Introduction

Considering a switch to solar power? The Connecticut Solar Tax Credit might just be the golden opportunity to make that leap more affordable. This incentive allows homeowners to claim a substantial 26% of their solar panel installation costs as a tax credit, translating to significant savings on state income taxes.

Imagine investing $20,000 in a solar system and potentially slashing your tax bill by $5,200! Not only does this credit apply to solar panels, but it also extends to energy storage systems, making it an enticing option for anyone looking to embrace renewable energy. As solar adoption continues to rise, understanding the ins and outs of this tax credit can empower homeowners to reduce both their utility bills and their environmental impact.

With a little guidance, navigating the eligibility requirements and application process can lead to a brighter, greener future for many Connecticut residents.

What is the CT Solar Tax Credit and How Does It Work?

If you’re contemplating transitioning to renewable energy, the Connecticut Solar Tax Credit offers a wonderful opportunity to save on your state income taxes while contributing to a greener planet. This financial incentive allows you to claim 26% of your panel installation costs as a tax credit. For example, if you invest $20,000 in your renewable power system, you could possibly decrease your state tax obligation by an impressive $5,200! This credit applies not only to residential photovoltaic panels but also to power storage systems, making it a versatile option for homeowners seeking to harness renewable resources.

Moreover, the latest statistics for 2024 indicate that the Connecticut Tax Credit for renewable energy is expected to significantly boost adoption, with projections showing a 15% increase in installations compared to the previous year. As Jan Krčmář, Executive Director of the Czech Solar Association, notes, “The stakes are high, given that companies need and want to decarbonize, hit climate targets, and tick ESG boxes.”

When choosing panel systems and inverters, it’s essential to take into account factors such as efficiency ratings, warranty terms, and compatibility with your power requirements. Consulting with a professional can help you determine the right specifications for your home. The primary aim of this tax credit is to encourage more homeowners to adopt sustainable power solutions, which can lead to lower utility bills and a considerable reduction in your carbon footprint. For instance, the Smith family in Hartford utilized the Connecticut Solar Tax Credit to install a renewable energy system that not only reduced their annual energy expenses by 40% but also aided in promoting a cleaner environment.

To benefit from this credit, simply fill out the appropriate tax forms when filing your state income tax return. Be sure to maintain thorough documentation of your energy investment to ensure a smooth process. With incentives like these, adopting renewable energy has never been more appealing for eco-conscious homeowners!

Eligibility Requirements and Application Process for Homeowners

To qualify for the Connecticut Solar Tax Credit, there are several key criteria you need to meet. First and foremost, you must be a resident of Connecticut, and your renewable power system should be owned outright; unfortunately, leased systems won’t qualify. According to recent statistics, about 75% of applicants successfully meet these eligibility requirements, highlighting the importance of understanding them before applying. It’s also essential that the installation takes place on your primary residence or a second home and is completed by a licensed contractor. As Teddi Ezzo from DEEP explains, ‘Ensuring your installation is done by a licensed contractor not only meets legal requirements but also guarantees quality workmanship.’

