Overview

Are you feeling overwhelmed by rising energy bills? In 2023, New Mexico’s solar incentives offer a nurturing solution for homeowners like you. With a 10% tax credit on installation costs and a generous 30% federal tax credit, solar energy becomes more accessible and affordable than ever. These incentives not only ease the burden on your wallet but can also lead to substantial savings on your electricity bills and enhance your property’s value. It’s common to feel hesitant about making such a significant change, but transitioning to renewable energy can empower you with energy independence and peace of mind.

Imagine the relief of knowing that you are not only saving money but also contributing to a healthier planet. Together, we can explore how these benefits can positively impact your life. If you’re curious about how solar energy can work for you, let’s connect and discuss the supportive options available. Your journey towards sustainable living starts with a simple step, and we’re here to guide you every step of the way.

Introduction

Rising energy costs have become a pressing concern for many homeowners, especially in sunny New Mexico, where the potential for solar energy is immense. We understand that the burden of high utility bills can be overwhelming. However, the New Mexico solar incentives for 2023 present a golden opportunity for residents to not only reduce these costs but also invest in a sustainable future.

With a combination of state and federal tax credits, including the Solar Market Development Tax Incentive, homeowners can significantly lower installation costs and enjoy long-term savings.

It’s common to feel uncertain with so many options available, but together we can navigate this landscape to maximize your benefits and ensure a smooth transition to renewable energy.

Let’s explore how you can take this step towards energy independence and a brighter, more sustainable tomorrow.

