Overview

The Maryland Solar Tax Credit provides homeowners with a significant financial incentive of 40% off their solar installation costs, capped at $5,000, to encourage the adoption of renewable energy. The article highlights that this initiative not only leads to substantial savings on electricity bills but also aligns with broader environmental goals, as evidenced by the increasing number of beneficiaries and the urgent need to utilize available funds before they are depleted.

Introduction

In the quest for sustainable living, the Maryland Solar Tax Credit emerges as a beacon of opportunity for homeowners eager to embrace renewable energy. This robust incentive not only allows residents to recoup a significant portion of their solar installation costs—up to 40%—but also plays a crucial role in fostering a greener future.

With the state poised to reduce carbon emissions and promote eco-friendly practices, understanding the intricacies of this tax credit becomes paramount. As homeowners navigate the eligibility requirements and claiming process, they discover a pathway to substantial long-term savings on energy bills, increased property values, and a chance to contribute to the state’s ambitious environmental goals.

The urgency surrounding the program’s funding adds to the excitement, making now the ideal moment to explore the financial benefits and incentives available through Maryland’s commitment to solar energy.

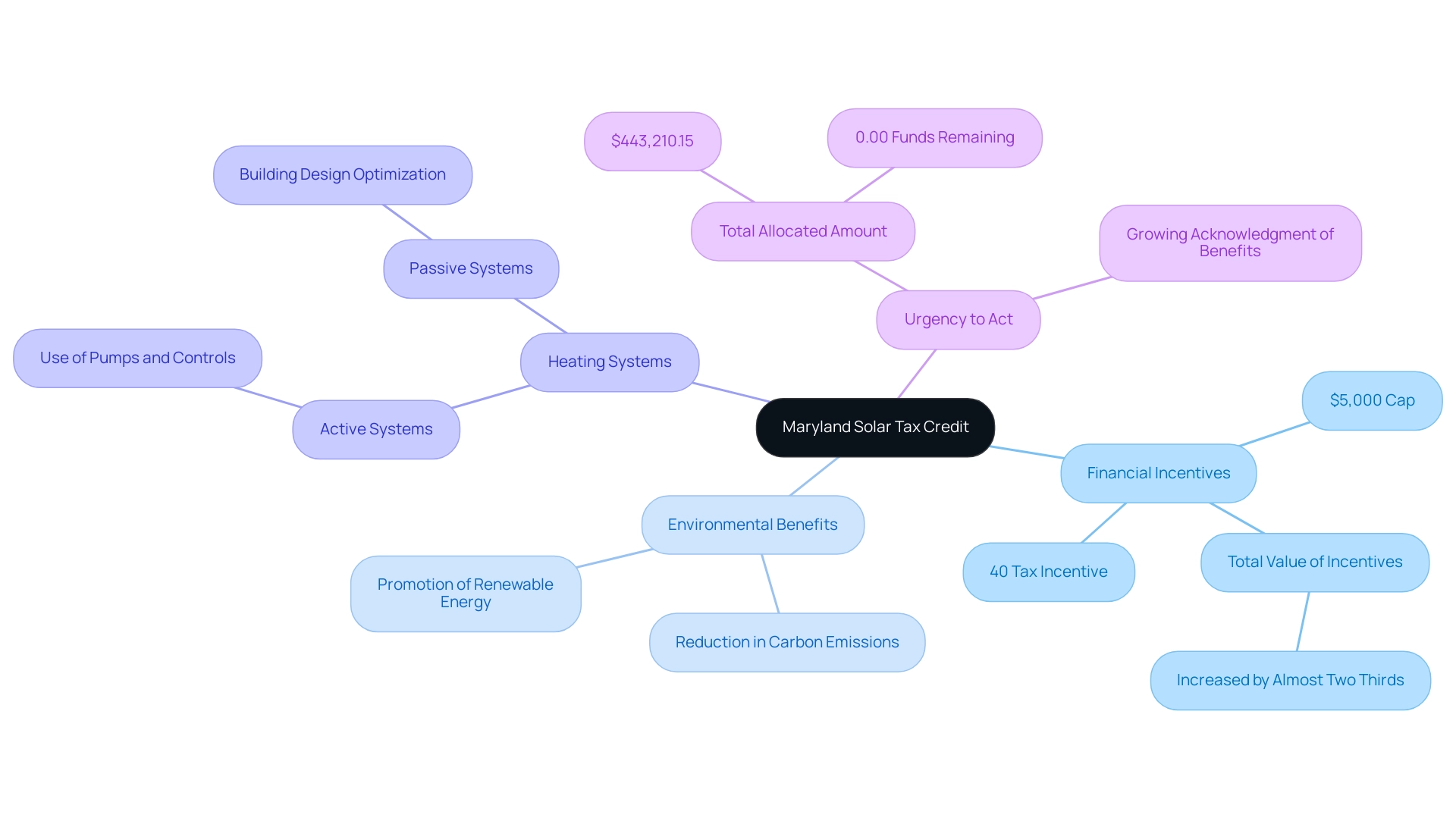

Overview of the Maryland Solar Tax Credit

The Maryland Solar Tax Credit serves as a strong financial motivation aimed at encouraging environmentally conscious property owners to invest in renewable power systems. Under this program, eligible homeowners can receive a tax incentive equivalent to 40% of their solar installation costs, capped at $5,000. This initiative not only facilitates significant savings on electricity bills but also promotes the adoption of renewable energy across the state, contributing to a reduction in carbon emissions.

As Cory Allyn, the Associate Director of Content & Strategy at Energy Circle, notes,

The number of families benefiting from these incentives has increased almost one third and the total value of the incentives has increased by almost two thirds.

This increase indicates a growing acknowledgment of the financial and environmental benefits offered by solar tax incentives. Notably, the total amount allocated for residential and commercial applications is $443,210.15, with no funds remaining, highlighting the urgency for homeowners to take advantage of this opportunity.

