Overview

We understand that rising energy costs can be a significant concern for homeowners. The 2023 Solar Incentive Program is here to help alleviate those worries by offering substantial financial benefits, including a federal tax credit that allows for a 30% deduction on installation expenses. This initiative not only supports you in managing your energy bills but also opens the door to the numerous advantages of investing in solar energy.

Imagine the peace of mind that comes with energy independence, knowing that you are taking control of your energy future. By navigating these incentives, you can enhance the affordability and appeal of solar energy, making it a viable option for your home. Together, we can work towards a more sustainable future, where your energy choices reflect your values and contribute positively to the environment.

We encourage you to explore these opportunities further. Let’s take this journey together towards a brighter, more sustainable tomorrow. If you have any questions or need guidance, please reach out. Your path to energy independence is just a conversation away.

Introduction

Navigating the world of solar energy can feel daunting, and we understand that the myriad of incentives available in 2023 may seem overwhelming for homeowners. However, the 2023 solar incentive program presents a golden opportunity to significantly reduce installation costs through federal tax credits and state-specific rebates. This makes solar energy not just an eco-friendly choice but also a financially savvy one. It’s common to feel uncertain with so many options and potential pitfalls, but how can homeowners ensure they maximize their benefits while avoiding common application mistakes? Together, we can explore these opportunities and find the best path forward for your energy independence.

Understand Solar Incentives in 2023

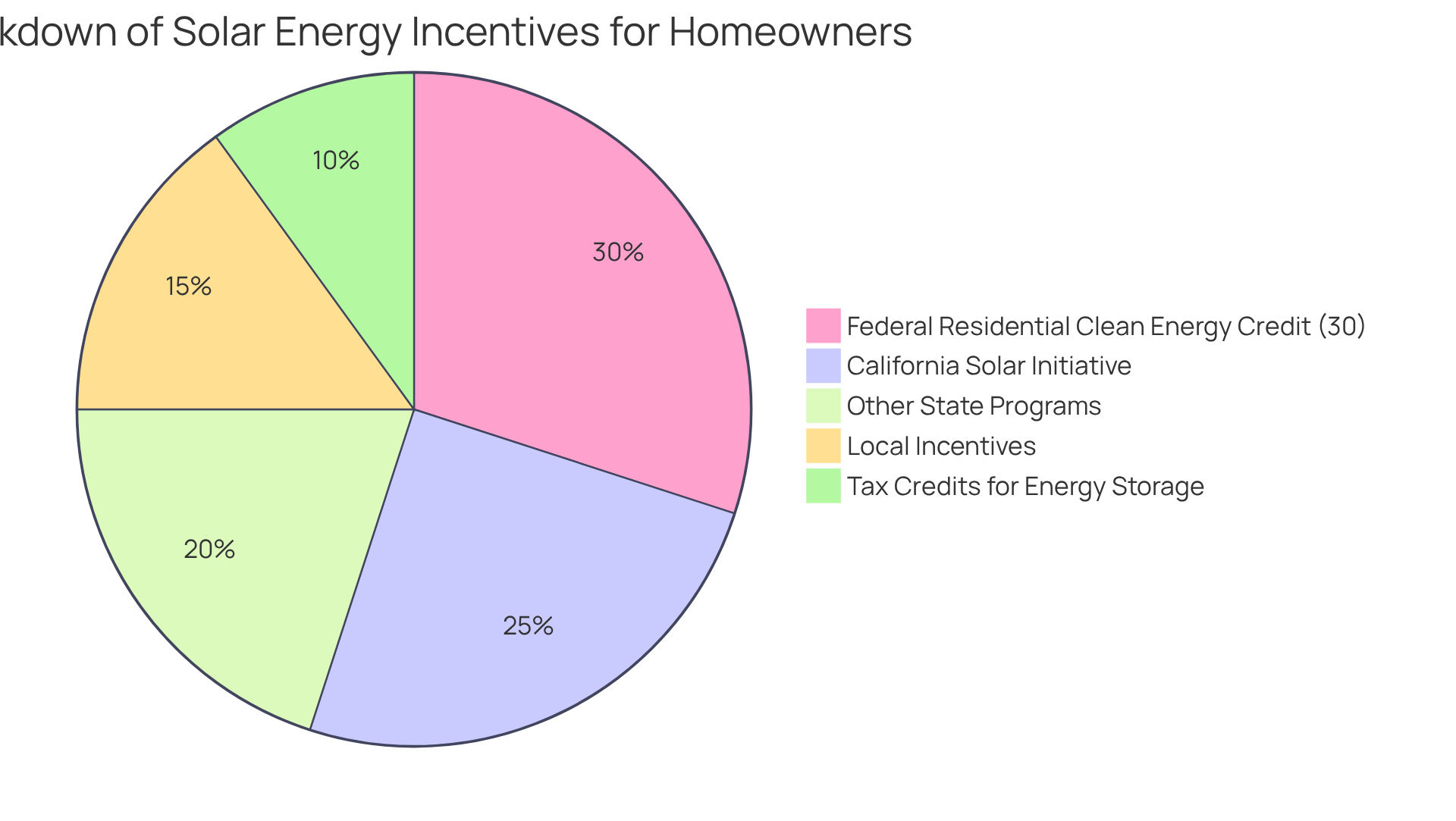

In 2023, many homeowners are understandably concerned about rising energy bills, and the 2023 solar incentive program plays a vital role in promoting a shift to . These rewards significantly reduce the initial expenses related to photovoltaic panel setups, making them more accessible and affordable. One of the most compelling motivators is the federal tax credit for renewable energy, which allows homeowners to deduct 30% of their installation expenses from their federal taxes. This substantial credit not only enhances affordability but also fosters broader acceptance of renewable sources across our nation.