Overview of Solar Incentives in New Mexico

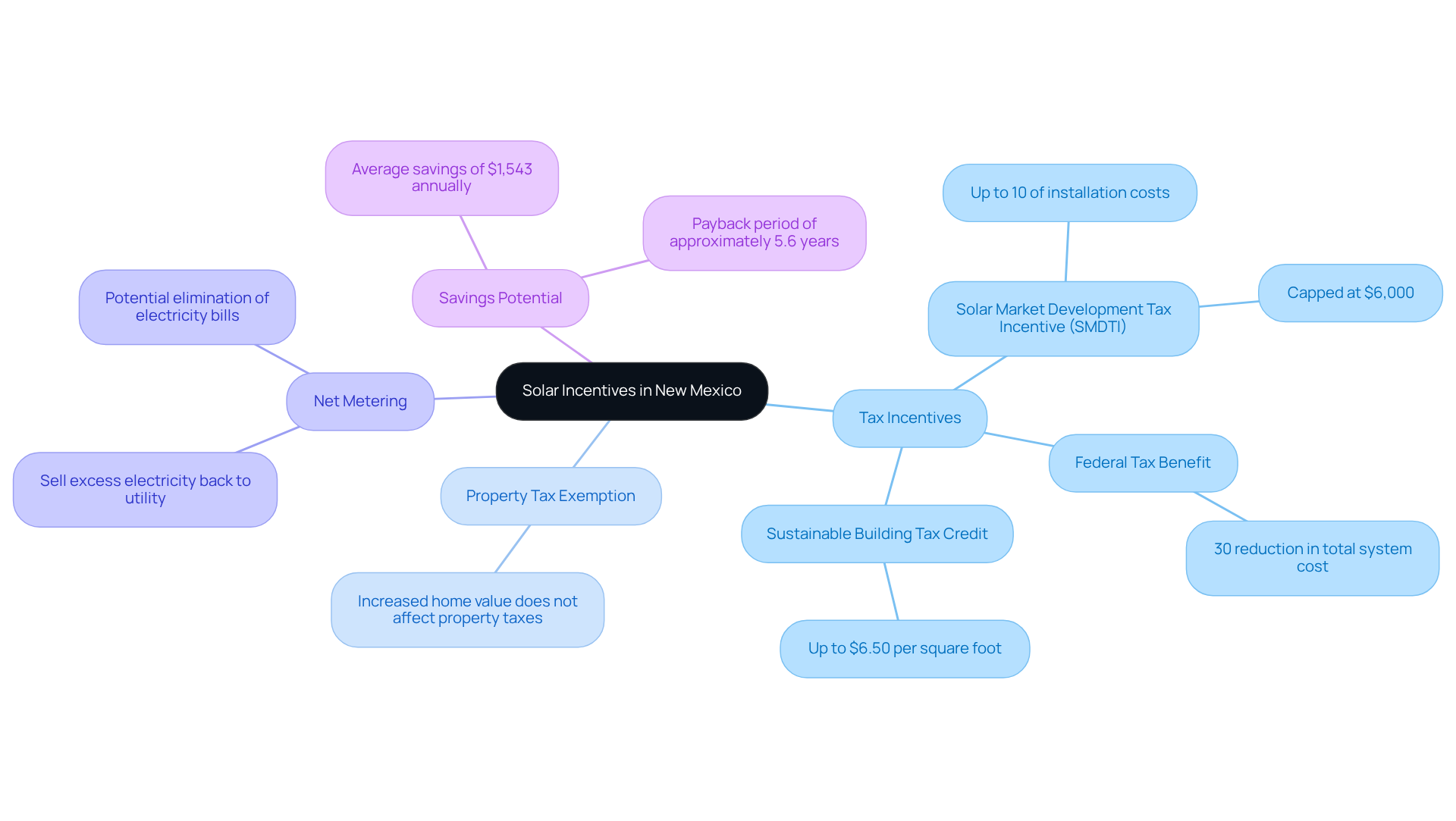

Are you feeling overwhelmed by rising energy bills? New Mexico solar incentives 2023 provide a range of benefits designed to help homeowners like you transition to renewable power systems. One standout option is the Solar Market Development Tax Incentive (SMDTI), which allows you to claim a tax benefit of up to 10% of your total installation expenses, capped at $6,000. When combined with the , these incentives significantly lower the initial costs of photovoltaic installations, making renewable energy more accessible than ever.

Additionally, you can benefit from a property tax exemption that ensures the increased value of your home from renewable energy systems won’t affect your property taxes. This, paired with net metering policies, allows you to sell excess electricity generated by your system back to local utility companies, potentially eliminating your electricity bills altogether.

Consider the success stories from homeowners in New Mexico who have embraced renewable energy investments. For instance, a typical 6-kW energy system, priced at around $3.28 per watt, can save you up to $1,543 annually on electricity costs, with a payback period of just 5.6 years. These New Mexico solar incentives 2023 not only enhance the financial viability of photovoltaic systems but also establish New Mexico as a leader in sustainable energy generation. Imagine investing in solar systems that can pay for themselves in under a decade—what a sound investment!

We understand that making such decisions can be daunting. However, the combination of generous tax credits, a sales tax exemption on installations, and New Mexico’s abundant sunlight, as highlighted by the New Mexico solar incentives 2023, creates an ideal environment for adopting renewable power sources. We encourage you to explore the New Mexico solar incentives 2023 to maximize your savings and make informed choices regarding your renewable energy investments. Furthermore, the New Mexico Sustainable Building Tax Credit rewards residents for investing in efficiency upgrades, further enhancing your renewable installations. Together, we can work towards a more sustainable and financially sound future.

