Overview

In today’s world, we understand that managing energy bills can be a significant concern for homeowners in California. It’s common to feel overwhelmed by the rising costs and the complexities of energy choices. Fortunately, there are various no credit check power company options available that can ease this burden. Companies like Powercore Electric, Payless Power, and Peace Power offer flexible energy solutions without requiring credit checks or deposits, paving the way for a more accessible energy experience.

Imagine having the freedom to choose an energy plan that fits your needs without the worry of credit checks. These services not only empower consumers but also promote renewable energy options that can lead to greater energy independence. By making these choices, you can effectively manage your utility costs while contributing to a sustainable future.

Together, we can explore these empowering solutions that allow you to take control of your energy usage. If you’re ready to make a change, consider reaching out to these companies to learn more about how they can support your energy needs. Remember, you’re not alone in this journey; we’re here to guide you towards a brighter, more sustainable future.

Introduction

Navigating the energy landscape can feel overwhelming for homeowners, especially in California, where rising utility costs and stringent credit checks often create barriers to accessing essential services. We understand that this situation can lead to stress and uncertainty.

Fortunately, there are several no credit check power companies available that offer innovative solutions designed to alleviate these financial burdens. This article explores seven options that empower homeowners to take control of their energy needs without the worry of upfront deposits or credit evaluations.

Together, we can find the best fit for your unique situation, allowing you to embrace energy independence and ease your financial concerns.

Powercore Electric: No Deposit, No Credit Check Energy Solutions

Are you feeling overwhelmed by rising energy bills? Powercore Electric understands your concerns and stands out as a no credit check power company by offering innovative power solutions that require no deposit, making it an excellent choice for California homeowners. Their services encompass solar panel installations and power storage systems, empowering you to harness clean resources without the financial hurdles often associated with traditional power suppliers. This approach not only fosters independence in energy sources but also reflects the company’s commitment to supporting the local community by making renewable energy accessible to everyone.

Imagine the relief of starting to save on your electricity bills right away, with potential reductions of 70% to 100% depending on local regulations. With flexible payment options, you can take control of your energy costs. The 25-year manufacturer warranty on solar panels ensures long-term reliability and peace of mind, reinforcing the value of your investment. As David Zeledon beautifully states, “Solar is a dependable power source that can supply electricity to those in need with little-to-no impact on the environment.”

Together, we can embrace a future where solar power is both affordable and environmentally friendly. Powercore Electric’s approach illustrates how we can pave the way for a more sustainable tomorrow. If you’re ready to explore these opportunities, let’s work together to find the best energy solutions for your home.

Payless Power: Flexible Prepaid Electricity Plans Without Credit Checks

We understand that managing energy bills can be a significant concern for many homeowners. Payless Power, a no credit check power company, offers prepaid electricity plans that empower you to take control of your utility costs by allowing you to pay for your consumption in advance. This flexibility is particularly beneficial for those who want to proactively manage their expenses. By embracing a pay-as-you-go model, you can avoid unexpected charges and maintain better control over your energy usage, making it an ideal choice for budget-conscious consumers.

Notably, over 5 million Texans have found value in Payless Power’s plans, which highlights their effectiveness in delivering savings. These plans come with daily usage notifications that help you track your consumption and prevent service interruptions. While it’s important to note that prepaid plans may have higher per-kWh rates compared to postpaid options, some customers have experienced unexpectedly high daily charges, which is crucial to consider when making your choice.

As one satisfied customer shared, “Payless Power really came through for me in a very bad bind and situation. Easy enrollment, easy payment making, and daily advisement, which is a total plus for a busy life.” If you’re exploring prepaid electricity plans, we encourage you to research and compare various options to find the best fit for your unique power needs. Together, we can work towards a more manageable and supportive energy solution that aligns with your lifestyle.

Pogo Energy: Pay-As-You-Go Electricity with No Credit Check

We understand that managing energy bills can be a source of stress for many homeowners. Pogo Energy, a no credit check power company, offers a pay-as-you-go electricity solution that alleviates this concern by removing the necessity for credit checks, allowing clients to pay only for the power they use. This flexible model is especially beneficial for those with fluctuating incomes, as it offers the freedom to manage energy costs through a no credit check power company, without the burden of long-term contracts. Imagine being able to top up your account with as little as $60, ensuring prompt access to power without the fear of disconnection during transitions.

