Overview

We understand that as investors, the significance of the SPWR earnings date can weigh heavily on your mind. It’s common to feel uncertain about how this date influences stock performance and market sentiment. By grasping the implications of earnings reports—such as revenue growth and profit margins—you can gain strategic insights that empower you to navigate potential market volatility. Together, we can explore how these insights can lead to informed investment decisions, providing you with the confidence to approach the market with clarity and purpose.

Introduction

As energy costs continue to rise, many homeowners find themselves searching for effective solutions. The upcoming SPWR earnings date on June 5, 2025, represents a critical moment for investors, and we understand how this can add to your concerns. This article aims to provide essential insights into SPWR’s financial performance, illustrating how a deeper understanding of earnings reports can empower you to navigate market volatility and seize potential opportunities.

In these challenging times, it’s natural to wonder: how will this latest earnings announcement impact investor sentiment and influence stock prices within the competitive solar landscape? Together, we can explore these questions and work towards a more sustainable future.

Powercore Electric: Combat Rising Energy Costs with Solar Solutions

We understand that rising energy expenses can be a significant concern for homeowners. Powercore Electric is here to offer that empower you to effectively tackle these increasing costs. By installing photovoltaic panels, you can achieve an average decrease of $1,500 each year in your electricity expenses, leading to substantial savings over time. This shift not only promotes energy independence but also helps create a sustainable future, as home-based photovoltaic systems can save you between $20,000 and $75,000 throughout their lifespan.

It’s common to feel overwhelmed with California’s electricity costs rising by about 32% over the last ten years. However, the attractiveness of renewable energy is expanding quickly among homeowners and stakeholders alike. Successful case studies reveal that homes equipped with solar panels sell for an average of 4.1% more than those without, further underscoring the financial benefits of investing in solar solutions.

As the demand for renewable energy continues to rise, we want you to know that Powercore Electric is committed to helping you navigate this transition. Together, we can ensure that you enjoy both economic and environmental advantages. Let’s work towards for your home.

Understanding Earnings Dates: A Crucial Insight for Investors

The SPWR earnings date is a crucial moment for investors, as it signifies when the company reveals its financial performance. We understand that the anticipation surrounding the , set for June 5, 2025, may be significant. It’s common to feel a mix of excitement and concern, especially since expectations surrounding the SPWR earnings date often lead to increased volatility.

Stock prices can experience significant fluctuations in response to financial reports, which can be unsettling. Historical data reveals that stocks in the solar sector, including SPWR, typically react strongly to these announcements, especially around the SPWR earnings date, with price changes reflecting market sentiment and expectations.

Many studies indicate that stock returns during profit announcements are often positive, presenting potential opportunities for gains. By grasping the timing and implications of these announcements, investors can gain a strategic advantage, enabling them to navigate potential market shifts effectively.

We recognize that expert analyses suggest the forecasting power of profit announcements is amplified when multiple firms disclose results on the same day, particularly in cases of negative news. This insight underscores the importance of being prepared for possible price fluctuations around the SPWR earnings date, as these can significantly influence investment strategies.

Moreover, profit volatility is closely linked to the cost of capital, which further impacts stakeholder behavior and stock performance. Together, we can work towards understanding these dynamics and making informed decisions.