Key Tax Credits and Rebates for Solar Energy

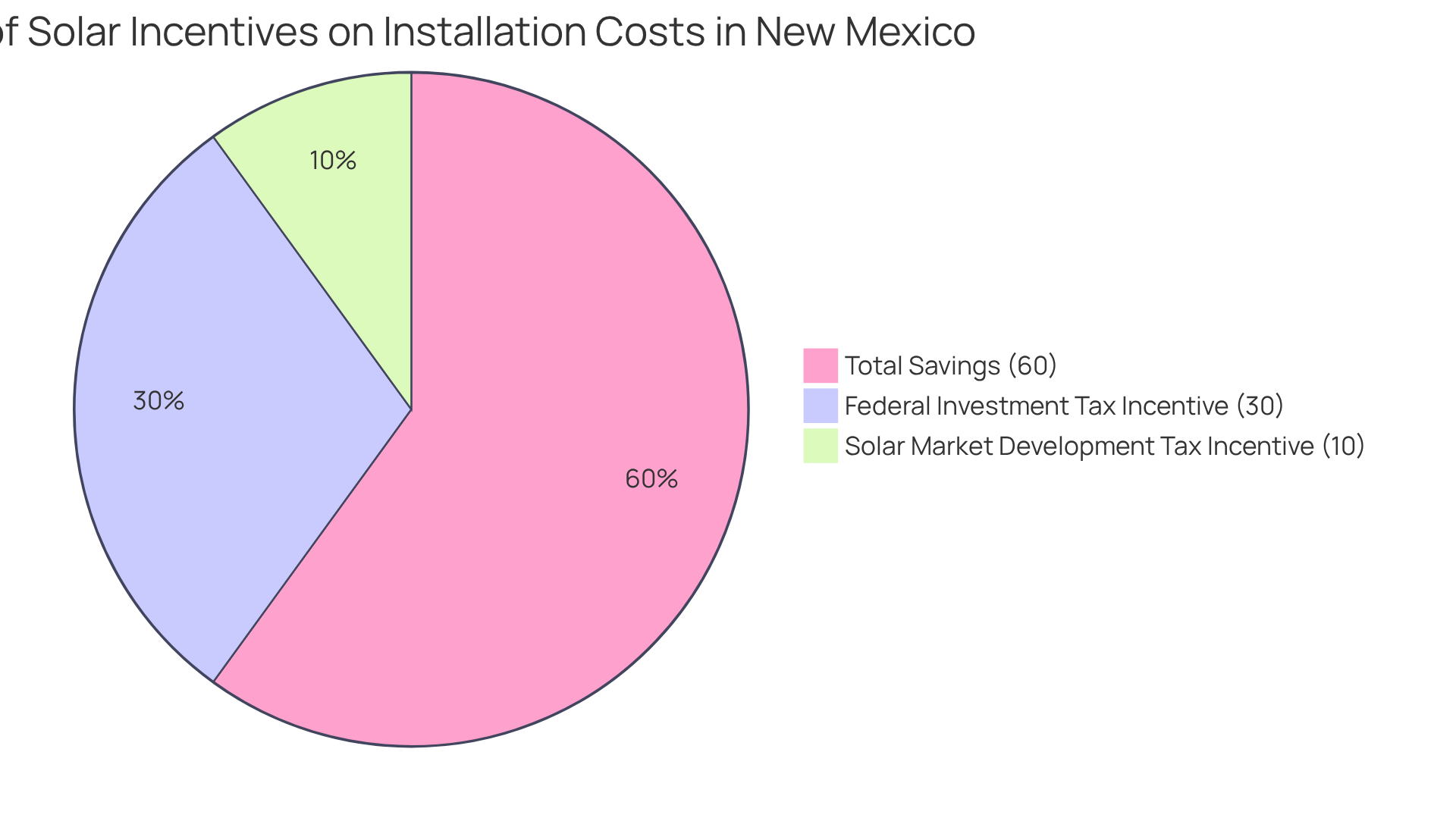

We understand that rising energy bills can be a significant concern for homeowners in New Mexico. Fortunately, new mexico solar incentives 2023 provide supportive solutions available to help you take control of your energy expenses. The Solar Market Development Tax Incentive (SMDTI) is one of the new mexico solar incentives 2023 that offers a 10% reduction on expenses related to renewable energy systems, including equipment, materials, and labor. This incentive can significantly lower your installation costs, making solar energy more accessible.

Additionally, the federal Investment Tax Incentive (ITI) provides a substantial 30% tax reduction for photovoltaic systems installed before December 31, 2025, which is part of the new mexico solar incentives 2023. Thanks to the Inflation Reduction Act, this tax incentive has been extended until 2034, giving you more time to invest in sustainable energy solutions. While New Mexico currently does not offer rebates or sales tax exemptions for renewable energy installations, homeowners can still benefit from a as part of the new mexico solar incentives 2023, ensuring that your property taxes won’t increase due to the added value of your solar installation.

When combined, the new mexico solar incentives 2023 along with these state and federal tax incentives can lead to significant savings. For instance, a standard 10-kW photovoltaic system in New Mexico, valued at approximately $23,800, can be reduced to about $14,280 after applying these incentives. This is a wonderful opportunity to invest in your home and future.