Additionally, Pogo Energy’s proactive communication strategy keeps you informed about your account balances. We send alerts before your balance reaches zero, helping to prevent service interruptions. This approach not only enhances customer satisfaction but also empowers property owners to maintain control over their expenses. Together, we can work towards a solution that is both dependable and flexible, making it an ideal choice for those seeking energy independence. Let’s take this step towards a more manageable and supportive energy experience.

Now Power Texas: No Deposit Electricity Plans for Easy Access

We understand that managing energy bills can be a source of concern for many homeowners. That’s why Now Power Texas, a no credit check power company, offers no deposit electricity plans, making it easier for residents to access power without the burden of upfront costs typically associated with traditional suppliers. This compassionate approach is especially beneficial for those who may feel hesitant to commit financially.

By removing the deposit requirement, Now Power Texas opens the door for more consumers to explore renewable power alternatives, supporting the growing demand for sustainable solutions. Together, we can embrace a future where energy independence is within reach.

Let’s work towards making your energy choices not only more affordable but also aligned with your values for a greener tomorrow. Contact us today to learn how we can support you on this journey.

Peace Power: Energy Services Without Credit Checks

We understand that navigating energy bills can be overwhelming for homeowners in California. Peace Power serves as a no credit check power company that offers power solutions designed to alleviate this burden, removing the need for background checks and making it a dependable choice for those seeking reliable energy options. This commitment to accessibility is crucial, especially for individuals with imperfect financial backgrounds who often struggle to secure utility resources. As noted by various sources, prepaid electricity allows consumers to bypass credit assessments and security deposits, which is a key feature of a no credit check power company like Peace Power, aiming to provide accessible power solutions.

By prioritizing customer care and community support, Peace Power has established itself as a trustworthy provider for a diverse range of customers, including:

- Low-income families

- Youth

- Frequent travelers

- Anyone in search of flexible power solutions

Effective implementations of these accessible power solutions not only empower clients but also promote responsible resource use. With a focus on enhancing self-sufficiency in energy management, Peace Power stands out as a reliable no credit check power company for property owners who want to manage their power needs without the stress of financial evaluations. Together, we can explore how Peace Power can support your energy journey, ensuring you have the resources you need to thrive.

SaskPower: Accessible Energy Programs Without Credit Checks

We understand that managing energy bills can be a significant concern for homeowners. That’s why SaskPower is considered a no credit check power company, offering accessible power programs that remove the need for credit checks, making it easier for you to access essential utility services. These initiatives are thoughtfully designed to help you effectively manage your expenses while also promoting sustainable practices. To benefit from these programs, participants need to be customers of specific power companies and have a qualifying household income.

By providing solutions that cater to various financial situations, SaskPower demonstrates a strong commitment to ensuring power is available for everyone. Imagine saving up to $230 a year on your utility bills through the Energy Assistance Program—this not only highlights the program’s value but also underscores the potential for financial relief.

Testimonials from satisfied participants, like Chris Tessmer, remind us that “There are so many small ways to save and they’re all right under our noses!” This approach not only helps lower utility costs but also aligns with broader goals of efficiency and sustainability. It’s common to feel overwhelmed by financial constraints, but these programs ensure that even those with limited means can access reliable power solutions from a no credit check power company.

Furthermore, understanding the context of Saskatchewan’s historically low investment in efficiency programs emphasizes the importance of these initiatives. Together, we can work towards a future where energy independence is within reach for everyone. If you’re interested in these programs, we encourage you to reach out to SaskPower for guidance on eligibility and the application process. Let’s take this step towards a more sustainable and supportive energy future together.