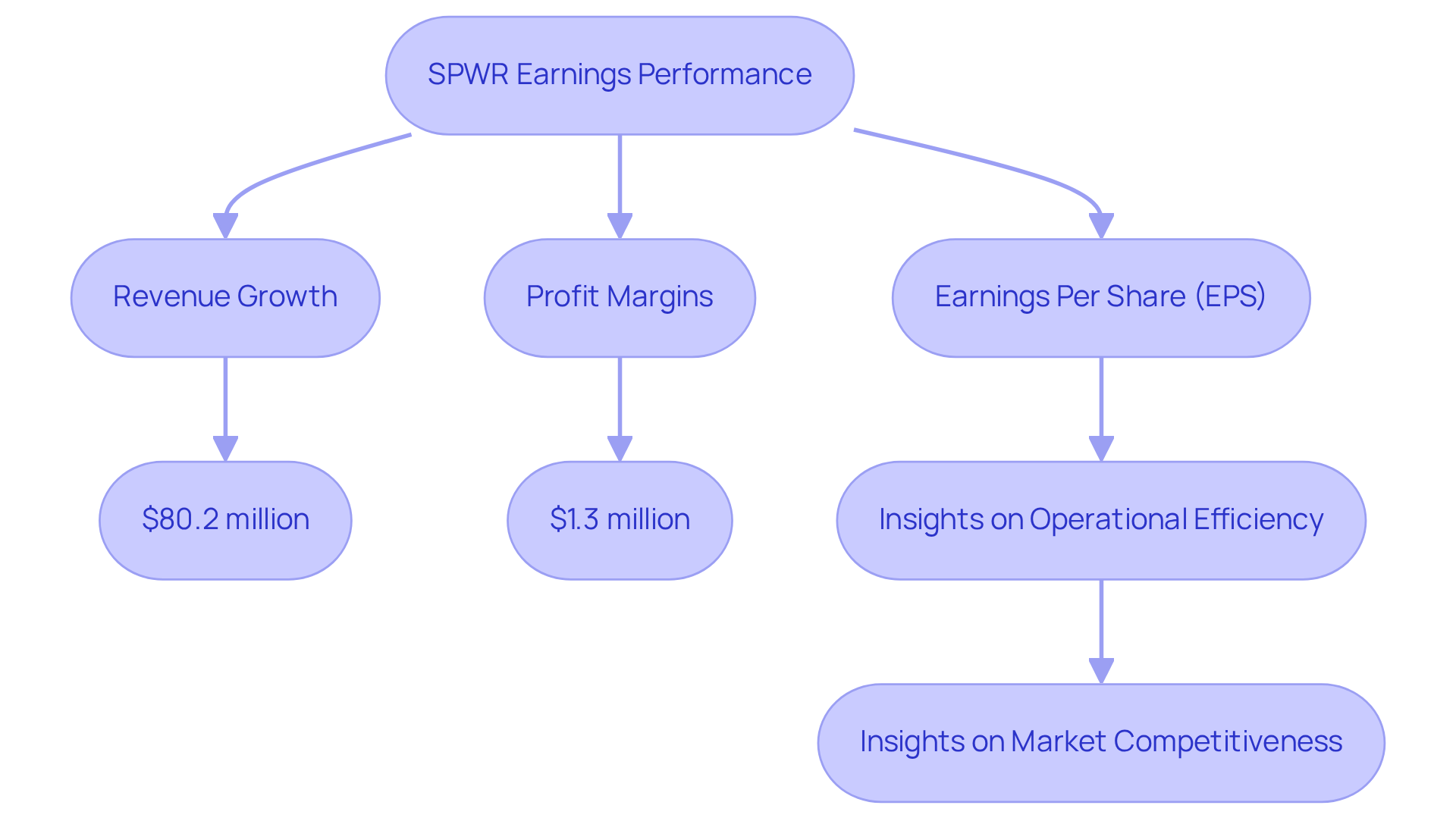

SPWR Earnings Performance: Key Metrics Every Investor Should Analyze

We understand that managing energy bills can be a significant concern for many homeowners. When evaluating SPWR’s around the SPWR earnings date, it’s essential to focus on indicators that matter to you: revenue growth, earnings per share (EPS), and profit margins.

For example, in Q1 2025, the company reported:

- Revenue of $80.2 million

- Profit of $1.3 million, marking a notable turnaround from earlier quarters.

By examining these metrics, you can gain insights into the company’s operational efficiency and market competitiveness, which are crucial in your journey towards energy independence. Together, we can explore how solar energy can not only alleviate your energy costs but also contribute to a sustainable future. Let’s work towards a brighter, more energy-efficient home.