We encourage you to act swiftly, as the federal tax incentive is nearing its end. Together, we can explore how renewable energy solutions can enhance your home and provide you with the energy independence you deserve. Let’s work towards a sustainable future for you and your family.

How to Apply for Solar Incentives in New Mexico

Are you feeling overwhelmed by rising energy bills? You’re not alone, and there’s a supportive solution available: . To embark on your journey toward energy independence in New Mexico, follow these simple steps to apply for solar incentives:

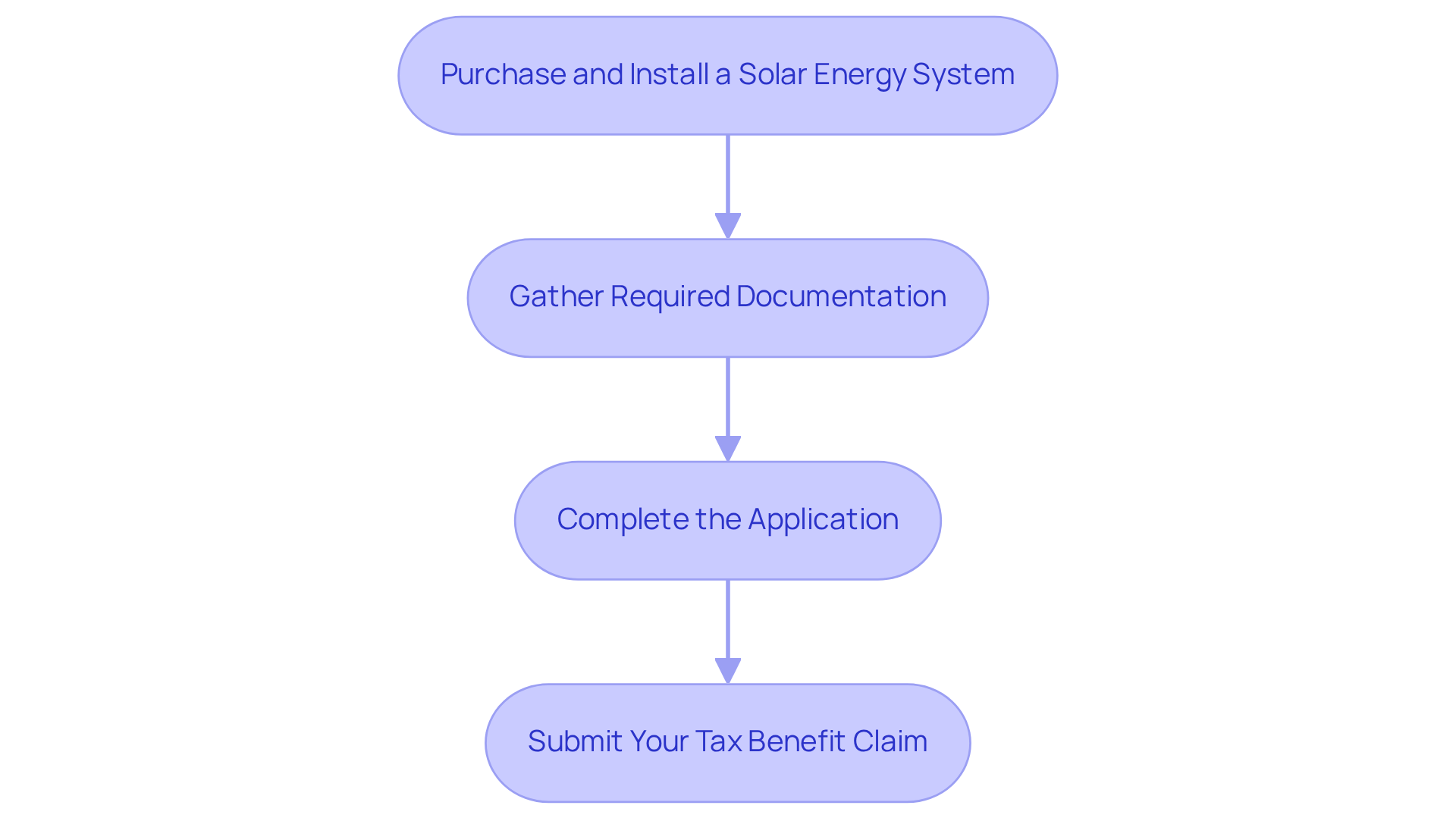

- Purchase and Install a Solar Energy System: It’s essential to have your system installed by a qualified contractor who understands your needs.