FICO: Understanding Utility Credit Checks and Your Options

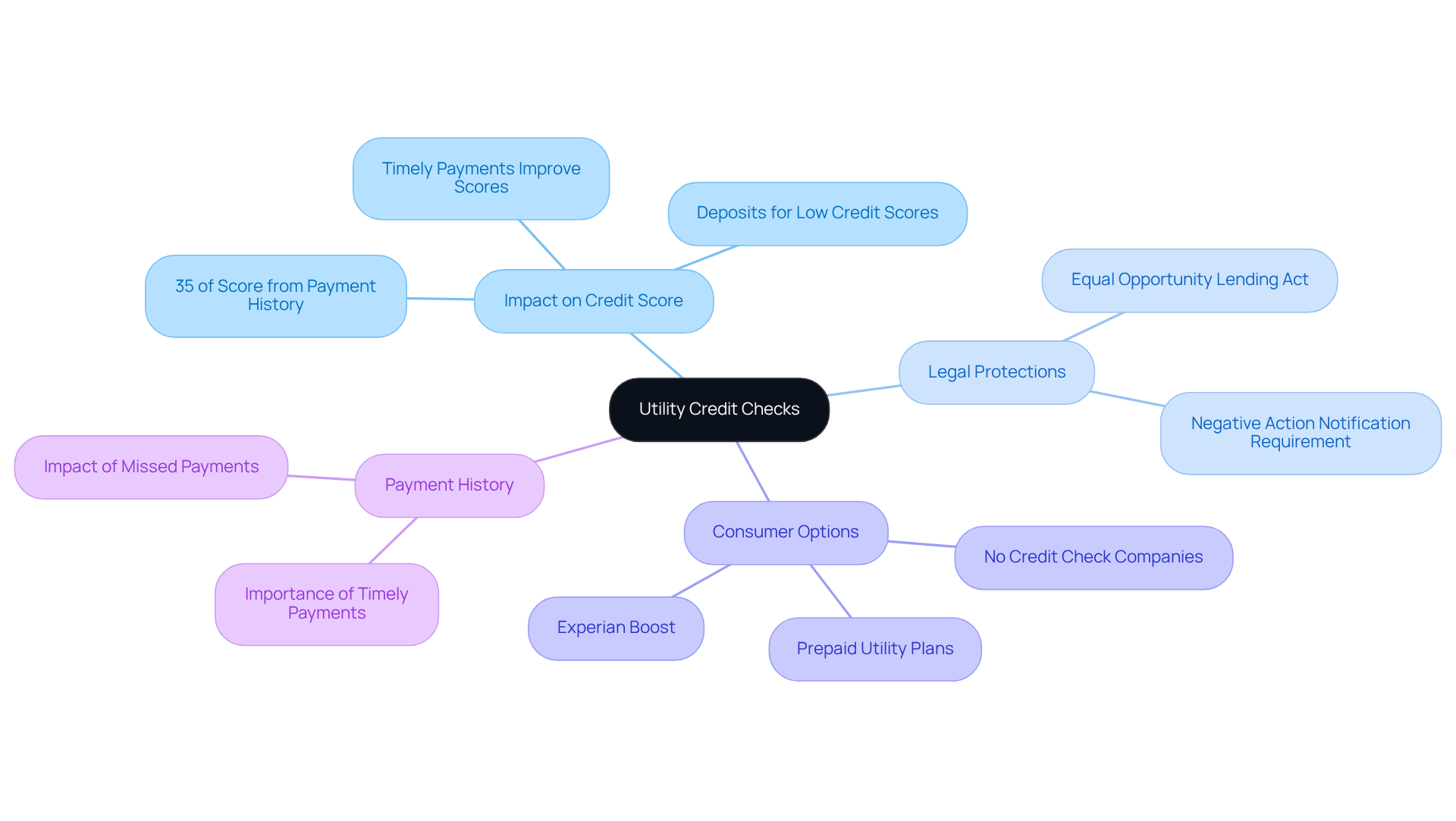

Utility evaluation assessments are crucial for homeowners, especially in California, as they significantly influence power options. We understand that navigating these evaluations can be daunting, particularly when they assess a consumer’s creditworthiness, impacting the availability and cost of energy resources. Although specific statistics on the percentage of affected homeowners weren’t provided, it’s common for utility companies to require deposits or limit service options for those with less favorable financial histories.

Understanding the implications of these financial assessments is essential for you as a consumer. Payment history, which constitutes 35% of your credit score, is a key factor that utility companies consider. This means that timely utility payments can enhance your score, while missed payments might lead to increased costs and service limitations. Resources like Experian Boost can empower you to leverage your utility payment history to improve your scores. However, utilizing this service requires granting Experian access to your payment details and confirming your utility payments.

