Overview

Are you feeling overwhelmed by rising energy bills? You’re not alone. Many homeowners share this concern, and it’s completely understandable. Fortunately, federal programs for solar panels offer significant funding and benefits, such as tax credits and grants, designed to help you transition to renewable energy sources and reduce your energy costs. For instance, the Investment Tax Credit (ITC) allows you to deduct 30% of your installation costs from your taxes, making solar energy a more attainable option.

By embracing solar energy, not only do you take a step towards energy independence, but you also contribute to a larger movement of sustainability and community health. Cleaner energy practices not only benefit your household but also create local jobs, fostering a healthier environment for everyone. It’s common to feel uncertain about making such a change, but remember, you are not alone in this journey.

Together, we can explore how these programs can work for you. If you’re ready to take action and learn more about how solar energy can transform your home and community, reach out today. Let’s work towards a brighter, more sustainable future together.

Introduction

In a world where the burden of energy bills weighs heavily on many, the emergence of federal solar programs shines brightly as a source of hope for homeowners and communities alike. These initiatives not only offer valuable financial incentives, such as tax credits and grants, but also act as a catalyst for a meaningful transition to renewable energy.

By making solar power more accessible, they empower individuals to take control of their energy costs while contributing to a cleaner environment. We understand that navigating these options can feel overwhelming, but as the landscape of energy consumption evolves, grasping the intricacies of these programs is essential for homeowners eager to embrace the benefits of solar energy.

From eligibility criteria to community impacts, the implications of federal solar initiatives extend far beyond personal savings, shaping a sustainable future for all. Together, we can work towards harnessing these opportunities for a brighter tomorrow.

Explore Federal Solar Programs and Their Importance

We understand that rising energy bills can be a significant concern for homeowners. Federal initiatives, such as the federal program for solar panels, are here to help alleviate those worries by encouraging the use of renewable resources, particularly photovoltaic power, through various incentives like tax credits, grants, and loans. One of the most impactful initiatives is the Residential Clean Energy Credit, which allows property owners to subtract 30% of the installation expenses for from their federal tax returns. This financial assistance not only makes renewable power more attainable but also leads to substantial savings for homeowners.

The significance of these initiatives extends beyond personal benefits; they align with our national goals to decrease carbon emissions and promote sustainable practices. For example, the Investment Tax Credit (ITC) has been instrumental in reducing the costs of photovoltaic systems, resulting in higher adoption rates among property owners. Indeed, research shows that national incentives have significantly increased property owner involvement in renewable initiatives, contributing to a more sustainable power future.

Looking ahead to 2025, these national initiatives will continue to evolve, providing homeowners with opportunities to invest in solutions that enhance their autonomy and reliability. With battery storage technology now requiring a minimum capacity of 3 kilowatt hours to qualify for incentives, you can further optimize your energy usage and savings. This ensures that you can store surplus power for later use, enhancing overall efficiency. The top battery choices not only provide reliable power during outages and adverse weather conditions but also support long-term cost savings and environmental benefits.

Successful case studies illustrate the lasting advantages of these programs. Homeowners who have embraced the federal program for solar panels report not only reduced utility costs—often totaling thousands of dollars over time—but also increased property values and improved power stability. For instance, numerous case studies highlight the effectiveness of sunlight-powered heaters in various residential settings, showcasing significant savings and sustainability efforts. By adopting these initiatives, homeowners are not just investing in their futures; they are also contributing to a collective effort to transition towards cleaner power sources, including the federal program for solar panels. As President Joe Biden noted while enacting the Inflation Reduction Act, this represents the most substantial measure the federal government has ever taken regarding climate change, underscoring the importance of these initiatives in achieving a sustainable power future. Together, we can embrace these opportunities and work towards a brighter, more sustainable tomorrow.

Identify Key Federal Funding Opportunities for Solar Installations

Are you feeling overwhelmed by rising energy bills? Homeowners like you can find solace in the numerous federal programs for solar panels that provide funding opportunities for photovoltaic installations, making the shift to renewable energy sources much more affordable. One standout option is the Investment Tax Credit (ITC), which allows you to deduct 30% of the total cost of your solar system from your federal taxes. This credit has played a crucial role in the growth of the renewable resources sector since the late 1970s, and projections suggest it will remain vital in 2025. According to a recent assessment by the Congressional Budget Office (CBO), tax credits significantly influence investment decisions and economic efficiency, underscoring the importance of the ITC.

