Introduction

Navigating the world of solar financing can feel overwhelming, especially for those grappling with bad credit. However, the good news is that achieving your solar energy dreams is more attainable than many might think. With a variety of options available, from specialized lenders who look beyond traditional credit scores to innovative financing solutions like Power Purchase Agreements and community solar programs, there are pathways for everyone.

This guide aims to demystify the financing process, offering practical steps and alternative solutions that empower homeowners to embrace sustainable energy. Whether it’s understanding the ins and outs of credit improvement or exploring unique financing avenues, this article will illuminate the route to harnessing the sun’s power—without letting credit challenges stand in the way.

Can You Secure Solar Financing with Bad Credit?

Certainly, obtaining funding for renewable energy with poor financial history is not merely a fantasy—it’s completely achievable! While options may appear restricted, numerous lenders are stepping up to look beyond the traditional scoring system. They take into account factors such as your income, job stability, and even the possible energy savings you could benefit from your installation.

It’s like having a conversation with someone who truly understands your situation. In fact, there are lenders specifically catering to individuals interested in bad credit solar financing, so don’t hesitate to shop around and compare different offers to find the best fit for you. Furthermore, Power Purchase Agreements (PPAs) enable consumers to pay for the electricity produced by photovoltaic systems without having to acquire the panels outright, offering another practical payment alternative.

For renters, exploring specific financing programs like the FHA’s Energy Efficient Mortgage program can also be beneficial. Plus, keep in mind that there are government programs and incentives aimed at making renewable energy more attainable. For instance, the Biden-Harris Administration’s recent announcement of $7 billion in Solar for All Grants aims to save low-income Americans $350 million each year—an encouraging sign that the support is out there.

As Zoë Gaston from Wood Mackenzie notes, ‘US residential energy: cloudy skies will lead to a market reset in 2024,’ suggesting a positive shift in the landscape ahead. With 54% of installers anticipating to sell more renewable energy systems in 2024, as emphasized in the case study ‘Optimism for Solar Sales in 2024,’ there are indeed encouraging signs for those looking to secure financing. Additionally, think about the advantages of incorporating Tesla home chargers and battery alternatives into your power system, as they can improve your autonomy and efficiency.

With a bit of determination and some smart purchasing, you can discover a method to incorporate renewable energy into your home, regardless of your financial background. This guide is here to assist Long Beach renters like you access eco-friendly power options and explore the economic and environmental advantages of heating systems, including both active and passive solutions that promote long-term sustainability.

Step-by-Step Guide to Obtaining Solar Financing with Bad Credit

- Evaluate Your Financial Status: Start your path towards renewable energy by reviewing your financial report. Comprehending your score is crucial, as it can assist you in recognizing areas for enhancement. Also, check for any inaccuracies that may be negatively impacting your score—correcting these could give it a nice boost.

- Research Lenders: Seek out lenders that focus on bad credit solar financing to assist individuals with poor financial history, as there are numerous alternatives available due to the heightened demand for solar funding from major firms like Amazon and Google. Online platforms can be especially useful for comparing terms and interest rates tailored to your financial situation.

- Prepare Documentation: Gather all necessary documents, such as proof of income, tax returns, and details about any existing debts. Being thorough in your documentation helps lenders evaluate your application effectively and efficiently, minimizing delays in processing.

- Consider a Co-Signer: If possible, bring a co-signer with superior financial history on board. This support can significantly enhance your chances of securing bad credit solar financing, making a substantial difference in the financing approval process.

- Apply for Financing: When you’re ready, submit applications to multiple lenders to increase your chances of approval. Be transparent about your credit situation and provide all requested information to ensure a smooth bad credit solar financing process. Always verify that you’re sharing your personal information on trusted platforms.

- Review Loan Offers: Once you submit your applications, take the time to review the loan offers you receive. Pay close attention to the terms, interest rates, and repayment schedules. Choose the option that aligns best with your financial goals, ensuring it feels manageable for your unique situation. For instance, homeowners in Washington can expect to save approximately $21,475 over 25 years by investing in renewable energy, marking it as a financially sound decision.

- Understand Solar Panel Functionality: Solar panels work by converting sunlight into electricity through photovoltaic cells. This process not only reduces your electricity bills but also contributes to a cleaner environment. By comprehending how photovoltaic panels function, you can make a knowledgeable choice regarding your power requirements.

