $6 billion in rebates for residential clean power investments, showcasing the widespread impact of these incentives. Financial advisors emphasize that utilizing such tax credits can significantly lower the upfront costs of adopting renewable energy, making it an even more appealing option for eco-conscious homeowners across Colorado.

Recent case studies further illustrate this point, revealing how families have dramatically reduced their utility costs and carbon footprints by adopting solar heating technologies tailored to their local climates. For instance:

- Homeowners in Southern California have experienced savings of over 70% with efficient water heating systems.

- Those in the Pacific Northwest have effectively utilized evacuated tube systems despite frequent cloud cover, achieving reductions of around 40%.

- Additionally, passive power collection designs, such as those using large south-facing windows, have shown effectiveness in cooler regions, further enhancing efficiency.

It’s truly a win-win situation: not only do you save money, but you also join a growing community of homeowners committed to sustainable living!

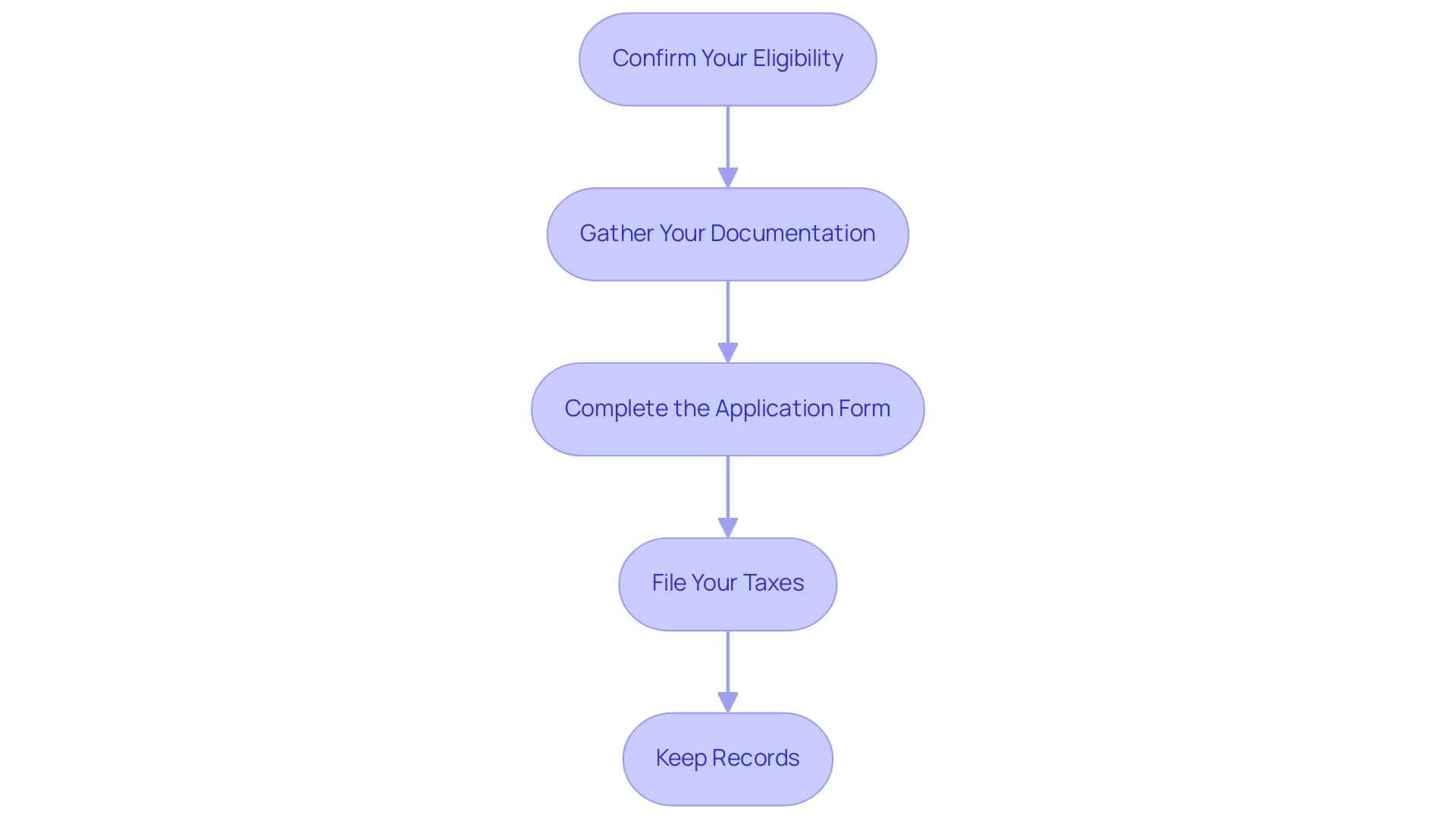

Step-by-Step Guide to Applying for the Tax Credit

Applying for the Colorado Solar Panel Tax Credit is a straightforward process that can lead to significant savings, especially for eco-conscious homeowners looking to invest in renewable resources. Solar panels work by converting sunlight into electricity, which can power your home and reduce your reliance on traditional energy sources. Here’s how to navigate the application process effectively:

- Confirm Your Eligibility: Start by ensuring that your energy system is installed by a qualified contractor and that you own the system outright. It’s essential that your installation complies with all state requirements—this step is crucial for a smooth application.

- Gather Your Documentation: Collect all essential documents, such as your solar installation contract, proof of payment, and any warranties or permits related to the installation. Having these ready will save you time later on.

- Complete the Application Form: Next, fill out the Colorado Department of Revenue’s tax credit application form. You can typically find this form on their official website or through your trusted tax professional. It’s important to ensure that all information is accurate and complete.

- File Your Taxes: When it’s time to file your state income taxes, make sure to include the completed application form along with any supporting documents. This step is essential to ensure you receive your tax credit.

