Overview

Phone companies that do not conduct credit checks, such as prepaid providers like Mint Mobile, Cricket Wireless, and Boost Mobile, offer a compassionate solution for those looking to stay connected without the burden of financial scrutiny.

This approach promotes inclusivity, allowing individuals with limited financial histories—like students and low-income individuals—to access essential services.

We understand that navigating financial evaluations can be stressful, and this option alleviates that concern, enabling everyone to maintain their connections without added pressure.

Introduction

In an age where connectivity is essential, it’s common to feel excluded from vital telecommunications services due to the barriers imposed by credit checks. We understand that this can be frustrating and disheartening.

Fortunately, a growing number of phone companies are stepping up to offer alternatives that prioritize accessibility and inclusivity, ensuring that everyone has the opportunity to stay connected.

This article explores the landscape of mobile providers that do not conduct credit checks, revealing options that empower consumers, particularly those with limited financial histories.

However, as these options expand, it’s important to reflect on the trade-offs involved: what are they, and how do these plans truly impact users in the long run?

Define Phone Companies That Don’t Conduct Credit Checks

We understand that navigating financial assessments can be daunting, especially for those with limited financial history. When considering what phone company doesn’t do credit checks, it’s important to note that many providers offer prepaid arrangements or alternative funding options, allowing customers to access vital telecommunications services without the burden of financial scrutiny. This approach emphasizes accessibility, ensuring that individuals with low or no financial history can stay connected.

Prepaid providers like Mint Mobile and Cricket Wireless offer plans that align with what phone company doesn’t do credit checks, empowering users to pay in advance. This method not only broadens access to mobile services but also enables consumers to manage their finances without the stress of financial evaluations. Together, we can find solutions that make staying connected easier for everyone.

Explore Reasons for Avoiding Credit Checks

Many customers are interested in finding out what phone company doesn’t do credit checks due to their concerns about financial ratings or past monetary challenges. We understand that background checks can pose significant hurdles for individuals with limited financial histories or those who have faced economic difficulties, leading many to wonder what phone company doesn’t do credit checks.

By eliminating financial assessments, companies like what phone company doesn’t do credit checks can reach a broader audience, including:

- Students

- Low-income individuals

- Those on the path to recovery from financial hardships

This approach not only promotes inclusiveness but also allows consumers to access essential communication options without the anxiety of being denied based on their financial backgrounds, leading to the inquiry of what phone company doesn’t do credit checks. Together, we can create a more supportive environment that empowers everyone to stay connected.