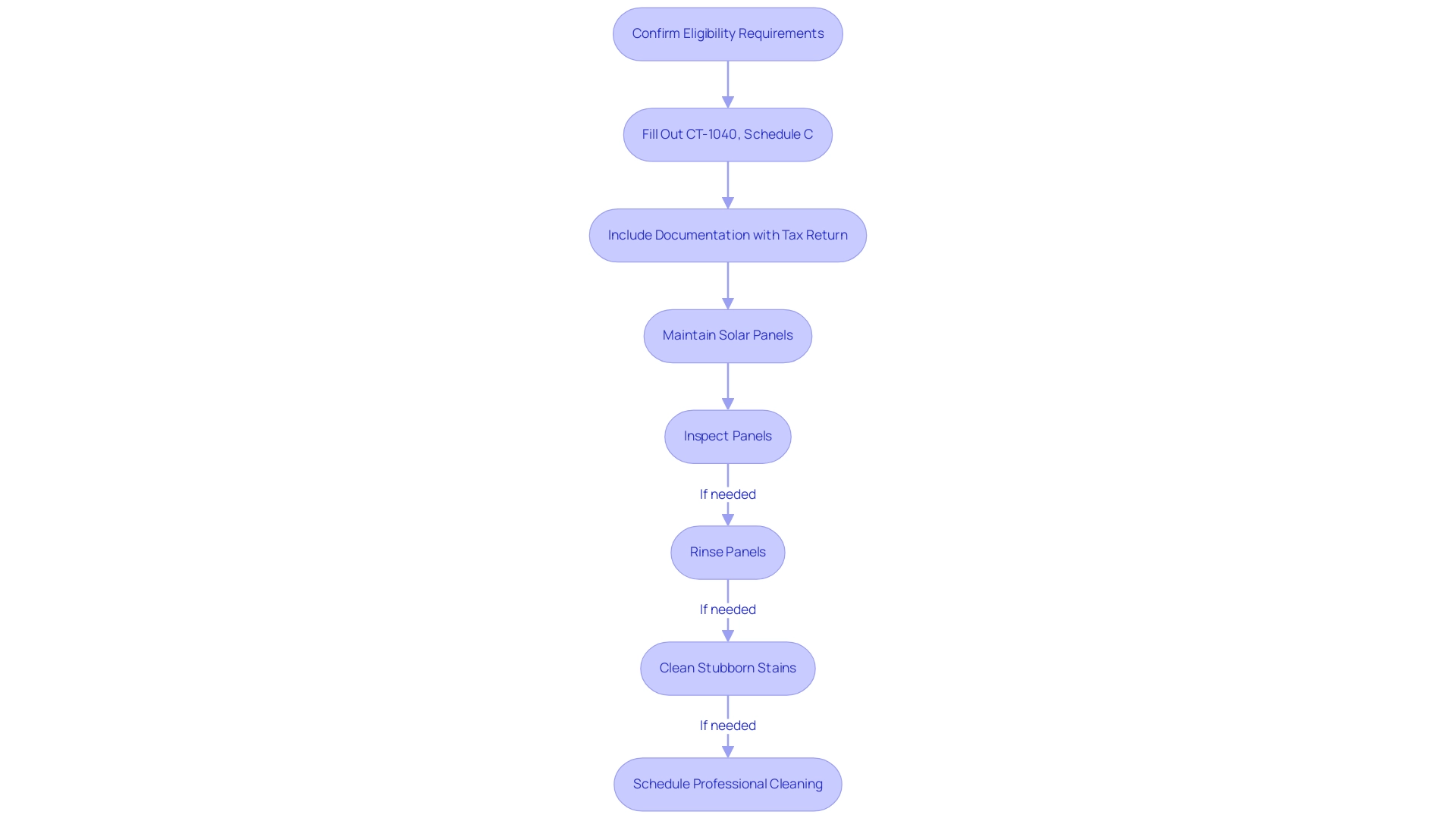

Once you’ve confirmed that you meet these eligibility requirements, the next step is to fill out the Connecticut Department of Revenue Services Form CT-1040, Schedule C, and include it with your state tax return. Don’t forget to keep all relevant documentation regarding your installation, like invoices and proof of payment, as these will be crucial for claiming your credit. A common reason for denial of applications is the lack of proper documentation, so be thorough.

Additionally, maintaining clean panels is essential for maximizing energy efficiency and ensuring the longevity of your investment. Here are some step-by-step guidelines for maintaining your panels:

- Regularly inspect your panels for dirt, debris, or any signs of damage.

- If possible, rinse them with water to remove dust and grime.

- For stubborn stains, consider using a soft brush or hiring a professional cleaning service.

- Schedule a professional cleaning at least once a year to ensure optimal performance.

If you run into any questions during the process, feel free to reach out to your installation company or consult a tax professional—you’re not alone in this! Homeowners who proactively gather their documentation and seek advice tend to have a higher success rate in their applications, and by ensuring your panels are well-maintained, you can enjoy both financial and environmental benefits. Furthermore, think about investigating government initiatives that provide incentives for maintenance, as these can further improve your investment in renewable resources.

Benefits of the CT Solar Tax Credit for Homeowners

The CT Solar Tax Credit offers a significant chance for property owners, greatly improving the availability of renewable solutions. As Melissa Smith, a specialist in the field, observes, ‘The financial incentives related to renewable resources can significantly reduce the obstacles for property owners contemplating this sustainable choice.’