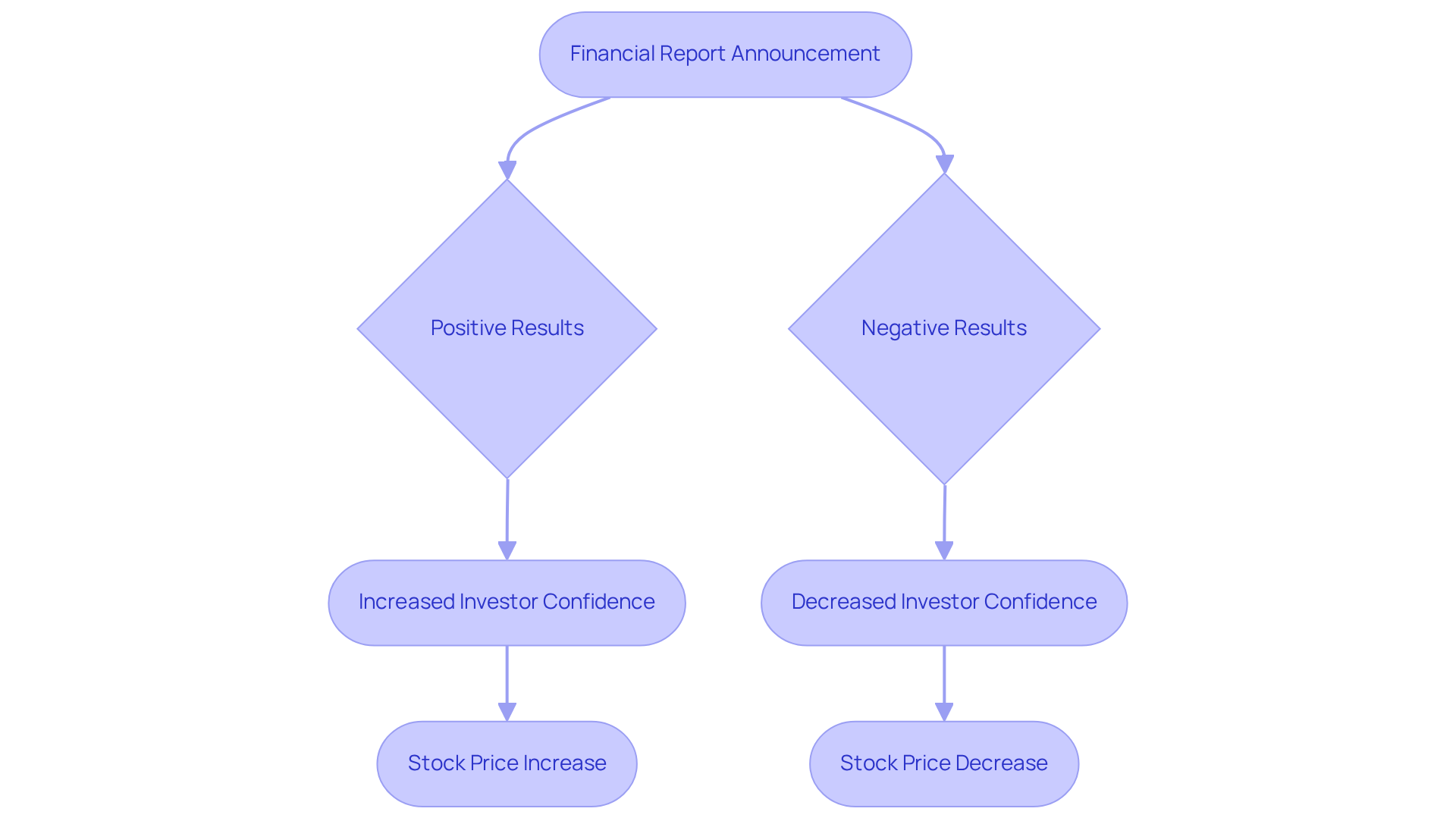

Market Trends: How SPWR Earnings Influence Investor Sentiment

We understand that earnings reports can evoke concern among stakeholders, especially when considering their impact on market dynamics. often lead to stock price increases, reflecting a boost in investor confidence. For example, after announcing a non-GAAP profit of $1.27 million in Q1 2025, the company’s stock saw a significant uptick, highlighting the market’s favorable response to improved profitability.

However, it’s common to feel anxious when financial results disappoint, as evidenced by the SPWR earnings date announcement causing a 5.50% decline in its stock on April 30, 2025. Additionally, the interest coverage ratio of -2.62 raises concerns about potential financial difficulties, which can further sway market sentiment.

Monitoring market trends after these financial reports is essential for those looking to navigate stock fluctuations effectively. The relationship between earnings surprises and stock price movements underscores the importance of strategic timing and informed decision-making in the solar industry. Moreover, the Altman Z-Score of -3.37 signals a heightened risk of bankruptcy, adding another layer of concern for stakeholders.

On a more positive note, with a beta of 0.67, the company’s stock demonstrates lower volatility compared to the market average, which may appeal to risk-averse investors. Together, we can explore these dynamics and seek solutions that foster energy independence and financial stability.

Competitive Landscape: Evaluating SPWR Against Industry Peers

We understand that rising energy bills can be a significant concern for homeowners. In the competitive landscape of , our company faces strong rivals like First Solar and Enphase Energy. However, we want to assure you that a thorough evaluation of our performance reveals promising aspects, including our commitment to market share, pricing strategies, and technological innovations that prioritize your needs.