- Keep Records: Finally, maintain copies of all documents you submit for your records. This is not merely a good practice; you may need these for future reference or if any questions come up during the review process.

By meticulously adhering to these steps, you can simplify your application for the Colorado Solar Panel Tax Credit, maximize your savings, and support the expanding movement towards renewable sources in Colorado. is estimated to be 3 to 4 weeks, so be prepared for this timeline. Furthermore, local utilities in Colorado provide various programs and rebates for residential renewable solutions, further enhancing your financial advantages. With Colorado ranking 13th in the nation for solar market growth, investing in solar energy here can lead to lower energy bills and a return on investment typically within ten years. The tax benefit not only reduces your costs but also contributes to a more sustainable environment, making it a win-win for your wallet and the planet!

Common Mistakes to Avoid

When you’re gearing up to apply for the Colorado Solar Panel Tax Credit, it’s essential to navigate the process carefully and steer clear of some common missteps:

- Missing Deadlines: Keep those application deadlines on your radar! Submitting your forms late can mean waving goodbye to your hard-earned tax benefit. According to the IRS, nearly 80 percent of eligible individuals participated in tax incentives like in Tax Year 2010, highlighting the importance of timely submissions.

- Incomplete Documentation: Take a moment to double-check that all required documents are included with your application. Missing paperwork can lead to frustrating delays in processing. Case studies have shown that incomplete applications often result in significant processing delays, which can jeopardize your tax credit eligibility.

- Incorrect Information: Accuracy is key! Make sure every detail on your application form is spot-on. Incorrect information can result in your application being rejected. Experts recommend reviewing your application thoroughly, as even minor errors can lead to complications. As noted by tax advisors, “Ensuring accuracy in your application is crucial to avoid unnecessary rejections and delays.”

- Failing to Consult a Tax Professional: If anything about the application feels overwhelming, don’t hesitate to reach out to a tax expert who understands the ins and outs of incentives in Colorado. Their expertise can help you avoid costly mistakes. As highlighted in a recent review, consulting with professionals can significantly improve your chances of approval.

By staying vigilant and informed about these common pitfalls, you can enhance your chances of a successful application and fully enjoy the benefits of your energy investment. Remember, a little preparation goes a long way!