Assess Benefits and Drawbacks for Consumers

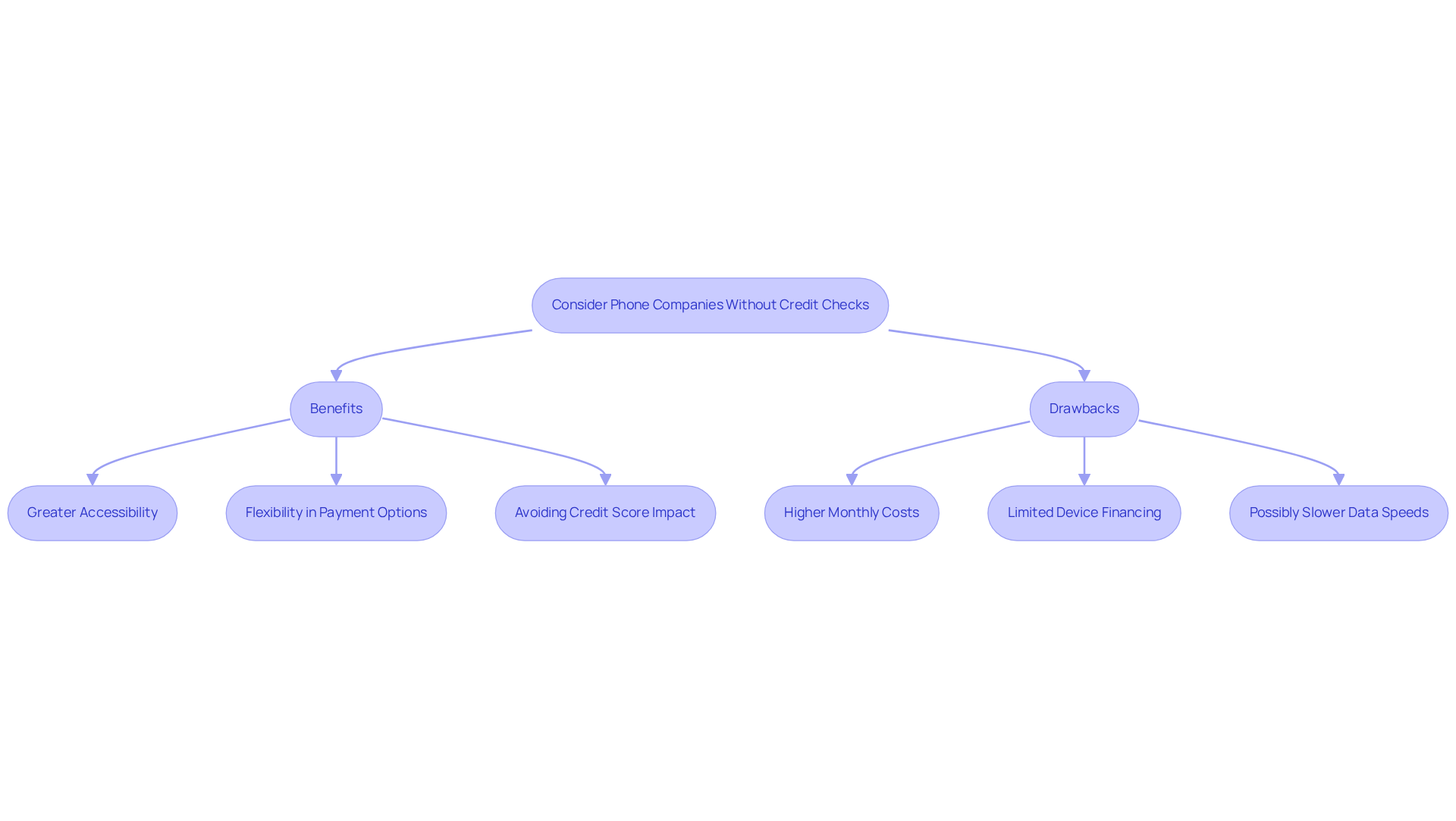

When considering what phone company doesn’t do credit checks, you can enjoy significant benefits, including greater accessibility and flexibility in payment options. This approach allows consumers to avoid potential impacts on their credit scores, which can be a source of concern for many. The flexibility of prepaid options, in particular, enables individuals to pay for services in advance, alleviating the burden of long-term commitments.

However, it’s important to consider potential drawbacks, such as:

- Higher monthly costs compared to traditional postpaid plans

- Limited device financing options

- Possibly slower data speeds during peak usage times

Understanding these factors is essential for consumers as they weigh their choices, ensuring they make informed decisions that align with their needs and circumstances.