As of early 2025, we have made notable strides in profitability, yet we recognize that competitors like Enphase have experienced remarkable growth, with their stock soaring over 600% since the market decline in March 2020. This growth is largely due to their advanced microinverter technology, which has gained popularity among installers. We acknowledge these advancements and are committed to offering you the best solutions available.

Market share analysis indicates that while we maintain a robust position, we face competition from First Solar, which has been expanding its utility-scale energy projects and capturing a significant share of the market. It’s common to feel uncertain about these dynamics, especially as the average residential energy system price rose by 3% year-over-year in Q1 2025. This trend reflects the broader industry challenges, including increasing equipment costs and supply chain issues.

Technological advancements are crucial in shaping competitive dynamics. For instance, the adoption of Tunnel Oxide Passivated Contact (TOPcon) modules is becoming prevalent, enhancing efficiency and reducing overall system costs. As we continue to innovate and adapt to these market trends, we are dedicated to tackling these challenges head-on while leveraging our strengths in customer service and community orientation.

We invite eco-conscious homeowners to consider the benefits of solar panel shingles and explore government programs that can provide financial assistance for solar installations. Together, we can enhance the value of your investment and work towards a more sustainable future. Remember, you are not alone in this journey; we are here to support and guide you every step of the way.

Investor Sentiment: The Impact on SPWR Stock Performance

We understand that investor sentiment towards SPWR earnings date can feel overwhelming, particularly since are critical indicators of a company’s health and future prospects. Favorable profit announcements often lead to a surge in shareholder confidence, fostering a heightened demand for the stock. For example, when Broadcom reported strong Q1 results, with a revenue of $14.92 billion compared to the expected $14.61 billion, its stock prices jumped 16% in extended trading, reflecting a wave of investor optimism. This illustrates how similar positive announcements in the renewable energy sector could significantly influence SPWR’s stock performance.

Conversely, it’s common to feel concerned when disappointing financial results dampen sentiment, causing stock prices to decline. This dynamic was evident in the recent challenges faced by US renewable energy firms, where weaker-than-anticipated residential installation demand led to excess inventory and slowed revenue growth. Such trends highlight the importance of closely monitoring financial reports, as the SPWR earnings date can directly influence stock performance and the decisions made by shareholders.

Looking ahead to 2025, the connection between profit reports and stock demand becomes especially crucial. The renewable energy sector is navigating challenges such as increasing interest rates and fluctuating energy prices. Experts suggest that understanding the dynamics surrounding the SPWR earnings date is vital for anyone seeking to effectively navigate the market. Revenues and EPS for photovoltaic firms are anticipated to grow between 10 and 20% annually throughout the sector, offering a hopeful long-term perspective despite current hurdles.

Moreover, as Carlos Slim Helu reminds us, a solid understanding of historical market trends can guide our future investment strategies. By examining profit reports and their impact on stock performance, we can make more informed choices together, aligning our strategies with the evolving landscape of the renewable energy sector. Together, we can embrace the journey towards energy independence and sustainable solutions.

Regulatory Changes: Understanding Their Impact on SPWR’s Earnings

We understand that regulatory changes can be concerning, especially those related to and tariffs, as they significantly impact the SPWR earnings date. A recent overhaul of California’s energy compensation structure, which reduces payments for excess energy sold back to utilities by approximately 80%, serves as a prime example of this shift. It’s common to feel uncertain about such changes, especially given the anticipated discouragement of new installations, highlighted by a significant drop in rooftop renewable energy projects following similar compensation reductions in mid-2023. These reductions in financial incentives can lead to decreased demand for photovoltaic installations, which will directly impact SPWR earnings date and its revenue streams.

Moreover, the phase-out of tax credits poses additional challenges that may resonate with your concerns. For instance, the expected decrease in federal tax credits might lessen the appeal of photovoltaic investments, further limiting market demand. A recent analysis suggests that extending investment tax credits through 2050 could increase annual U.S. photovoltaic generation by 10%. This underscores the significance of these incentives in fostering growth and enhancing energy independence.

As investors, it’s essential to stay alert to these regulatory changes, as they have the potential to transform the company’s strategic direction and financial outlook. Together, we can navigate the interaction between incentive frameworks and market demand, which will be crucial in influencing the company’s performance in this evolving energy landscape. Let’s work towards a future where sustainable solutions not only alleviate your energy concerns but also empower you to take control of your energy choices.