- Explore Government Renewable Energy Programs: Many government initiatives provide financial incentives for homeowners to install renewable energy panels. These can include tax credits, rebates, and low-interest loans, making renewable energy more accessible. Investigate local and national initiatives to determine how they can help you with funding your energy installation.

- Consider Real-World Examples: Research case studies like Home Run Financing, which provides options for funding various renewable energy projects, including hot water systems and pool heaters, through a single home improvement loan application. This method simplifies your funding procedure and links you with nearby contractors for various renewable installations, ensuring you can fully benefit from government panel programs while optimizing your power requirements.

Exploring Alternative Financing Options for Low Credit Borrowers

[[Community Renewable Energy Programs

Community renewable energy](https://gresb.com/nl-en/community-solar-is-the-fastest-growing-segment-of-the-us-solar-market-is-it-right-for-your-properties) initiatives](https://arcadia.com/blog/community-solar-statistics) are a fantastic way for homeowners to dip their toes into the renewable energy pool without the heavy burden of upfront costs. By investing in shared energy projects, participants can enjoy significant savings on their electricity bills—households enrolled in low-income initiatives in Colorado, for instance, save between 15-50% annually, averaging about $382! Programs like Arcadia simplify the process for consumers to enroll in community energy, ensuring those savings while promoting a sense of community.

Furthermore, Tabco Towers has shown how community renewable energy can counter increasing operating expenses, assisting in keeping rent affordable for low- and moderate-income residents, highlighting the real advantages of these programs.

PACE Funding

For homeowners worried about financial ratings, Property Assessed Clean Energy (PACE) funding is a game changer. This creative method enables you to cover your energy installations via property taxes, indicating that qualifying for bad credit solar financing isn’t linked to your financial history. The adoption rates for PACE financing have been steadily increasing, making renewable energy more accessible than ever before.

As Kerri Devine, Head of Engineering at Lumen Energy, states,

Our sector is involved in a crucial conversation to enhance sustainability via ESG transparency and industry cooperation.

Unions

Don’t overlook your local unions! Many of them provide specialized loans created specifically for photovoltaic installations, with terms that are often more favorable than those from traditional banks. This indicates that even if your financial standing isn’t perfect, bad credit solar financing options are still available to help you transition to renewable energy.

Energy Leases and Power Purchase Agreements (PPAs)

If the idea of buying a renewable energy system feels overwhelming, think about energy leases or Power Purchase Agreements (PPAs). These arrangements allow you to utilize sunlight without the initial expenses. Rather than purchasing the system, you merely pay according to the power generated, making it a feasible choice for individuals encountering financial difficulties.

With the recent surge in panel manufacturing capacity—an impressive 11 gigawatts increase in Q1 2024—there’s never been a better time to explore these financing avenues and embrace the benefits of renewable energy.

Powercore Electric offers a range of services designed to help homeowners save with renewable sources, including installation, maintenance, and bad credit solar financing options tailored for various credit situations. Their expertise guarantees that homeowners can effectively shift to renewable power while maximizing their savings.

Benefits of Solar Water Heaters

Furthermore, these water heaters offer substantial benefits for homeowners, including decreased utility expenses, reduced carbon emissions, and enhanced property value. These systems can heat water to high temperatures efficiently, contributing to a more sustainable lifestyle. Many regions also offer incentives or rebates for installing solar water heaters, making them an economically attractive option.

By choosing solar, not only do you combat rising energy costs, but you also contribute to economic growth and greenhouse gas reduction, aligning your home with sustainable living practices.