Additionally, while Rhode Island is the only state to rank in the top 10 for home utility credits, Maryland’s program remains a vital resource for residents. Furthermore, the program aligns with national data indicating that states with sunnier climates tend to favor such incentives, enhancing their effectiveness. Homeowners can also consider the benefits of both active and passive heating systems when evaluating their energy solutions:

- Active systems use pumps and controls to circulate heat transfer fluids, providing consistent heating.

- Passive systems rely on building design to optimize heat absorption.

These systems can reduce utility costs significantly while promoting sustainability. Utilizing the Maryland Solar Tax Credit represents a vital step towards sustainable power use and long-term financial savings, ultimately supporting Maryland’s goal for a cleaner power future. Homeowners should act promptly, as the urgency of the program’s funding situation highlights the significance of making informed choices regarding renewable investments.

Eligibility Requirements for Homeowners

To qualify for the Maryland solar tax credit for renewable power, eco-conscious homeowners must adhere to specific eligibility criteria, ensuring that only legitimate photovoltaic systems benefit from the Maryland solar tax credit program. These requirements include:

- The sun-powered system must be installed on a residential property situated in Maryland.

- The installation must be finished and functional within the tax year for which the benefit is claimed.

- Homeowners must own the energy system outright; leasing arrangements do not qualify for this tax credit.

- The installation must be carried out by a qualified contractor to ensure compliance with state regulations.

By following these guidelines, property owners can effectively navigate the application process and maximize their financial benefits, potentially leading to significant lifetime savings. As Liam McCabe notes, ‘Claiming the ITC is easy! Just follow these three simple steps: Print out IRS form 5695, fill out the form using the documentation you get from your installer, and submit the completed form when you file your taxes.’

With the average expense of setting up a 5 kW energy system in Maryland varying from $11,425 to $15,457, comprehending these prerequisites is essential for property owners seeking to make a wise investment in renewable energy. The potential savings from the Maryland solar tax credit can significantly offset these costs, further justifying the investment. Furthermore, property owners should recognize the steps involved in setting up residential photovoltaic systems, which include:

- Site assessment

- System design approval

- Final inspection

These steps ensure adherence to regulations and allow connection to the utility grid.