Technological Advancements: Their Role in SPWR’s Growth Potential

We understand that rising energy bills can be a significant concern for homeowners. As you seek solutions, it’s heartening to know that technological advancements in photovoltaic energy are paving the way for a brighter, more sustainable future. Innovations like bifacial photovoltaic panels, which capture sunlight from both sides, can produce up to 30% more electricity than conventional panels, significantly enhancing energy output. Similarly, perovskite solar cells have achieved efficiencies exceeding 25%, with the potential for further improvements, making them a cost-effective alternative to traditional silicon panels.

As the market evolves, these innovations are poised to not only reduce costs but also enhance profitability for companies like SPWR, particularly ahead of the SPWR earnings date, positioning them advantageously against their rivals. The energy storage market is also projected to expand at a compound annual growth rate of 9.5%, reaching $31.72 billion by 2031, highlighting the growing demand for reliable energy solutions that empower homeowners like you.

It’s common to feel uncertain about how these advancements might impact your energy choices. However, observing how these technologies affect a company’s profitability and market share can provide valuable insights. The integration of innovative solutions not only improves operational efficiency but also strengthens a firm’s competitive edge in a rapidly changing energy landscape. Together, we can embrace these changes, as the successful execution of these technologies is likely to be a key factor in the , reflecting a broader trend towards sustainability. Let’s work towards a future where energy independence is within reach.

Customer Feedback: Assessing SPWR’s Reputation and Investor Confidence

Customer feedback plays a pivotal role in shaping SPWR’s reputation and, by extension, investor confidence. We understand that many homeowners are concerned about , and favorable feedback from clients highlights how Powercore Electric offers quick and effective service.

Many customers have remarked that the team ‘stayed on schedule’ during installation projects, which speaks to our commitment to reliability. This is not just about service; it’s about building strong community ties and a dedication to exceptional care.

Customers have expressed their satisfaction, stating they would recommend Powercore to friends, reinforcing the importance of trust in our community. This level of customer satisfaction is crucial, especially in the solar industry, where experiences can directly influence market dynamics.

By comprehending these metrics, stakeholders can better evaluate SPWR’s market position, especially in relation to the SPWR earnings date and its potential for future expansion. Together, we can work towards a sustainable future, especially considering Powercore Electric’s local knowledge and dedication to providing sustainable energy solutions for California communities.

Let’s take this journey towards energy independence together.