In addition to the ITC, the Rural Energy for America Program (REAP) offers grants and loans tailored for rural small businesses and agricultural producers looking to invest in renewable power systems. For instance, a recent case study highlighted a rural farm that successfully secured funding through REAP to install a photovoltaic system, resulting in substantial savings and increased sustainability. This initiative has effectively supported many renewable projects, demonstrating its success in promoting . Moreover, the Department of Energy provides various funding options aimed at enhancing photovoltaic technologies, which you should explore to maximize your financial benefits.

in Stockton, California, are ready to assist residents in navigating these initiatives, ensuring you can fully leverage the available incentives. By taking advantage of the federal programs for solar panels, you can significantly reduce your initial costs and gain more energy independence while also contributing to a cleaner environment. Additionally, it’s wise to consider the best photovoltaic panels for overcast days, as these options can improve energy generation even in less-than-ideal weather conditions. Understanding the installation process and the unique advantages of renewable solutions will empower you to make informed decisions about your sustainable investments. Together, we can work towards a brighter, more sustainable future.

Understand Eligibility and Application Processes for Federal Solar Programs

Understand Eligibility and Application Processes for Federal Energy Programs

As a homeowner, you might be feeling the weight of rising energy bills and wondering how you can make a positive change. Federal energy initiatives, such as the federal program for solar panels, offer a path toward sustainable solutions, and understanding the eligibility and application processes is the first step. Here’s a supportive guide to help you navigate this journey:

-

- We understand that investing in solar energy can be daunting, but it’s important to know that homeowners must own their solar energy systems to qualify.

- A tax liability is required to benefit from the credit, so it’s essential to assess your financial situation.

- Complete IRS Form 5695, detailing the costs associated with . This step, while it may seem complex, is crucial for maximizing your benefits.

-

Rural Energy for America Program (REAP):

- To ensure a smooth application process, submit documentation outlining your project costs and how you plan to utilize the funding.

Key Eligibility Insights:

- It’s encouraging to note that nearly half of the families who claimed solar credits in 2023 had incomes below $100,000, indicating that these programs are accessible for many middle-income households.

- Remember to gather all necessary documentation meticulously; this can make a significant difference in facilitating a smooth application process.

- The IRS Form 5695 application has a sampling rate of about 1 in every 1,000 tax returns, emphasizing the importance of accuracy in your submissions.

Important Considerations:

- We recognize that financial limits can be a concern. The NEPC has maintained a $500 maximum credit limit since 2011, which can affect the financial benefits of these programs.

- Staying informed about potential expiration discussions regarding residential energy tax credits is vital, as this may influence your decisions and actions moving forward.

By understanding these eligibility criteria for the federal program for solar panels and following the outlined steps, you can make informed decisions about . Together, we can work toward a more sustainable future.