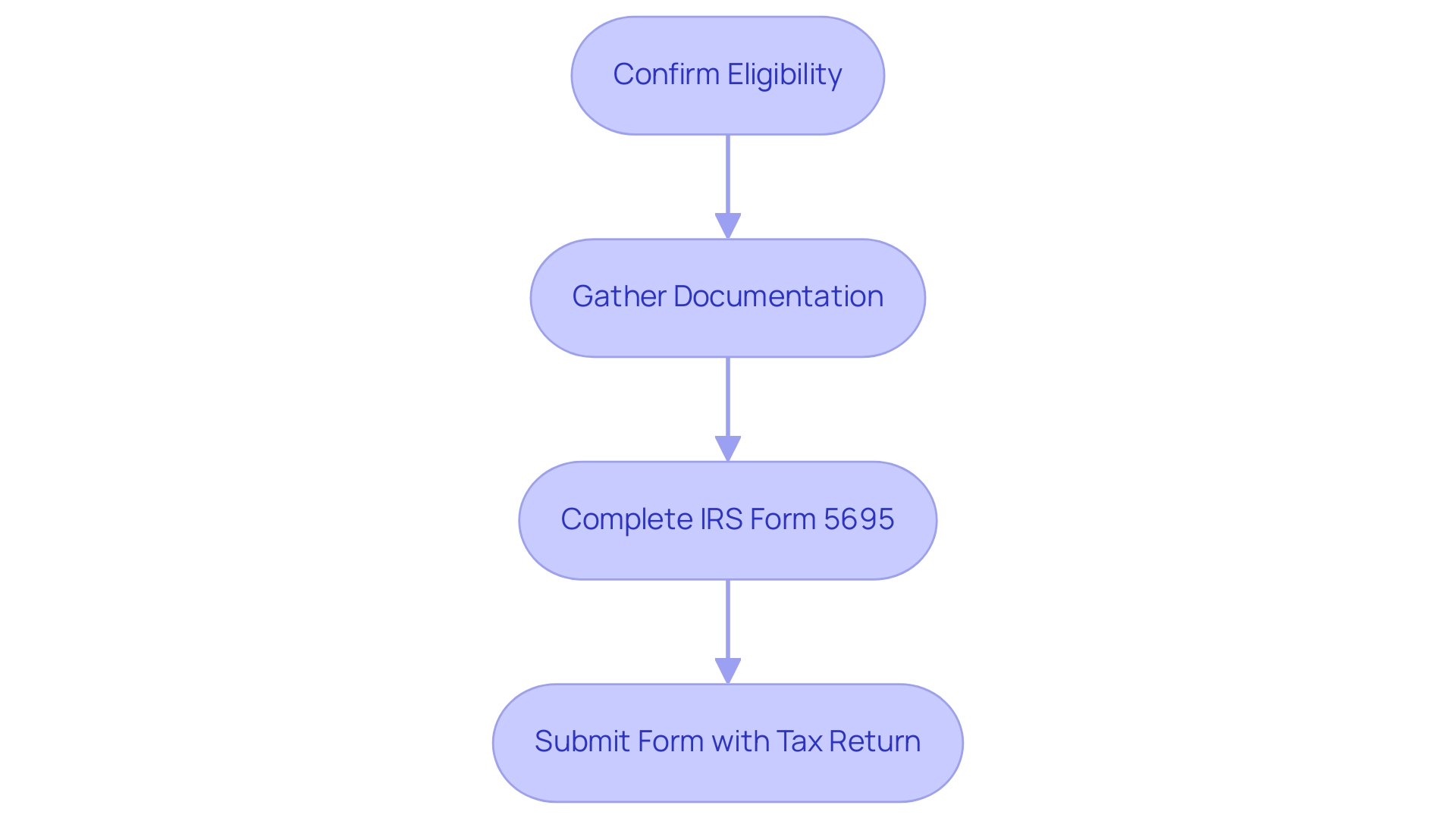

To further assist homeowners, here is a step-by-step guide on applying for the Maryland solar tax credit:

- Confirm eligibility for the Maryland solar tax credit by ensuring that your energy system meets the criteria outlined above.

- Gather necessary documentation from your installer, including proof of purchase and installation.

- Complete IRS form 5695 with the collected documentation.

- Submit the form with your tax return.

Comprehending how photovoltaic panels function is also essential. Solar panels convert sunlight into electricity through photovoltaic cells, which generate direct current (DC) electricity. An inverter then converts this DC electricity into alternating current (AC) electricity, making it usable for home appliances. This thorough comprehension of photovoltaic panel functionality and best practices for choosing panel inverters will enable homeowners to make informed choices regarding their power requirements.