Maximizing Your Tax Credit Benefits

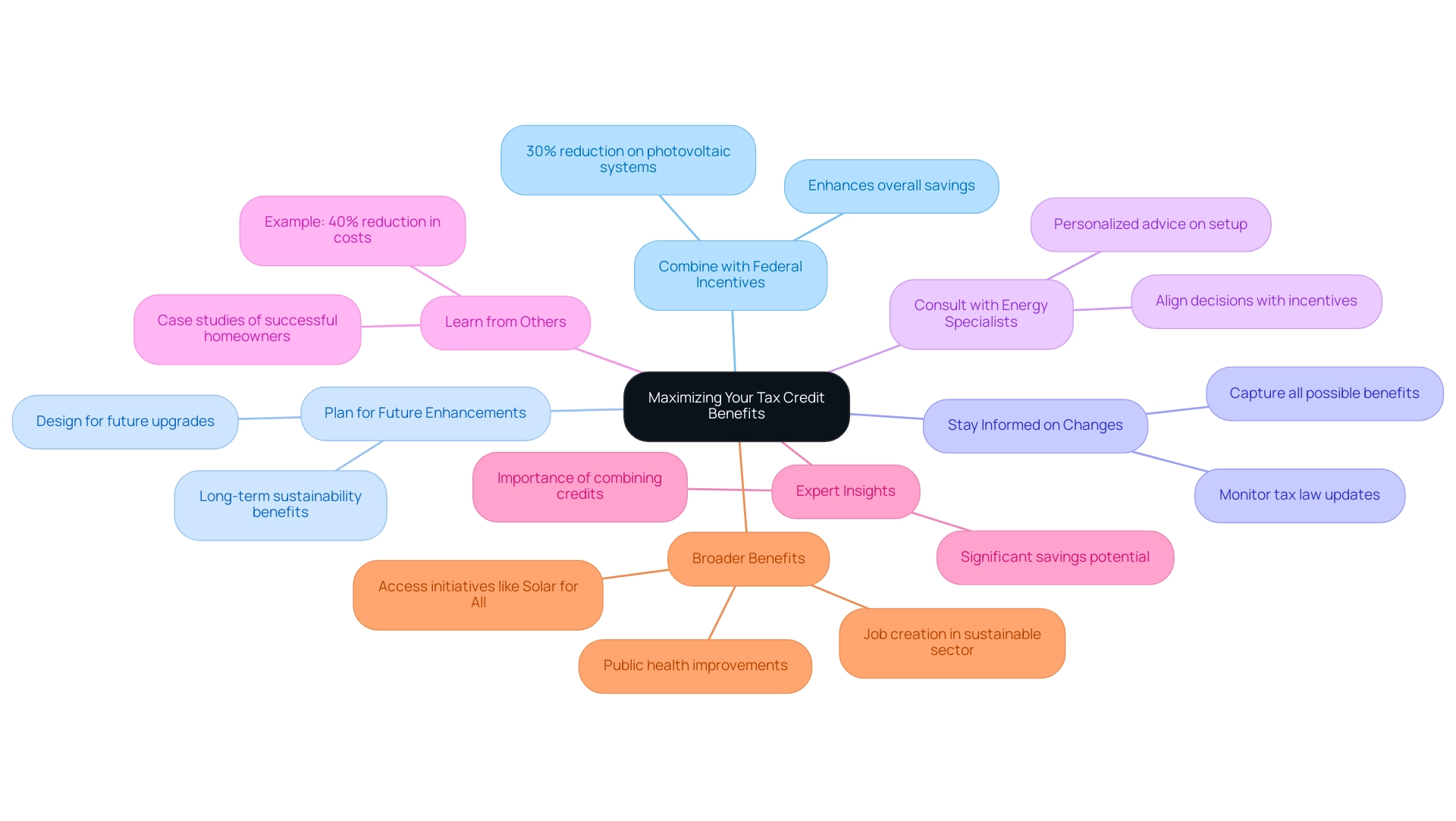

To make the most of your benefits, here are some friendly tips to consider:

- Combine with Federal Incentives: Remember, you can also benefit from federal renewable energy tax reductions alongside your state incentives. For 2023, the federal renewable energy tax incentive provides a substantial 30% reduction on the expense of photovoltaic systems, enabling you to greatly decrease your total investment and enhance your savings. This combination can lead to considerable cost reductions and enhance your financial independence.

- Plan for Future Enhancements: If you’re considering expanding or upgrading your energy system in the future, keep the tax incentive in mind. Designing your system to accommodate future enhancements can open the door to additional benefits in later tax years, further promoting long-term sustainability.