Assess the Community and Environmental Benefits of Federal Solar Initiatives

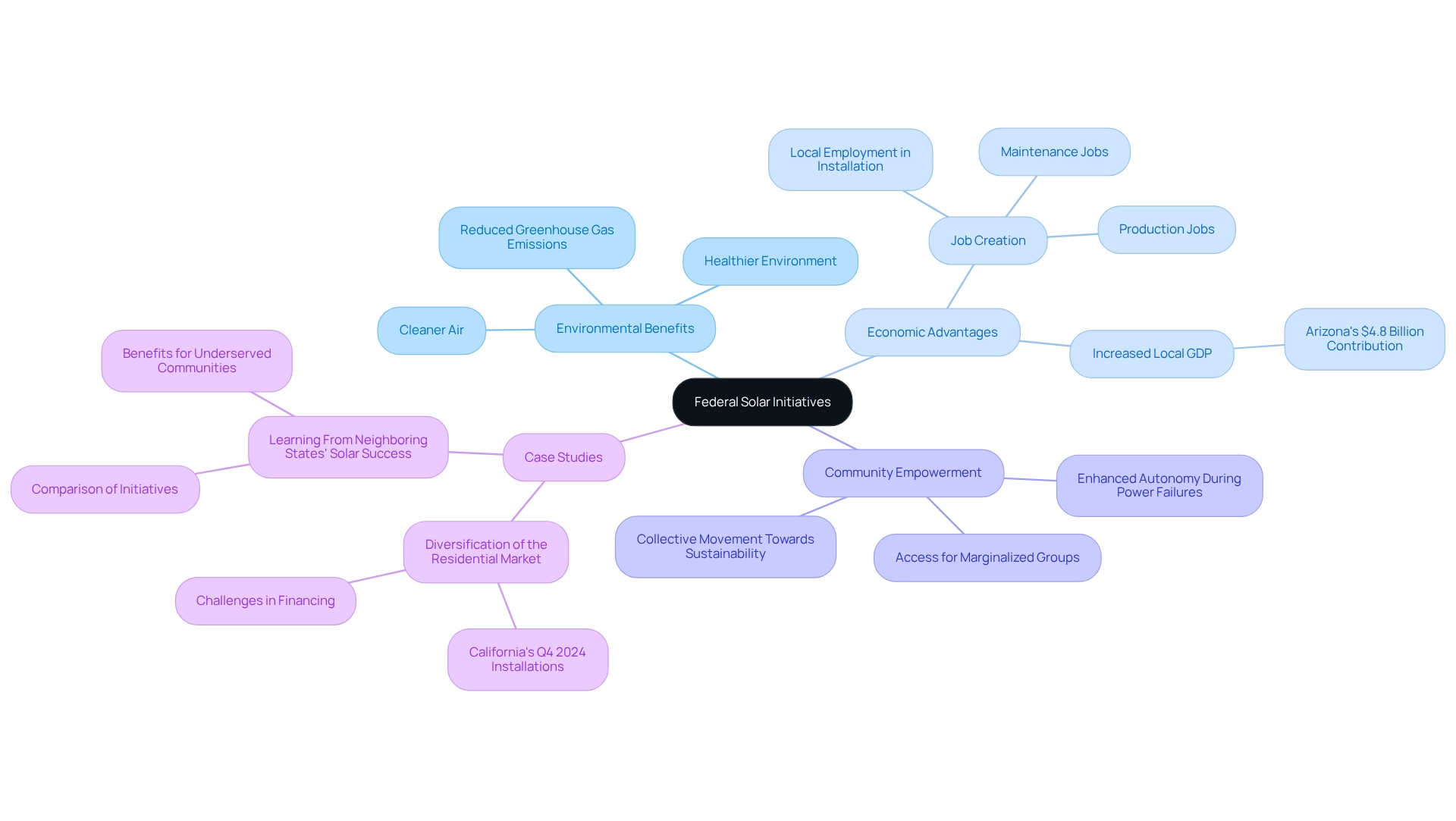

We understand that rising energy bills can be a significant concern for homeowners. The federal program for solar panels is part of federal energy initiatives that extend their advantages beyond individual households, significantly enhancing community and environmental health. By encouraging the use of renewable power, these programs play a vital role in decreasing greenhouse gas emissions and fighting climate change, resulting in cleaner air and a healthier environment. The economic advantages are just as remarkable; renewable installations create local employment in fields like installation, upkeep, and production, thus boosting the local economy.

Communities that actively adopt sustainable power frequently encounter enhanced autonomy and strength, especially during power failures. For instance, a recent case study highlighted that in Q4 2024, California experienced a surge in residential energy installations, driven by rising electricity costs and evolving net metering regulations. It’s common to feel apprehensive about market challenges, including financing expenses and a reduction in the installation pipeline. However, the opportunity for expansion remains robust as state initiatives progress.

Additionally, community programs related to renewable sources are especially advantageous for marginalized groups, offering access to sustainable resources that can lessen the effects of fossil fuel contamination. These initiatives not only provide significant savings on resource expenses but also encourage a collective movement towards sustainable practices. As mentioned by the Coalition for Community Energy Access, a suggested community energy plan in Arizona could add around $4.8 billion to state gross domestic product and generate over 50,000 job years of employment over 35 years. By participating in the federal program for solar panels, homeowners play a crucial role in creating a sustainable future for their communities, ensuring that the advantages of clean energy are distributed broadly. Together, we can build a brighter future. Additionally, as highlighted in the case study ‘Learning From Neighboring States’ Solar Success,’ can significantly benefit local communities, particularly those impacted by pollution from fossil fuels.

Conclusion

We understand that rising energy bills can be a significant concern for homeowners, prompting a search for sustainable solutions. The exploration of federal solar programs reveals their critical role in fostering a transition to renewable energy. These initiatives not only provide substantial financial incentives, such as the Investment Tax Credit and the Rural Energy for America Program, but they also empower you to significantly reduce energy costs while contributing to a more sustainable future. By making solar energy more accessible and affordable, these programs encourage widespread adoption, helping to lower carbon emissions and promote cleaner air.

Navigating the eligibility and application processes for these programs can feel daunting, but with clear guidelines and support available, you can take advantage of the financial benefits and enhance your energy independence. The positive impact of these initiatives extends beyond personal savings; they stimulate local economies, create jobs, and improve community resilience against energy crises.

Ultimately, federal solar programs represent a collective effort towards a cleaner environment and a sustainable energy future. By participating in these initiatives, you not only invest in your own financial stability but also contribute to a larger movement that benefits communities and protects our planet. Embracing solar energy is not merely an individual choice; it is a vital step towards a brighter, more sustainable tomorrow for everyone. Together, we can make a difference.