How to Claim the Maryland Solar Tax Credit

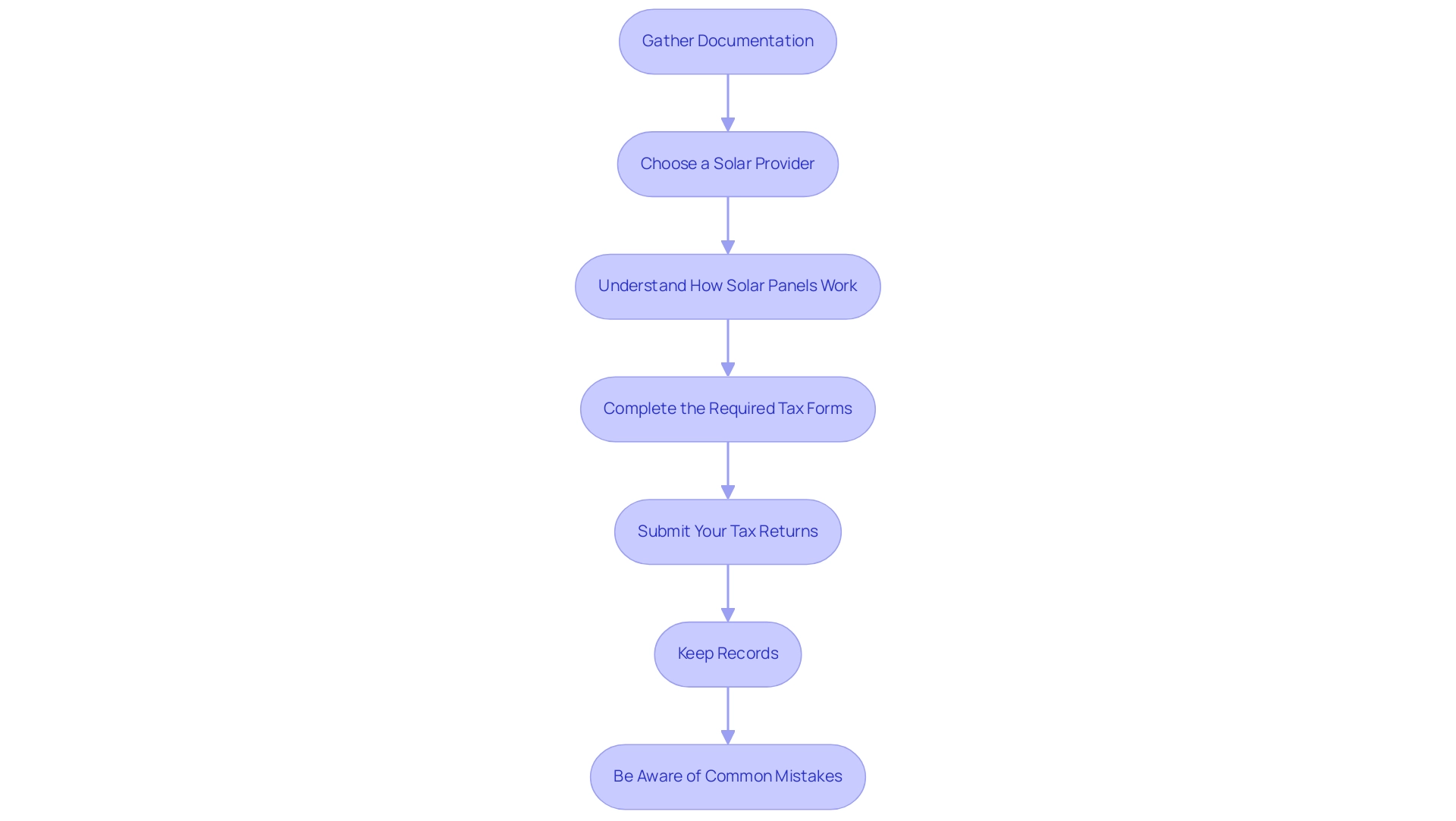

Claiming the Maryland solar tax credit can be a manageable process when approached systematically. Here are the essential steps to ensure a successful claim:

- Gather Documentation: Begin by collecting all necessary receipts, installation contracts, and relevant paperwork that confirm the costs and installation of your energy system. Proper documentation is essential, as it supports your claim for financial incentives like the Maryland solar tax credit offered by government renewable energy programs.

- Choose a Solar Provider: Popular installers in Maryland, including those located in Annapolis, Baltimore, Bethesda, and Bowie, can help streamline your installation process. Hiring a trustworthy installer can also guarantee that you optimize your potential tax benefits while comprehending the operation of the panels being set up.