Moreover, the Equal Opportunity Lending Act provides a pathway for consumers to demonstrate their reliability, even if their partner has a poor financial rating. This legislation ensures that financial assessments are fair and do not unfairly penalize individuals based on their partner’s financial background.

Additionally, utility providers are obligated to issue a negative action notification within 30 days of denying service. This is a vital consumer protection measure that informs property owners of their rights concerning financial assessments. As a homeowner, you might also consider exploring options from a no credit check power company or prepaid utility plans, which could serve as alternatives that do not require stringent financial assessments.

Given these considerations, we encourage you to stay informed about your financial status and investigate resources that clarify the assessment process. By understanding how utility assessments work, you can make more informed choices about your service providers and seek options from a no credit check power company that may not involve rigorous financial evaluations. Together, we can navigate this landscape and find solutions that suit your needs.

Experian: Insights on Utility Companies and Credit Checks

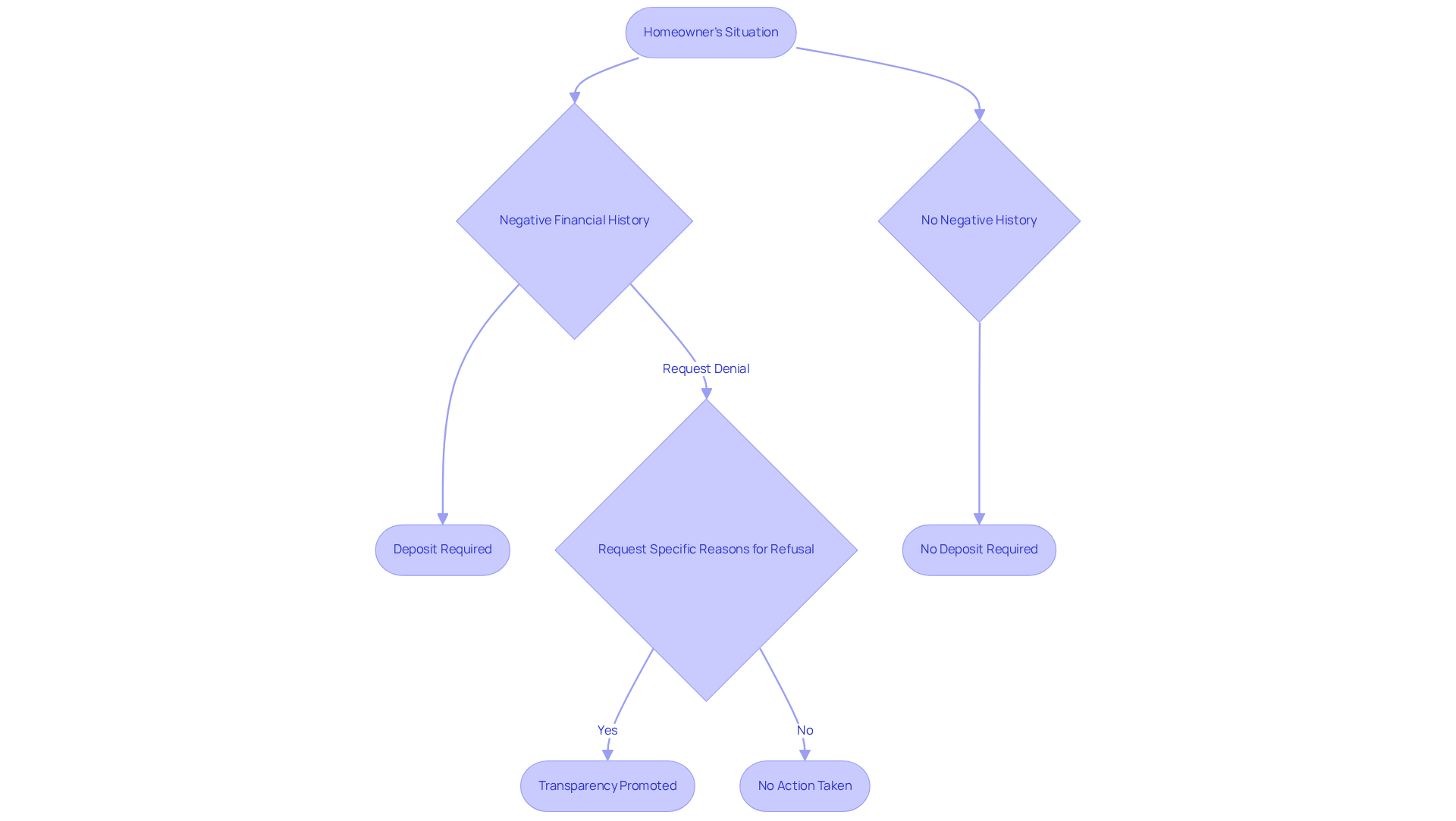

We understand that many homeowners are concerned about how their financial history might impact their ability to secure energy resources, especially when considering a no credit check power company. Experian provides valuable insights into how utility firms assess potential customers, which is crucial for navigating these challenges.

When a negative financial history is discovered, utility providers often require a deposit, significantly affecting the costs associated with application processes; however, a no credit check power company may not impose such requirements. By familiarizing yourself with the criteria utility companies use, including the fact that a single hard inquiry can typically lead to a few points’ drop in your FICO Score, you can make informed decisions and find a no credit check power company that fits your financial situation.

It’s common to feel uncertain, but remember that you have the right to request specific reasons for any refusal within 60 days of receiving a notice. This promotes transparency in the process and empowers you as a consumer. Additionally, consider exploring budget billing plans that may be available to help manage your utility expenses effectively.

This knowledge is essential for California homeowners striving to secure reliable utility services while addressing credit concerns. Together, we can work towards a more stable and supportive energy future.