Identify Phone Companies Without Credit Checks

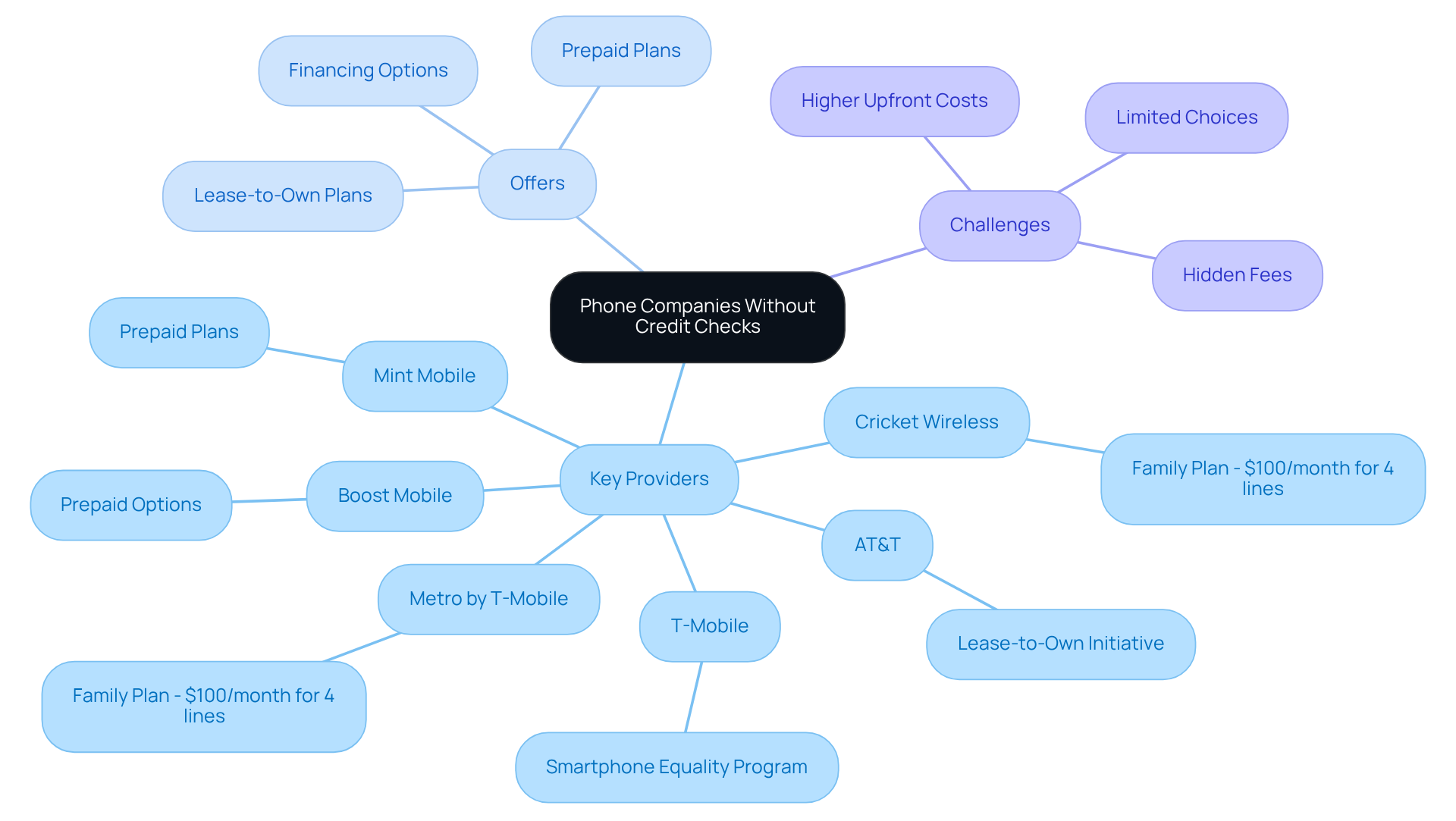

Many phone providers are now offering plans, which raises the question of what phone company doesn’t do credit checks, making telecommunication services more accessible to a broader audience. T-Mobile’s Smartphone Equality Program stands out by providing financing options without the need for financial assessments, promoting inclusivity in mobile access. Similarly, AT&T has introduced a lease-to-own phone initiative that allows customers to acquire devices without undergoing financial evaluations.

When considering what phone company doesn’t do credit checks, notable carriers like:

- Cricket Wireless

- Mint Mobile

- Boost Mobile

offer prepaid options that completely bypass these checks. For instance, Metro by T-Mobile and Cricket Wireless offer family plans for $100/month for four lines with unlimited data, showcasing the affordability of these choices. These providers leverage their extensive networks to deliver reliable support, ensuring that financial barriers do not obstruct access to essential communication.

However, it is important for consumers to remain aware of potential challenges, including:

- Higher upfront costs

- Limited choices

- The possibility of hidden fees

Additionally, locating no-credit-check providers with solid rural coverage can be difficult, making it crucial for users to thoroughly research their options. This shift towards options from what phone company doesn’t do credit checks reflects a growing market trend that caters to consumers who value flexibility and accessibility in their telecommunications selections.

As one satisfied customer, GUSS K., expressed, “Thank you for the advice. I am very happy with the work you are doing… Everyone has been so nice and helpful.