- Understand How Solar Panels Work: Solar panels convert sunlight into electricity through photovoltaic cells, which generate direct current (DC) electricity. This electricity is then converted into alternating current (AC) by an inverter, making it usable for your home. By utilizing sunlight energy, homeowners can significantly lower their electricity bills and contribute to a more sustainable environment.

- Complete the Required Tax Forms: Fill out Form 502CR, Maryland’s designated form for claiming the Maryland solar tax credit as part of the renewable energy incentive. Recent updates to this form may include additional sections, so it’s important to review the latest guidance to avoid any errors.

- Submit Your Tax Returns: Include the completed Form 502CR with your Maryland tax return to apply for the Maryland solar tax credit. If you are filing electronically, ensure that you follow the prompts in your tax software to properly include the renewable energy credit.

- Keep Records: After submission, retain all documents and forms for your records. This is vital in case of audits or inquiries regarding your claim.

- Be Aware of Common Mistakes: Many homeowners overlook the importance of thorough documentation, which can lead to delays or denials. Ensure every piece of paperwork is accurate and submitted on time.

Along with these steps, keep in mind that for installations finished in 2025, the payback period is anticipated to drop to under 8 years, creating a favorable moment to invest in renewable energy. The advantages of government renewable energy initiatives encompass considerable savings on installation expenses through the Maryland solar tax credit and other tax incentives and rebates, which can greatly improve the financial viability of renewable energy investments. As one pleased property owner noted, “EnergySage saved me a ton of money by helping me get bids that were half the cost of the bids I got myself by calling around.”

By diligently following these steps and leveraging the insights from experienced homeowners, you can navigate the process of claiming your tax credit with ease, while enjoying the financial advantages of renewable installations.