OEB: Consumer Protection and Assistance for Energy Access

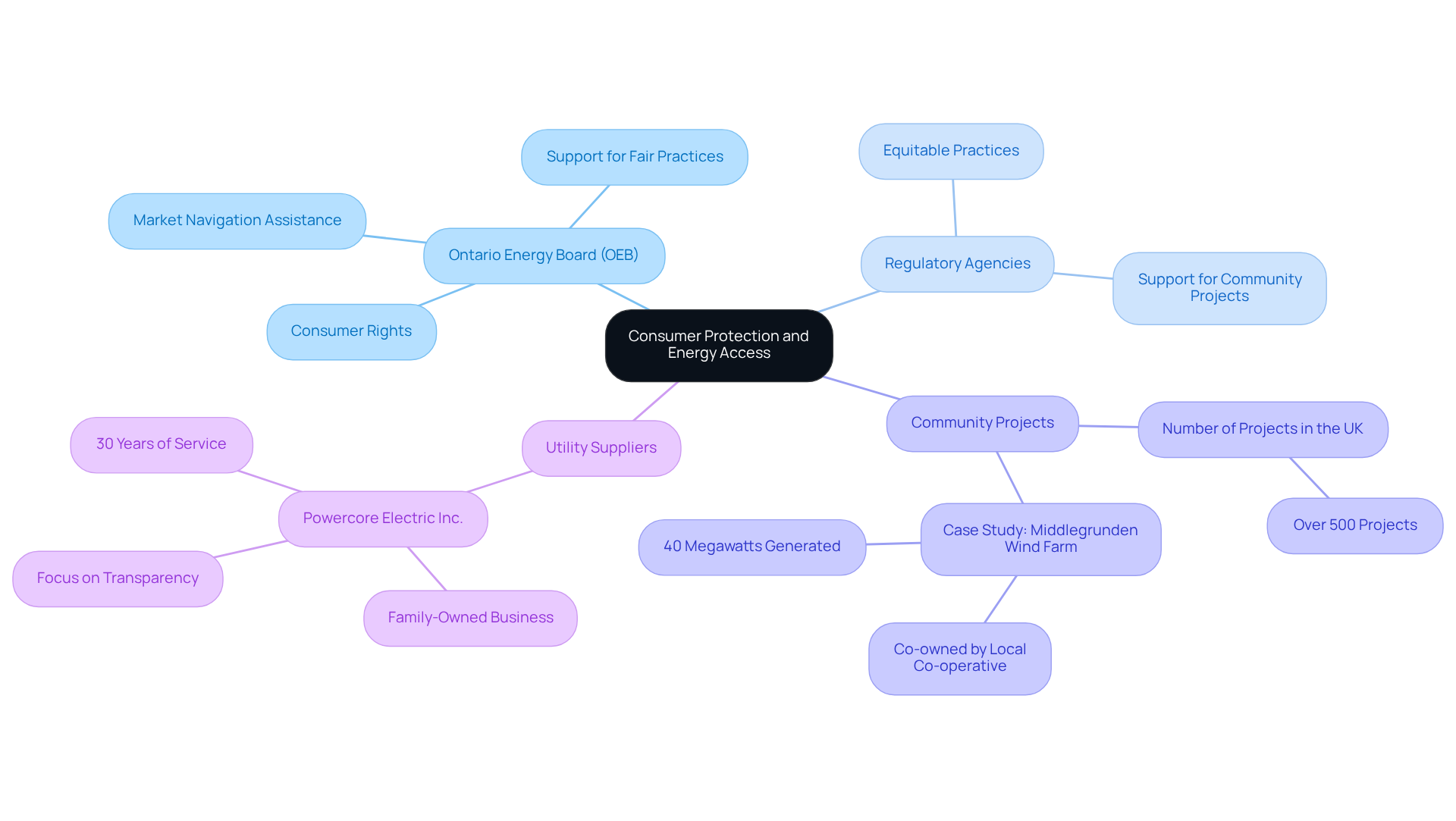

We understand that navigating energy bills can be a source of stress for many homeowners. The Ontario Energy Board (OEB) plays a vital role in consumer protection and support for access to power, ensuring that power suppliers adhere to fair practices and providing assistance to consumers as they navigate the market. By promoting openness and accessibility, the OEB helps you make knowledgeable choices regarding your utility services, guaranteeing that everyone has the chance to obtain dependable power. This dedication to consumer protection is essential in fostering a just and equitable environment.

In California, regulatory agencies like the OEB are crucial in upholding equitable practices in the sector. This is similar to the increasing number of community projects, which have exceeded 500 in the UK, highlighting the significance of local involvement in solutions.

Powercore Electric Inc., a family-owned business in Roseville, exemplifies this commitment to transparency and community focus, ensuring that California residents can rely on their utility suppliers. It’s common to feel overwhelmed by the options available, but by staying informed about your rights and the resources available to you, you can navigate the power market effectively and access the best solutions for your needs.

Together, we can work towards a brighter, more sustainable future.

CIBC: Managing Your Credit Report for Better Energy Access

Overseeing your financial report is essential for property owners who are concerned about managing their utility services effectively. We understand that navigating the complexities of financial reports can feel overwhelming, but by taking proactive steps to maintain a positive financial history, you can significantly enhance your chances of accessing utility solutions that may seem out of reach.