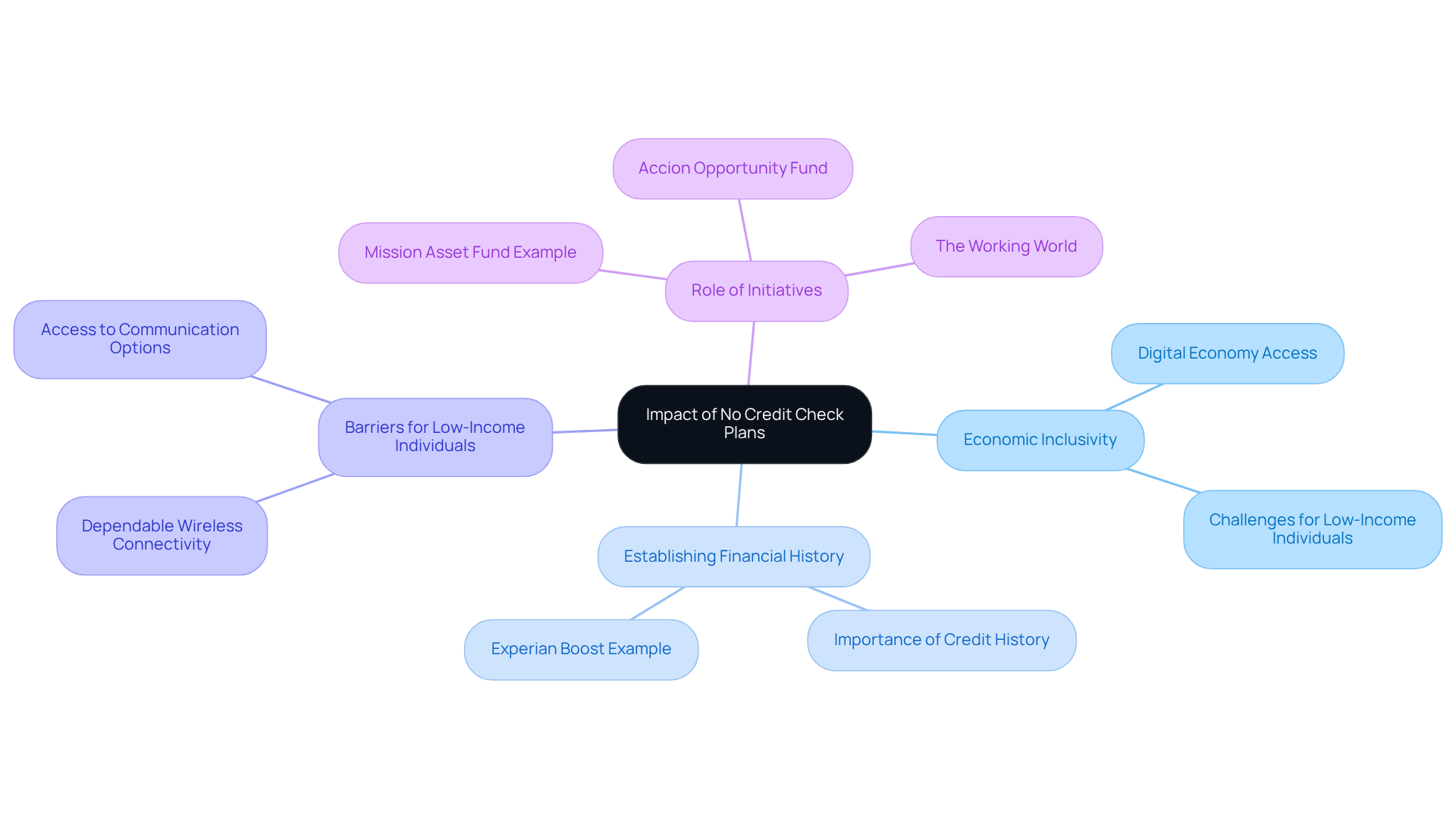

Understanding the Impact of No Credit Check Plans

No financial assessment options are essential in promoting economic inclusivity within the telecommunications sector. We understand that access to mobile services can be challenging for individuals from various financial backgrounds. By allowing these individuals to connect, obtain essential information, and engage in the digital economy, these initiatives play a crucial role in closing the digital gap.

As Mel Jones observes, “One of the most crucial aspects of financial inclusion is the capacity for individuals to create a financial history,” which emphasizes how these initiatives assist people in establishing their creditworthiness.

As the demand for flexible and accessible portable solutions continues to rise, it is expected that more consumers will ask what phone company doesn’t do credit checks, significantly impacting the future landscape of the telecommunications industry.

It’s common to feel concerned about the barriers that low-income individuals face in obtaining communication options, especially as we approach 2025. Statistics suggest that a significant segment of this demographic lacks dependable wireless connectivity, highlighting the necessity for inclusive solutions.

For instance, the Mission Asset Fund provides no-interest ‘lending circle’ loans to help low-income consumers achieve financial success, illustrating practical examples of financial inclusivity.

Together, we can emphasize that ensuring access to mobile services is a critical step toward achieving true financial inclusion, enabling individuals to improve their economic circumstances and engage fully in society.

Conclusion

The exploration of phone companies that do not conduct credit checks highlights a significant shift in the telecommunications landscape, prioritizing accessibility for consumers who may otherwise face barriers. By providing prepaid options and alternative financing methods, these companies are nurturing an inclusive environment where everyone can maintain vital communication without the fear of financial scrutiny.

Key insights reveal the benefits of these no credit check plans, such as greater flexibility and the ability to manage expenses without impacting credit scores. Providers like Mint Mobile, Cricket Wireless, and T-Mobile’s Smartphone Equality Program exemplify how the industry is evolving to meet the needs of diverse consumer demographics, including students and low-income individuals. However, it’s essential to remain aware of potential drawbacks, such as higher costs and limited device financing options.

Ultimately, the push for no credit check mobile services is not just about convenience—it’s a crucial step toward financial inclusion. As the demand for accessible communication solutions continues to grow, we encourage consumers to actively explore their options and support initiatives that promote equitable access to technology. Together, we can contribute to closing the digital divide and empower individuals from all financial backgrounds to thrive in an increasingly connected world.