Understanding and Improving Your Credit for Better Financing Opportunities

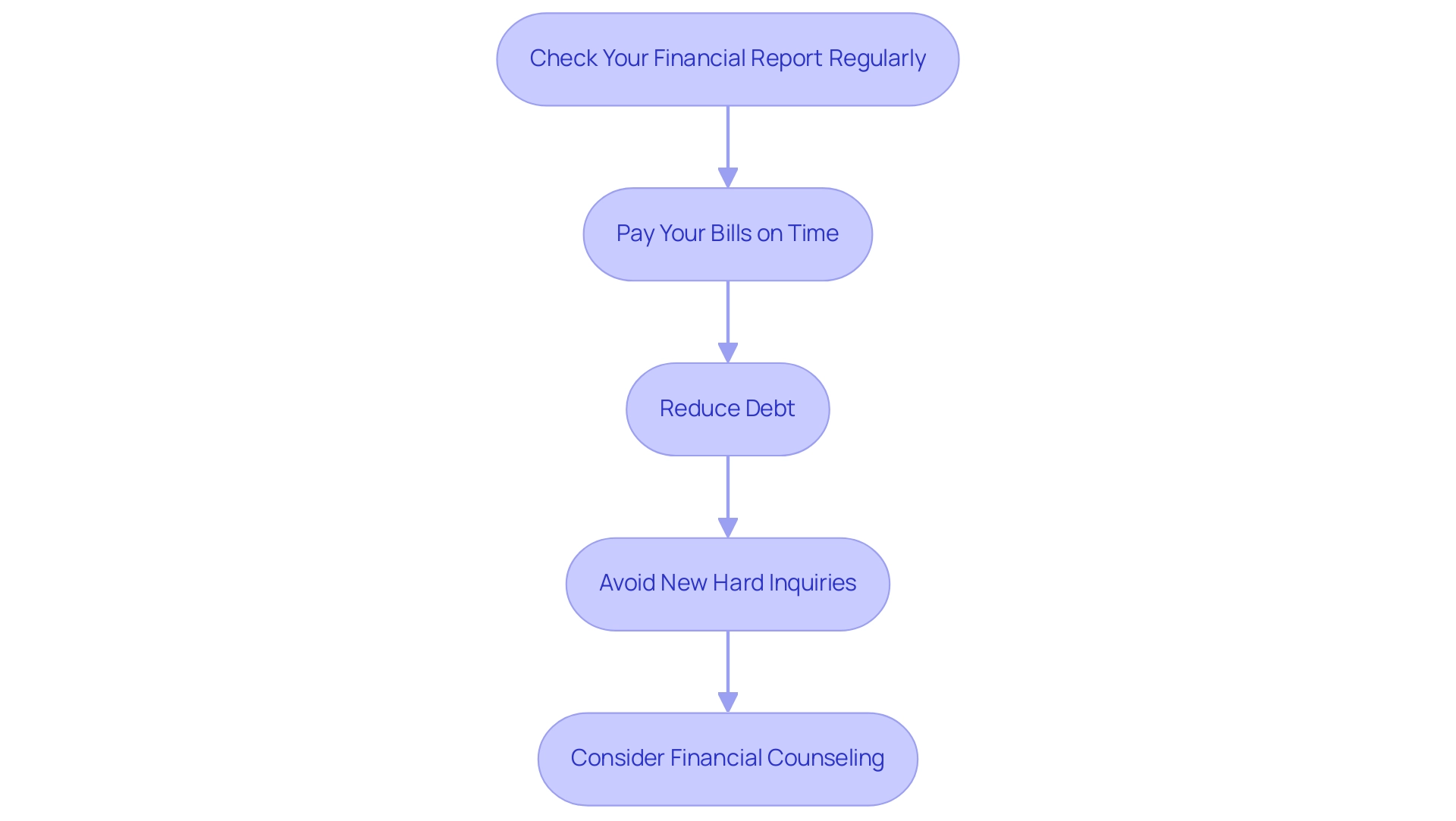

- Check Your Financial Report Regularly: Keeping an eye on your financial report is essential. Consistently examining it enables you to identify mistakes and challenge inaccuracies, ensuring your financial status is precise. This proactive approach can empower you to take control of your financial standing. It’s especially significant to recognize that roughly 19 million adults in the US lack a score due to minimal usage or outdated history, highlighting the need for awareness among homeowners contemplating bad credit solar financing.

- One of the simplest yet most effective actions you can take to improve your score is to pay your bills on time. Setting up reminders or automatic payments can help you stay on track. Remember, timely payments are crucial—research shows a strong correlation between prompt bill payments and enhanced scores, especially in 2024.

- Reduce Debt: Striving to lower your existing debts can significantly enhance your utilization ratio. Aim to keep this ratio below 30%. For many, this might mean making a plan to tackle high-interest debts first. As Schulz suggests, consider options like secured payment cards or becoming an authorized user on a trusted friend or relative’s card account to help establish or rebuild your financial standing while managing your spending.