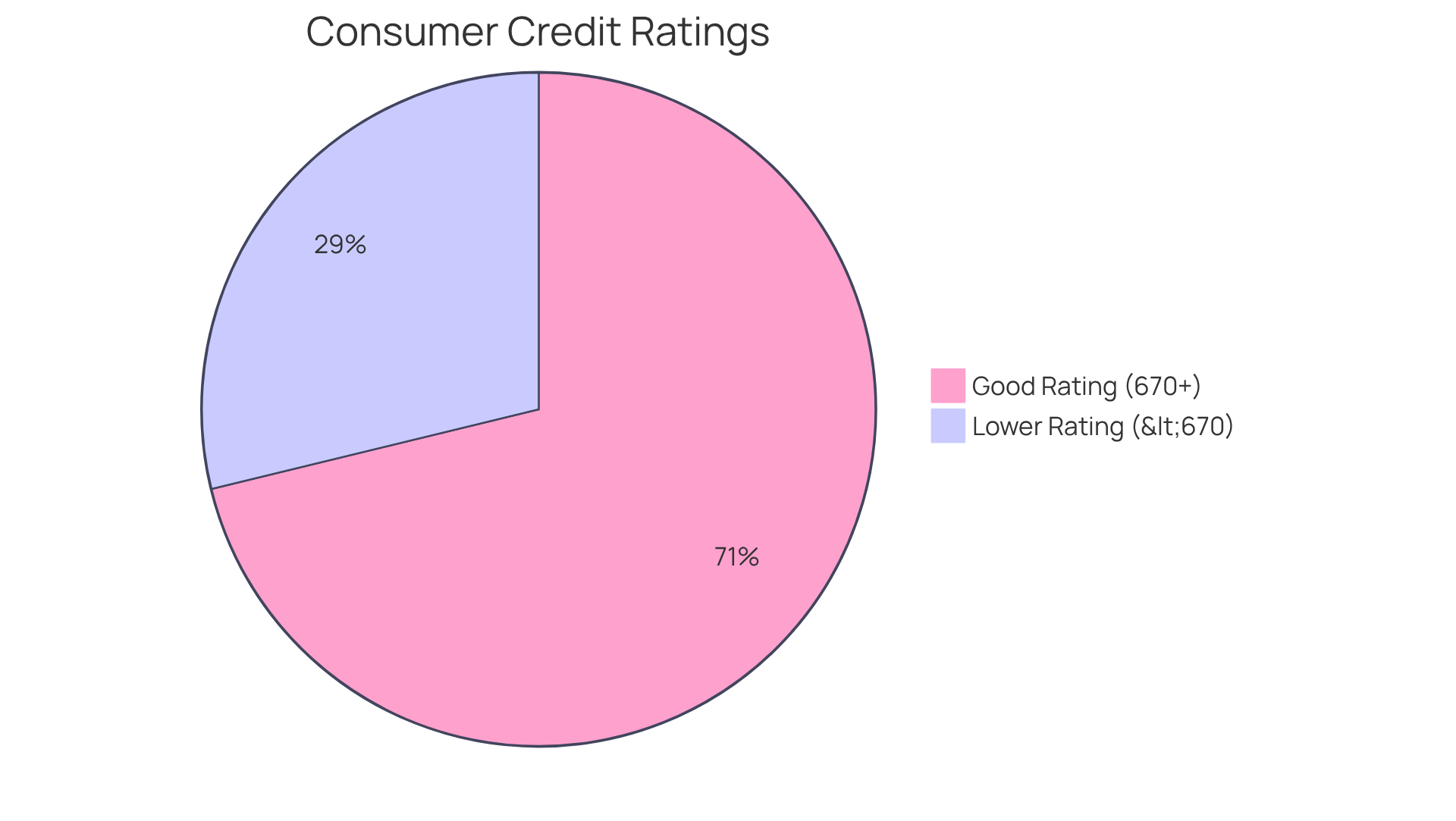

In fact, did you know that 71.2% of consumers received a good or better rating (670 or higher) in 2024? With the average score in the U.S. being 715, it’s clear that many homeowners are already on the right path. This financial awareness empowers you to manage your circumstances better, allowing you to explore a wider array of utility choices, including those from a no credit check power company, as well as no-deposit and prepaid plans offered by companies like SaveOnEnergy, which cater to those with limited financial backgrounds.

There are numerous success stories, such as the implementation of Experian Boost, which helps consumers quickly improve their FICO Score by recognizing timely payments for utility bills. This illustrates how enhanced financial management can lead to better energy service options, ultimately fostering a more sustainable energy future.

As Oscar Wilde wisely noted, ‘A man who pays his bills on time is soon forgotten.’ This emphasizes the importance of maintaining a positive credit history, and together, we can work towards achieving that goal.

Conclusion

Navigating the world of energy solutions can feel overwhelming, especially for homeowners in California who are often burdened by credit checks and high deposits. We understand that these financial barriers can create stress and uncertainty. This article highlights several no credit check power companies that provide innovative and flexible options, allowing you to access energy without the traditional hurdles. By exploring these alternatives, you can find the right fit for your needs, paving the way for a more manageable energy experience.

Key insights reveal the advantages of companies like:

- Powercore Electric, which offers renewable energy solutions without requiring a deposit.

- Payless Power, which provides prepaid plans that empower you to control your spending.

- Pogo Energy and Now Power Texas, which further illustrate the variety of options available, catering to different financial situations and preferences.

Each of these companies emphasizes flexibility and accessibility, ensuring that energy independence is within your reach.

As the landscape of energy providers evolves, it’s crucial to stay informed about your options. Embracing no credit check power companies not only fosters personal financial management but also contributes to a more sustainable energy future. We encourage you to explore these alternatives and take proactive steps towards securing reliable energy solutions that align with your values and needs. Together, we can work towards a brighter and more sustainable energy future.