One of the key advantages is the considerable savings on state income taxes, which can alleviate the initial financial burden of panel installations. This enables homeowners to recoup their investment more quickly and start enjoying the advantages of renewable resources sooner.

Furthermore, photovoltaic panels not only lower monthly electricity bills but also enhance your home’s resale value. Studies suggest that residences with photovoltaic systems sell for roughly 17% more than those lacking them, a trend backed by case studies indicating that more than 80% of homebuyers value resource efficiency.

Furthermore, property owners can improve energy savings by incorporating heating solutions, whether:

- Active systems that utilize advanced technology for consistent warmth

- Passive systems that harness natural design elements

These systems contribute to a sustainable lifestyle while providing long-term financial benefits. Beyond the economic incentives, property owners can take pride in their contribution to a cleaner, more sustainable environment. This combination of financial savings and ecological advantages makes the CT Tax Credit a compelling reason to invest in heating systems for your home.

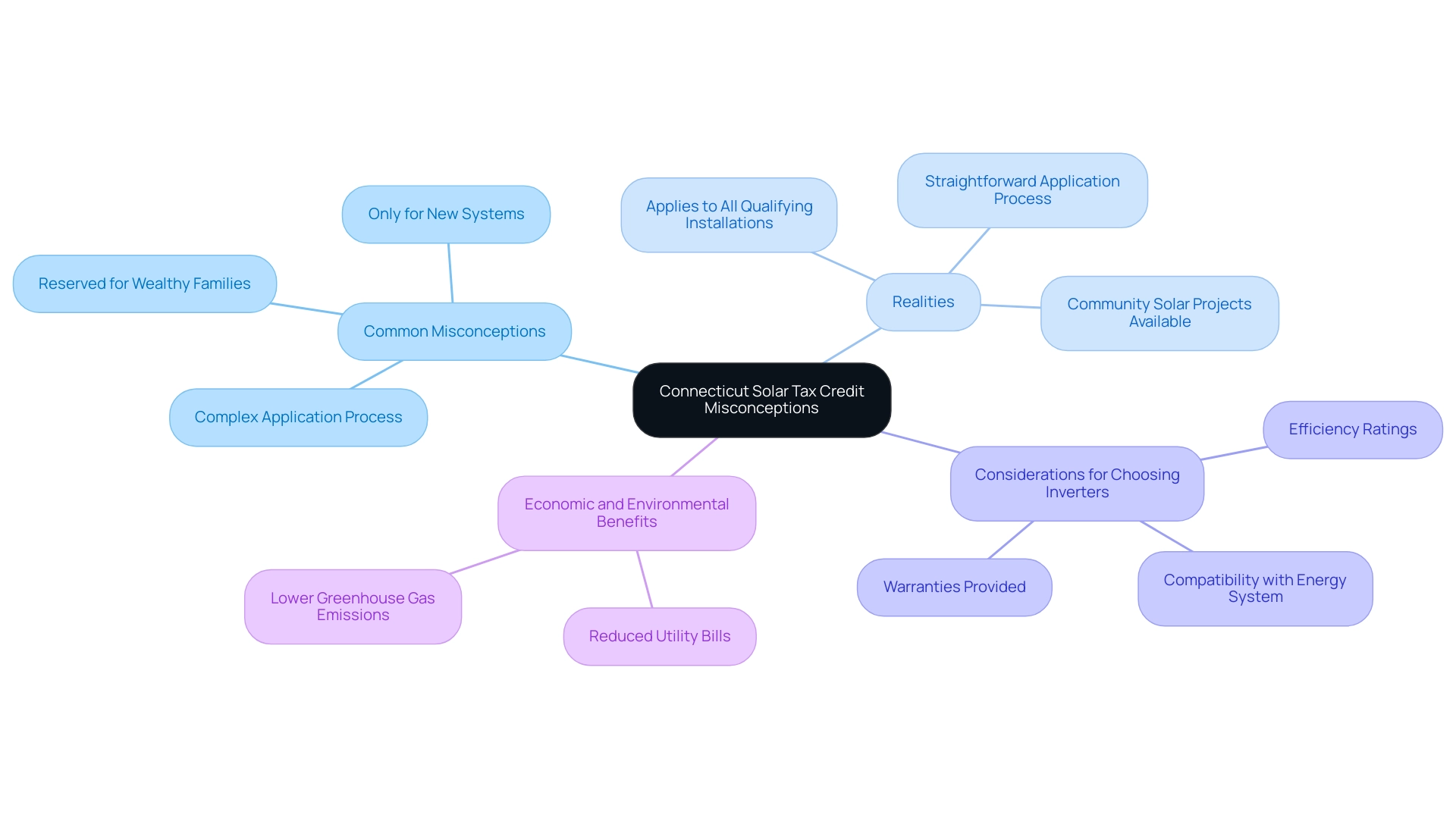

Common Misconceptions About the CT Solar Tax Credit

Numerous property owners frequently have misunderstandings about the Connecticut Solar Tax Credit, incorrectly thinking it is applicable only to new energy systems or that the application procedure is excessively complex. In reality, this tax credit applies to all qualifying installations, regardless of when they were set up, as long as they meet the necessary eligibility criteria. Fortunately, the application process is quite straightforward and can be navigated with the right documentation in hand.

Recent statistics reveal that approximately 30% of property owners are aware of the Connecticut Solar Tax Credit, highlighting a significant gap in understanding. Another prevalent misconception is that sunlight power is reserved for wealthy families. The reality is, the tax credit greatly expands access to renewable energy installations for a varied group of residents.

For instance, community renewable projects enable individuals to engage in alternative power without the requirement to install systems on their properties, potentially offering savings on electricity expenses. As Vikram Aggarwal, a CFA, aptly notes, ‘But none of this guarantees that this type of power would be a money-smart choice for you and your residence.’

By understanding these truths, property owners can empower themselves to make informed decisions about adopting renewable power and its many benefits, including the potential for significant economic and environmental advantages.

Furthermore, when choosing a panel inverter, individuals should consider factors such as:

- Efficiency ratings

- Compatibility with their energy system

- Warranties provided

Furthermore, government programs exist that can help subsidize the costs of photovoltaic installations, making it easier for homeowners to transition to renewable energy. The economic benefits of heating systems that harness sunlight, including reduced utility bills and lower greenhouse gas emissions, further reinforce the advantages of adopting this technology.