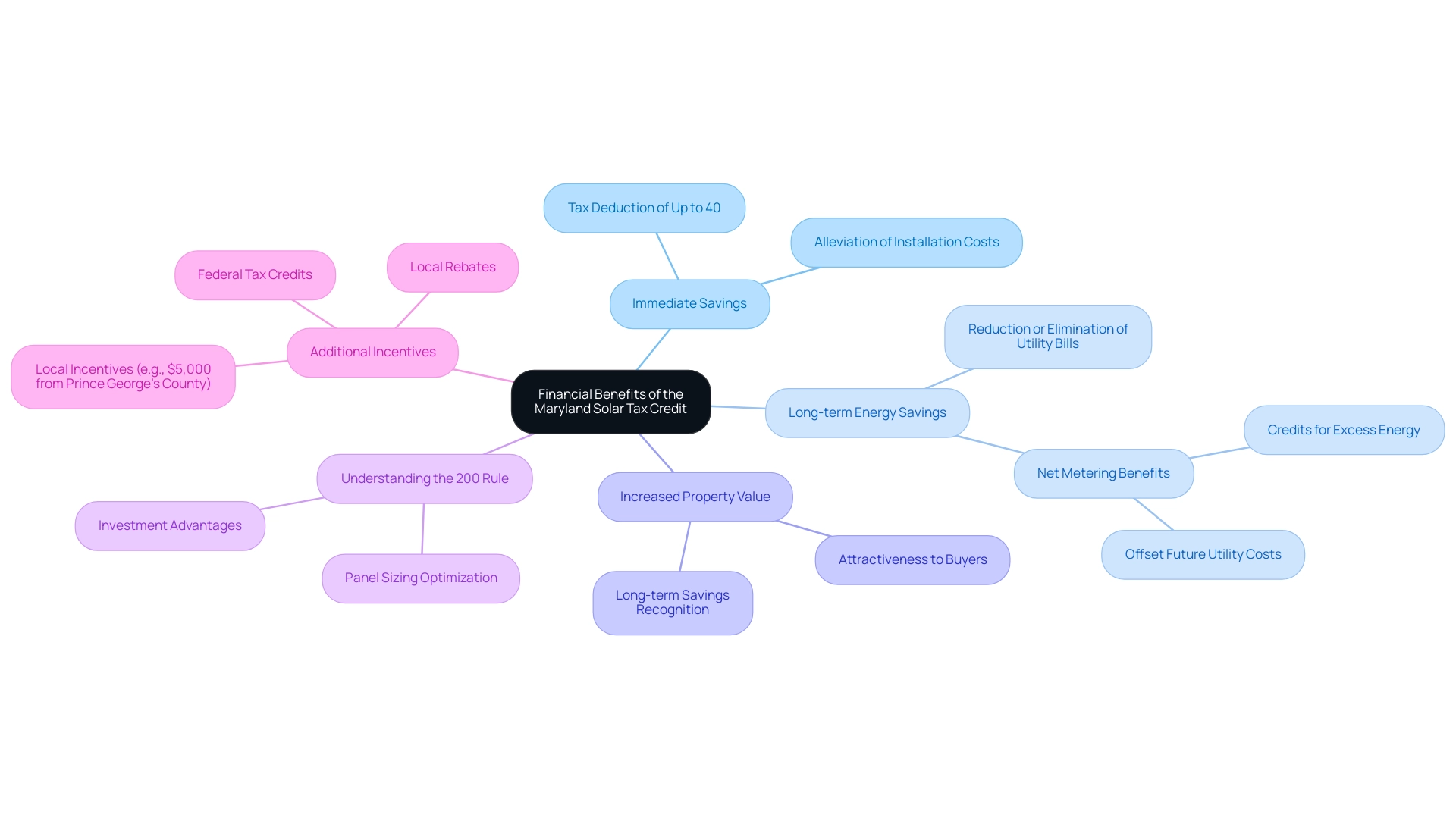

Financial Benefits of the Maryland Solar Tax Credit

Homeowners in Maryland stand to gain substantial financial advantages through the Maryland Solar Tax Credit, which offers a range of incentives designed to make solar energy adoption both sensible and rewarding:

- Immediate Savings: Homeowners can deduct as much as 40% of their installation expenses from their state taxes, resulting in considerable upfront savings that can alleviate the initial financial burden of installation.

- Long-term Energy Savings: Generating electricity through solar panels enables residents to significantly reduce or even eliminate their monthly utility bills, creating long-lasting financial relief. With net metering policies in place, residents can earn credits on their utility bills for any excess electricity produced, effectively reducing ongoing costs. For instance, as detailed in case studies on net metering, homeowners can offset future utility expenses by feeding surplus power back to the grid, potentially eliminating their electricity bills while only incurring fixed monthly fees.

- Increased Property Value: Properties fitted with renewable power systems, including Tesla home chargers, usually see an increase in value. This improvement makes them more attractive to potential purchasers, who may acknowledge the long-term savings linked to renewable sources.

- Understanding the 200% Rule: The 200% Rule enables property owners to better grasp panel sizing and the advantages of installation, ensuring they optimize their investment.

- Additional Incentives: When combined with federal tax credits and local rebates—such as the maximum $5,000 incentive from Prince George’s County, which covers 50% of eligible costs—the financial appeal of renewable power becomes even more compelling. This local incentive, along with the Maryland solar tax credit, exemplifies how government programs can significantly enhance financial benefits.

These incentives not only encourage environmentally friendly practices but also offer a financially sound investment for property owners seeking to improve their independence and property value. For instance, a case study from a Maryland property owner illustrates how they saved significantly by utilizing the Maryland solar tax credit along with local rebates, further showcasing the financial advantages available in the renewable market. As noted by a satisfied customer, “EnergySage saved me a ton of money by helping me get bids that were half the cost of the bids I got myself by calling around.”

This demonstrates the possible savings and benefits present in the renewable resource market. Furthermore, with the evolving landscape of performance-based incentives and subsidies, property owners are increasingly positioned to benefit from a variety of financial supports as photovoltaic technology advances.

Exploring Additional Maryland Solar Incentives and Rebates

Eco-conscious homeowners in Maryland seeking to invest in renewable energy can take advantage of the Maryland solar tax credit, as well as several valuable incentives and rebates that enhance the financial viability of installations.

-

Federal Renewable Energy Tax Incentive: Homeowners qualify for a 30% federal tax deduction on the total expense of renewable energy installations, enabling them to lower their initial investment while claiming this incentive alongside the Maryland solar tax credit, which enhances their savings.

For example, a 10 kW photovoltaic system in Maryland, priced at $33,700, effectively costs $23,590 after applying the federal tax incentive.

-

Net Metering: This vital program allows residents to accumulate benefits for the excess power produced by their photovoltaic systems.

By balancing electricity expenses with these incentives, property owners can further lower their monthly costs, making renewable energy not only sustainable but financially beneficial.

-

Maryland Energy Administration (MEA) Programs: The MEA provides a variety of grants and rebates specifically intended for photovoltaic systems.