- Gather Required Documentation: Collect all necessary documents from your installer, including invoices and proof of installation, to ensure a smooth application process.

- Complete the Application: Visit the New Mexico Energy, Minerals and Natural Resources Department (EMNRD) website to fill out the application for the Solar Market Development Tax Credit. By taking advantage of the New Mexico solar incentives 2023, you can claim a deduction of 30% of the solar panel system’s cost, significantly reducing your overall expenses.

- Submit Your Tax Benefit Claim: When it’s time to file your state taxes, include the completed application and any supporting documents to claim your tax benefit. Don’t forget to fill out IRS Form 5695 for federal tax benefits as well. Homeowners can expect total tax incentives for a 10-kW system to reach around $9,520, making the switch to renewable power not just a responsible choice, but a financially appealing one. Furthermore, New Mexico’s net metering policy allows you to receive credit for any surplus energy generated and sent back to the grid, further enhancing the financial benefits of your photovoltaic system.

As Julia Zaraeva wisely notes, “Sunny New Mexico is an excellent state to set up photovoltaic panels, produce power, and appreciate savings for your family budget.” Together, let’s take this step towards a brighter, more sustainable future.

Benefits of Utilizing Solar Incentives for Homeowners

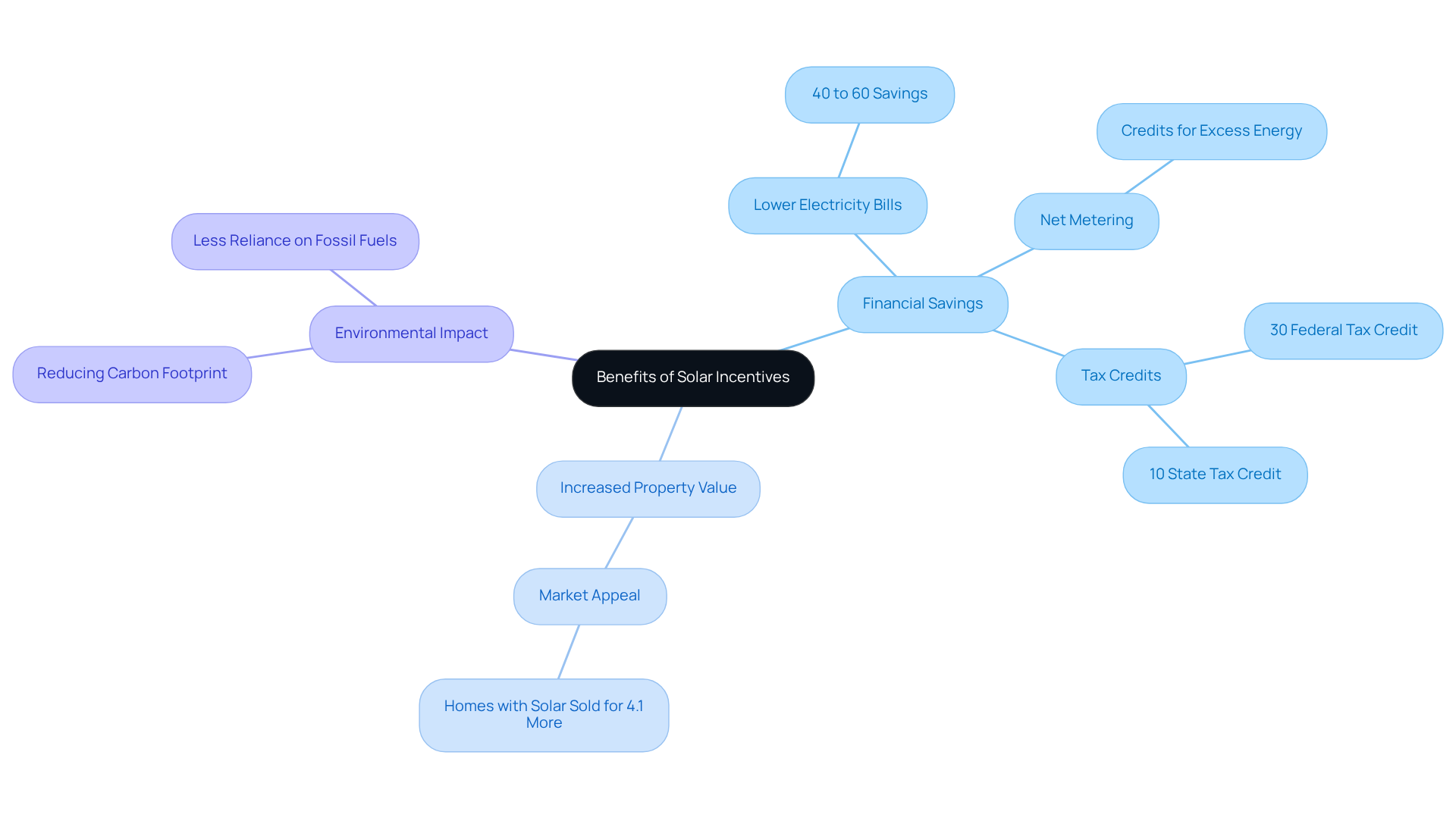

As a homeowner in New Mexico, you may often find yourself concerned about rising energy bills. It’s common to feel overwhelmed by the costs associated with electricity, but there’s hope. By utilizing new mexico solar incentives 2023, you can experience substantial benefits that not only ease your financial burden but also contribute to a sustainable future. Imagine conserving roughly $9,000 by investing in a photovoltaic system, which typically costs around $20,000. Thanks to the new mexico solar incentives 2023 and the , this investment becomes more accessible than ever.

Many homeowners like you have reported enjoying lower electricity bills, with savings ranging from 40% to 60% on monthly utility costs. Real-life stories illustrate this transformation, as families frequently observe significant reductions in their electricity expenses after installing photovoltaic panels. Moreover, these systems can enhance your property’s value; homes equipped with solar panels are often more appealing to prospective buyers.