Tips for Maximizing Your Benefits from the CT Solar Tax Credit

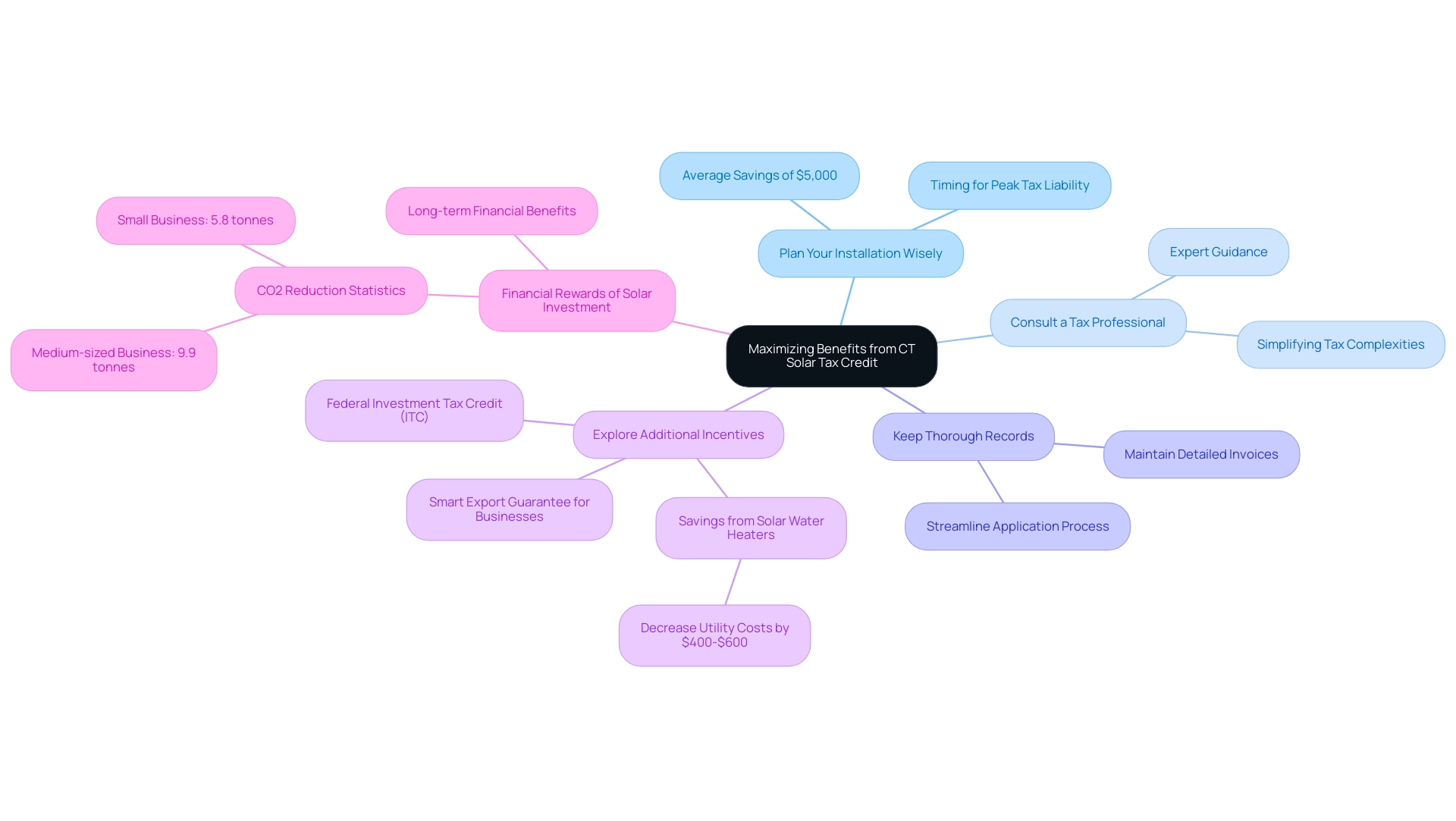

To fully capitalize on the CT Tax Credit and government panel programs, here are some friendly tips to guide you:

- Plan Your Installation Wisely: Timing is everything! Schedule your energy installation when your state tax liability is at its peak. This smart move can help you maximize the tax credit in the same year you install your system. In Connecticut, homeowners can save an average of $5,000 on their tax bills through photovoltaic installations.

- Consult a Tax Professional: Don’t navigate the tax maze alone. As Tamara Birch notes, ‘The maintenance costs for commercial photovoltaic panels are usually very low,’ but understanding tax credits can be complex. Partnering with a tax advisor can simplify these complexities, ensuring you make the most of every incentive available.

- Keep Thorough Records: A little organization goes a long way! Maintain detailed records of all expenses related to your renewable energy project, including invoices and contracts. This will streamline your application process and help you maximize your credit claims.

- Explore Additional Incentives: Look beyond the CT Solar Tax Credit; there may be other federal or local incentives that you can stack with it, such as the Smart Export Guarantee for Businesses, allowing businesses to sell surplus power back to the National Grid. Additionally, government programs like the Federal Investment Tax Credit (ITC) can further enhance your savings. Consider the financial advantages of water heaters powered by the sun, which can decrease utility costs by $400 to $600 each year while minimizing your carbon footprint. For instance, homeowners like Jane Doe have reported significant savings after utilizing these incentives.

By following these strategies, you can enjoy the full financial rewards of your solar energy investment and contribute positively to the environment.

Conclusion

Taking the plunge into solar energy with the Connecticut Solar Tax Credit can be a game-changer for homeowners. This tax incentive not only provides substantial savings—up to 26% of installation costs—but also encourages a shift towards sustainable energy solutions. By understanding the eligibility requirements and application process, homeowners can effectively navigate their way to significant financial benefits while reducing their environmental impact.

The advantages of this tax credit extend far beyond immediate savings on state income taxes. Homeowners can expect lower utility bills, increased property values, and the satisfaction of contributing to a cleaner planet. Additionally, dispelling common misconceptions about the credit can empower more individuals to take advantage of this opportunity, ensuring that solar energy is accessible to a wide range of households.

To maximize the benefits from the CT Solar Tax Credit, proper planning, thorough documentation, and consultation with professionals are essential. By being proactive and informed, homeowners can not only enjoy the financial rewards of their investment but also play a vital role in promoting renewable energy in their communities. Now is the perfect time to embrace solar power and take a step towards a brighter, greener future.