- Avoid New Hard Inquiries: When it comes to your rating, less can be more. Try to limit the number of new financial applications as each hard inquiry can have a negative impact. Focus on nurturing your existing accounts and enhancing your creditworthiness before seeking new lines of financing.

- Consider Financial Counseling: If managing your finances feels overwhelming, don’t hesitate to reach out for help. Credit counseling services can provide tailored guidance to help you navigate your financial challenges. Many individuals have successfully improved their scores by implementing strategies such as timely payments and limiting new applications, as detailed in the case study titled ‘Strategies to Improve Scores.’ This can be particularly advantageous when exploring bad credit solar financing alternatives for renewable energy solutions.

Navigating Risks in Solar Financing for Bad Credit Applicants

When evaluating energy funding choices, particularly for Long Beach renters, it’s crucial to navigate possible challenges related to bad credit solar financing, especially if you’re facing poor credit. Borrowers in this situation often encounter elevated rates, significantly increasing the overall cost of the loan. For instance, funding a photovoltaic system in California, where the average savings over 25 years can be substantial, a high-interest loan could considerably diminish those benefits.

It’s noteworthy that larger energy systems typically offer a lower cost per watt, especially in warmer climates like Southern California, which can help mitigate some of these costs when financing is approached wisely. Always take the time to calculate the total costs before making any commitments.

Additionally, be wary of predatory lending practices that can exploit low-credit borrowers. Some lenders may present terms that appear attractive but come with hidden traps.

As Emily Walker wisely points out,

But, as of 2024, photovoltaic energy is back down to pre-pandemic prices, making it a great time to get quotes!

This makes comparing lenders and thoroughly reviewing the fine print even more crucial. Look out for terms that seem too good to be true; they often are.

In 2024, average interest rates for bad credit solar financing can significantly exceed those for prime borrowers, highlighting the importance of careful consideration.

Understanding the loan’s terms and conditions is vital. Be clear about repayment schedules and any fees that might arise from late payments. Ensuring you can meet these requirements before signing anything is essential.

Missing payments can further harm your score, creating a cycle of debt that’s hard to escape. A solid repayment plan is crucial when taking on new debt.

Finally, remember that limited options for refinancing can pose a significant concern. If your financial situation improves later, refinancing may become challenging due to your initial reliance on bad credit solar financing.

This reflects trends seen in the car loan market, where different generations show diverse preferences for funding options. Always consider the long-term consequences of your funding choices thoughtfully, as they can greatly influence your financial well-being and your capacity to access sustainable power solutions.

In Southern California, renters can also investigate local incentives, such as the California Solar Initiative, which provides rebates for photovoltaic installations. Additionally, programs like the Property Assessed Clean Energy (PACE) financing can provide options for renters to finance energy improvements without upfront costs. Comprehending these programs can enable Long Beach renters to make informed choices while accessing eco-friendly power solutions.

Furthermore, considering solar technologies like community solar programs or solar leases can provide additional pathways to harness solar energy without the burden of high upfront costs.

Conclusion

Securing solar financing with bad credit is not only possible but increasingly accessible due to a variety of innovative solutions and supportive programs. By understanding the options available, such as:

- Specialized lenders

- Power Purchase Agreements

- Community solar initiatives

homeowners can find the right pathways to harness solar energy. The importance of thorough preparation—like assessing financial situations, gathering necessary documentation, and researching lenders—cannot be overstated. These steps empower individuals to navigate their unique circumstances and discover financing opportunities tailored to their needs.

Moreover, improving credit scores through consistent bill payments, reducing debt, and considering credit counseling can open up even more favorable financing options. The landscape for solar financing is evolving, with government incentives and programs designed to support those with lower credit scores. As the industry grows and adapts, so too do the opportunities for homeowners to invest in sustainable energy solutions.

Ultimately, the journey towards solar energy should not be hindered by credit challenges. With the right information and resources, homeowners can take confident strides toward a sustainable future. Embracing solar energy not only contributes to personal savings and energy independence but also plays a vital role in fostering a healthier planet. The time to explore these options is now, paving the way for brighter, cleaner energy solutions for everyone.