These programs can be employed alongside the Maryland solar tax credit, providing additional financial assistance for homeowners transitioning to renewable sources. For instance, the Residential Clean Energy Grant Program offers $1,000 for installations, but it’s crucial to act swiftly as this program will end in 2024. This urgency is heightened by Maryland’s commitment to reducing greenhouse gas emissions, as the state aims to cut emissions by 60% from 2006 levels by 2031 and achieve net-zero emissions by 2045.

-

Storage Tax Credit: Homeowners can also benefit from a tax credit for storage systems, worth up to 30% of costs. This incentive assists homeowners in optimizing their investments in renewable resources by improving autonomy and reliability, reflecting the economic and environmental advantages of incorporating resource-efficient solutions.

-

Utility Company Promotions: Various utility companies across Maryland offer additional incentives for photovoltaic installations, though these can fluctuate based on the region. Homeowners are encouraged to check with their local utilities for specific offers that can complement state and federal incentives.

-

Tesla Home Chargers: Investing in a Tesla home charger can further enhance the advantages of photovoltaic systems. These chargers enable homeowners to harness sunlight for electric vehicle charging, maximizing the use of renewable resources and decreasing dependence on the grid.

-

Photovoltaic Panel Functionality and Maintenance: Understanding how photovoltaic panels operate and the importance of regular cleaning and upkeep is crucial for maximizing efficiency. Homeowners should consider professional cleaning services to ensure optimal performance, as dust and debris can significantly affect production.

By exploring these options, homeowners can significantly enhance the financial benefits of their energy investments. As emphasized by Johanna Neumann, Senior Director of the Campaign for 100% Renewable Resources, ‘Our clean power growth over the past decade has demonstrated the viability and importance of these renewable sources.’ This feeling highlights the significance of utilizing these incentives before they run out, guaranteeing optimal savings on renewable power systems.

Furthermore, comprehending the context of Maryland’s biomass energy production, which represented 6% of the state’s renewable electricity in 2023, further highlights the significance of diversifying energy sources and investing in renewable technologies such as photovoltaic.