- Stay Informed on Changes: Tax laws and incentives can change, so it’s important to stay updated on any shifts related to the Colorado Solar Panel Tax Credit and other local incentives that may pop up. This knowledge can help you capture all possible benefits that contribute to both your wallet and the environment.

- Consult with Energy Specialists: Engage with knowledgeable installation professionals who can provide personalized advice on structuring your setup to maximize tax incentive benefits. These experts can guide you through your options and help you make informed decisions that align with financial incentives and eco-friendly practices.

- Learn from Others: Consider case studies of homeowners who have successfully combined state and federal energy incentives. For example, one family in Colorado succeeded in lowering their renewable energy installation expenses by more than 40% by effectively utilizing both tax incentives, highlighting the possible savings accessible while aiding in a cleaner planet.

- Expert Insights: Financial experts emphasize the importance of combining these credits. As one expert pointed out, ‘Employing both state and federal incentives is essential for optimizing your return on investment in renewable power.’ It’s a smart financial move that can lead to significant savings while supporting a sustainable future.

- Broader Benefits: Furthermore, investing in renewable sources contributes to job creation in the sustainable sector and can have beneficial public health effects by decreasing dependence on fossil fuels. Initiatives such as the Biden-Harris administration’s Solar for All program aim to improve fair access to renewable resources, ensuring that the advantages of this technology are accessible to various communities.

By implementing these strategies, you can maximize the value of your energy investment. Embracing renewable energy not only helps you save on utility bills but also plays a vital role in reducing greenhouse gas emissions. As Gilbert Michaud, an assistant professor in the School of Environmental Sustainability, notes, “These software packages make things easy for consumers.” With the right tools and information, transitioning to renewable energy can be a straightforward and rewarding experience.

Resources for Further Assistance

If you’re looking to maximize your benefits from , there are several excellent resources at your disposal:

- Colorado Department of Revenue: Their official website is your go-to spot for the latest updates on tax incentives, complete application forms, and essential guidelines. This is where you can stay informed about any changes or new incentives.

- Local Solar Installers: Connecting with certified solar installation companies in your area can be incredibly beneficial. They not only assist you in navigating the installation process but also help you comprehend how to utilize available tax incentives effectively.

- Tax Professionals: Consulting with tax advisors who specialize in renewable energy credits can provide tailored advice that suits your financial situation. They ensure you’re fully aware of the incentives you can claim, allowing you to make the most of your investment in renewable energy.

- Community Energy Programs: Don’t overlook community energy initiatives available throughout Colorado. These programs frequently offer extra financial motivations or resources for homeowners, facilitating the shift to renewable power. Notably, community energy gardens are exempt from property taxes for the percentage of electricity capacity attributed to residential or governmental subscribers, which can significantly enhance the financial benefits.

- Online Forums and Support Groups: Joining online communities focused on solar power can offer invaluable peer support. Sharing experiences within these platforms can assist you in navigating the application process with greater ease and confidence.

Additionally, it’s important to note that the Residential Clean Power Credit has recently increased to a generous 30%, making now an ideal time to invest in clean power solutions. Furthermore, local governments in Colorado may offer property tax or sales tax credits for renewable energy installations, as highlighted in the case study on local renewable energy incentives and rebates. By tapping into these resources, you’ll gain a deeper understanding of the Colorado Solar Panel Tax Credit and set yourself up for a successful application process.

Conclusion

Embracing the Colorado Solar Panel Tax Credit can be a transformative step for homeowners looking to invest in renewable energy while enjoying significant financial benefits. By deducting 26% of installation costs from state income taxes, this credit not only makes solar energy more accessible but also empowers homeowners to reduce their energy bills and carbon footprints. Understanding eligibility requirements, the application process, and common pitfalls ensures a smooth journey toward harnessing these advantages.

Taking proactive steps to maximize the tax credit—such as combining it with federal incentives, planning for future upgrades, and consulting with experts—can further enhance the benefits. Staying informed about changes in tax laws and leveraging available resources can make a substantial difference in the financial outcome of your solar investment.

Ultimately, this credit is more than just a financial incentive; it represents a commitment to sustainability and a cleaner environment. By investing in solar energy, homeowners contribute to a larger movement towards renewable resources, fostering a healthier planet for future generations. Now is the perfect time to take action, embrace solar energy, and enjoy the rewards that come with it.