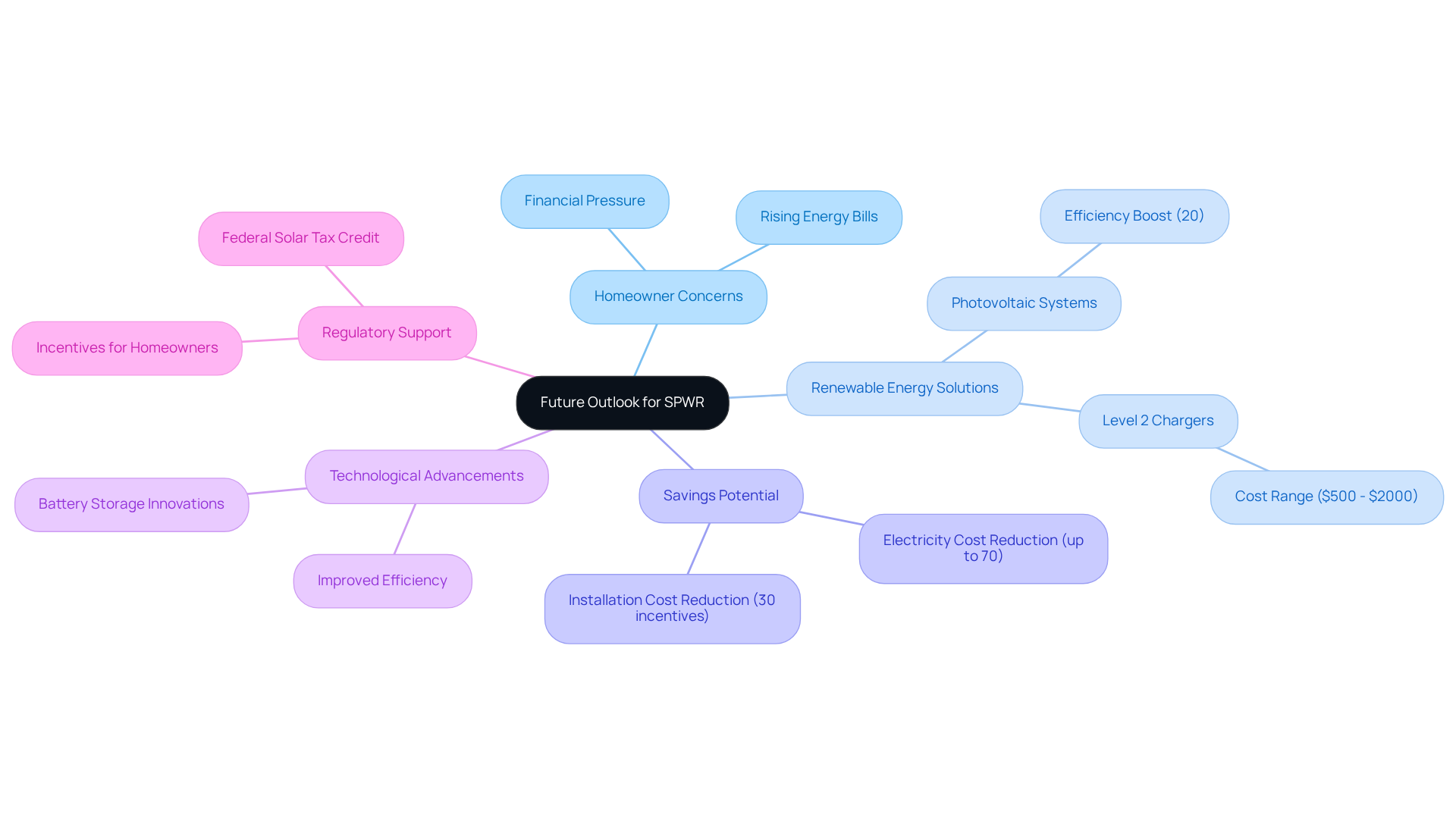

Future Outlook: What Investors Should Anticipate from SPWR

As we look ahead, we understand that many homeowners are concerned about rising energy bills and are seeking solutions that not only alleviate financial pressure but also contribute to a healthier planet. With the increasing demand for , there has never been a better time to explore options like photovoltaic systems and Level 2 home chargers. The typical price range for a Level 2 charger, between $500 and $2,000, is a worthwhile investment when considering the long-term savings. Imagine being able to lower your electricity costs by up to 70% simply by harnessing the power of the sun. This not only enhances the appeal of sustainable energy but also aligns beautifully with the values of environmentally conscious consumers.

We also recognize that advancements in technology, such as photovoltaic systems that can boost efficiency by 20%, are paving the way for a greener future. Moreover, potential regulatory support, including incentives that could reduce installation costs by 30%, presents an exciting opportunity for homeowners to embrace energy independence. Together, we can navigate this evolving landscape and empower ourselves with sustainable solutions.

As you consider these options, we encourage you to stay informed about the SPWR earnings date and the strategic initiatives of companies like SPWR. By doing so, you can leverage these opportunities for a brighter, more sustainable future. Let’s work towards a world where energy independence is within reach, and where each step we take is a step towards a more caring and sustainable community.

Conclusion

We understand that navigating the complexities of energy costs can be daunting for homeowners. Understanding the SPWR earnings date is essential for those looking to explore the potential of solar energy. The insights shared in this article highlight the significance of these announcements, as they reveal not only the financial health of the company but also their influence on stock performance and investor sentiment. By staying informed about the upcoming earnings date and its implications, you can make more strategic decisions that align with your goals for energy independence.

Key points discussed include:

- The importance of analyzing SPWR’s earnings performance metrics, such as revenue growth and profit margins.

- It’s common to feel uncertain about how market trends and regulatory changes impact the company’s operations.

- The competitive landscape reveals both the challenges and opportunities SPWR faces against its peers, emphasizing the need for continuous innovation and adaptation in a rapidly evolving industry.

As the renewable energy sector continues to flourish, staying attuned to SPWR’s earnings announcements and market dynamics will be crucial for investors like you. Embracing the potential of solar solutions not only benefits your financial situation but also contributes to a sustainable future for all of us. Together, let’s harness the power of informed investing to promote energy independence and capitalize on the promising advancements in solar technology. We’re here to support you on this journey, ensuring you have the guidance needed to make impactful decisions.