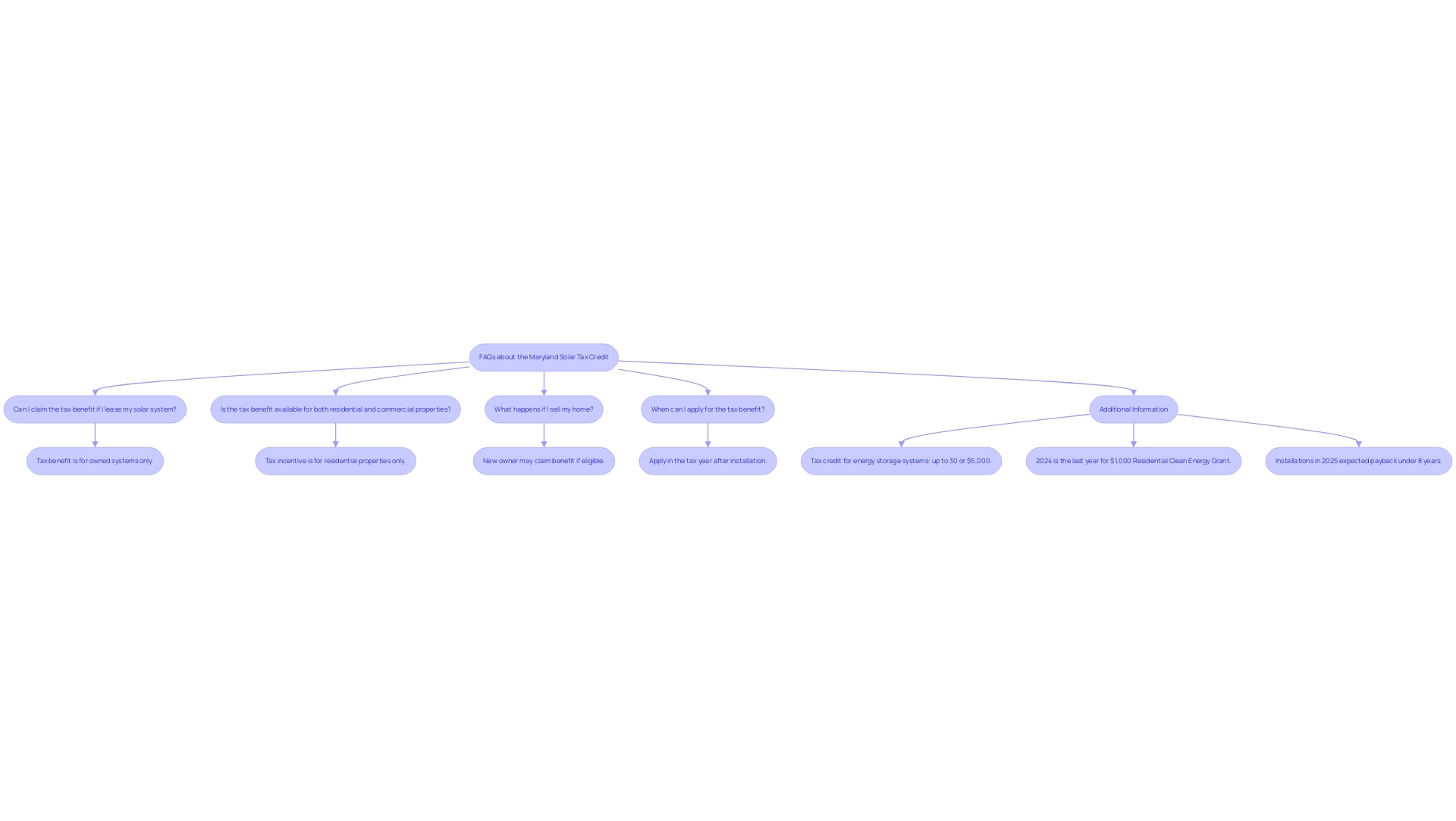

Frequently Asked Questions About the Maryland Solar Tax Credit

Below are some frequently asked questions regarding the Maryland Solar Tax Credit:

-

Can I claim the tax benefit if I lease my solar system?

The tax benefit is exclusively available for systems that homeowners own outright.

Leasing does not qualify for this incentive. -

Is the tax benefit available for both residential and commercial properties?

This tax incentive is specifically tailored for residential properties only. -

What happens if I sell my home?

If you sell your home, the new owner may claim the benefit, provided they meet the eligibility criteria. -

When can I apply for the tax benefit?

Property owners can apply for the tax incentive in the tax year after the installation of their photovoltaic system.

Understanding How Photovoltaic Panels Function

Photovoltaic panels convert sunlight into electricity through photovoltaic cells, which produce direct current (DC) electricity. This electricity is then converted into alternating current (AC) by an inverter, making it usable for home appliances. By utilizing sunlight power, property owners can greatly lower their electricity expenses and aid in ecological sustainability.

These FAQs serve as a useful resource, offering vital clarity and assistance for environmentally aware property owners considering the Maryland solar tax credit. Remarkably, the Maryland solar tax credit offers a tax credit for power storage systems worth up to 30% of the cost, or a maximum of $5,000, greatly improving the financial advantages for those seeking to invest in renewable resources. As 2024 marks the final year for the state’s Residential Clean Energy Grant Program, which offers an additional $1,000 incentive for new energy installations, it is crucial for homeowners to act promptly.

Additionally, installations completed in 2025 are expected to have a payback time of under 8 years, making solar energy an increasingly attractive and sustainable financial option.

Conclusion

The Maryland Solar Tax Credit presents a remarkable opportunity for homeowners to invest in renewable energy while enjoying significant financial benefits. By providing a tax credit of up to 40% on solar installation costs, capped at $5,000, the program not only eases the initial financial burden but also encourages the adoption of eco-friendly practices. As homeowners become more aware of their eligibility and the claiming process, they can unlock substantial savings on energy bills and see increased property values, all while contributing to Maryland’s environmental goals.

With the urgency surrounding the program’s funding, now is the ideal moment for homeowners to act. Understanding the eligibility requirements, navigating the claiming process, and taking advantage of additional incentives such as federal tax credits and local rebates can amplify the financial advantages of solar energy investments. The combination of immediate savings, long-term energy cost reductions, and enhanced property value makes solar energy a compelling choice for those looking to embrace sustainability.

As the landscape of renewable energy continues to evolve, Maryland’s commitment to reducing carbon emissions and promoting solar energy stands out. Homeowners are encouraged to seize this opportunity not only for their financial gain but also for the greater good of the environment. By investing in solar energy today, they can play a vital role in fostering a cleaner, more sustainable future for Maryland and beyond.