In addition, the new mexico solar incentives 2023 include a net metering policy that allows you to sell any excess electricity back to the grid, further increasing your financial savings. By transitioning to solar energy, you not only save money but also play a vital role in creating a cleaner environment. Together, we can reduce our carbon footprints and lessen our reliance on fossil fuels.

If you’re ready to explore how renewable energy can impact your life positively, we’re here to guide and support you every step of the way.

Conclusion

Transitioning to solar energy in New Mexico is not just a visionary choice; it is a financially savvy decision supported by a robust framework of incentives. We understand that many homeowners are concerned about rising energy bills, and the New Mexico solar incentives for 2023 offer substantial benefits to alleviate those worries. These incentives include:

- Tax credits

- Property tax exemptions

- Net metering policies

All designed to make renewable energy systems more affordable and accessible. By leveraging these opportunities, homeowners can significantly reduce their installation costs and enjoy long-term savings on energy bills.

Key incentives such as the Solar Market Development Tax Incentive (SMDTI) and the federal Investment Tax Incentive (ITI) together create a compelling case for adopting solar technology. Imagine the potential savings reaching thousands of dollars and the ability to sell excess energy back to the grid. These incentives not only enhance financial viability but also contribute to a cleaner, more sustainable future. Homeowners can expect to see their investments pay off quickly, with many reporting remarkable reductions in their monthly electricity costs.

Embracing solar energy is a step toward energy independence and environmental stewardship. It’s common to feel uncertain about such a significant change, but with the support of New Mexico’s solar incentives, homeowners are empowered to make impactful choices that benefit both their finances and the planet. Together, we can explore these incentives and lead to a brighter, more sustainable future, encouraging a collective movement toward renewable energy solutions. Take action today to unlock the potential of solar energy and join the growing community of homeowners who are transforming their energy consumption for the better.