Moreover, many states offer additional rebates and local utility programs that can further amplify savings. Imagine being able to combine the federal tax credit with regional advantages—maximizing your financial gains! Understanding the 2023 solar incentive program is crucial for homeowners who are seeking to make informed decisions about their energy investments. Together, we can pave the way for a more sustainable energy future.

It’s exciting to note that photovoltaic installations are projected to rise by 66% over the next ten years, highlighting the growing trend and potential future benefits of adopting this energy source. Homeowners should also be aware that if the federal renewable energy tax credit exceeds their tax liability, they can carry over the unused credit to the following year. To claim this credit, simply fill out IRS form 5695 after installation. With over $6.3 billion noted in investment tax credits primarily for rooftop energy systems and batteries, the financial impact of these incentives is considerable, creating a favorable moment for homeowners to explore renewable options.

Additionally, consider the advantages of solar-powered water heaters, which offer substantial savings on utility expenses and reduce dependence on non-renewable energy sources. By harnessing sunlight, these systems not only decrease carbon emissions but also align with environmental sustainability goals, making them an appealing choice for eco-conscious homeowners. Selecting Powercore Electric for ensures professional assistance throughout the benefits process, optimizing your savings and enhancing the overall value of your investment. Together, let’s work towards a brighter, more sustainable future.

Explore Available Solar Incentives and Tax Credits

As a homeowner, you may often find yourself worried about rising energy bills. Fortunately, the 2023 solar incentive program brings a wealth of opportunities that can significantly improve the cost-effectiveness of photovoltaic systems. offers a substantial 30% tax incentive on the expenses of photovoltaic installations, available through 2032. The 2023 solar incentive program makes investing in renewable energy not just appealing, but a wise choice for those looking to embrace a sustainable lifestyle.

In addition to federal benefits, many states, including California, provide their own supportive programs. For example, the California Solar Initiative offers cash rebates based on the size of the solar system installed, encouraging homeowners like you to adopt solar technology. We understand that navigating these options can feel overwhelming, but investigating local initiatives is essential, as benefits can vary significantly by area.

To make the most of these opportunities, we encourage you to explore resources such as the Database of State Incentives for Renewables & Efficiency (DSIRE). By leveraging these local benefits, you can not only reduce your energy costs but also contribute to a more sustainable future for everyone. Together, we can work towards a greener tomorrow, ensuring that your investment in solar energy is both impactful and rewarding.

Apply for Solar Incentives: A Step-by-Step Guide

Are you feeling overwhelmed by rising energy bills? You’re not alone. Many homeowners share this concern, and it’s completely understandable. Fortunately, there is a solution that not only addresses your financial worries but also contributes to a sustainable future—solar energy. By harnessing the power of the sun, you can reduce your dependence on the grid and lower your utility costs. Here’s how to take advantage of the 2023 solar incentive program and make this investment work for you.

- Determine Eligibility: First, it’s important to verify that your energy installation qualifies for both federal and state incentives. Ensure your system meets all necessary requirements, including ownership and installation dates. This step is crucial in maximizing your benefits.

- Gather Documentation: Next, collect all pertinent documents, such as receipts for the renewable energy system, installation contracts, and any other necessary paperwork to support your claim. Having everything organized will ease the process and give you peace of mind.

- Complete IRS Form 5695: This form is essential for claiming the federal renewable energy tax credit. Fill it out accurately, ensuring all costs associated with the installation are documented. The IRS Form 5695 instructions provide detailed guidance on what information is needed, making it easier for you to navigate this step.

- File Your Tax Return: Include Form 5695 with your federal tax return for the year in which the solar system was installed. If you are also seeking state benefits, follow the specific application process outlined by your state’s energy office. We understand that this can feel daunting, but we’re here to help.

- Submit Additional Applications: If relevant, submit any extra applications for state or local benefits, ensuring you meet all deadlines. Many regions offer their own incentives, such as the 2023 solar incentive program, which can significantly lower the total expense of installing solar energy systems, making this an opportunity you don’t want to miss.

- Follow Up: After submission, keep track of your application status. Be prepared to provide any additional information if requested, as this can expedite the processing of your incentives.

Understanding how photovoltaic panels function is crucial for homeowners contemplating this investment. Solar panels transform sunlight into electricity, which can be utilized to supply power to your home, diminishing your dependence on the grid and decreasing your utility costs. In 2023, the IRS stated that more than 280,000 Americans utilized the tax credit for renewable energy, indicating the increasing acceptance of alternative energy solutions. By comprehending the filing procedure and criteria, you can ensure that you maximize your advantages from these rewards. Moreover, the typical expense of purchasing and setting up photovoltaic panels in the U.S. is $19,537, emphasizing the potential savings from and the importance of utilizing government initiatives. Together, we can work towards a more sustainable future, and we’re here to guide you every step of the way.

Troubleshoot Common Issues with Solar Incentive Applications

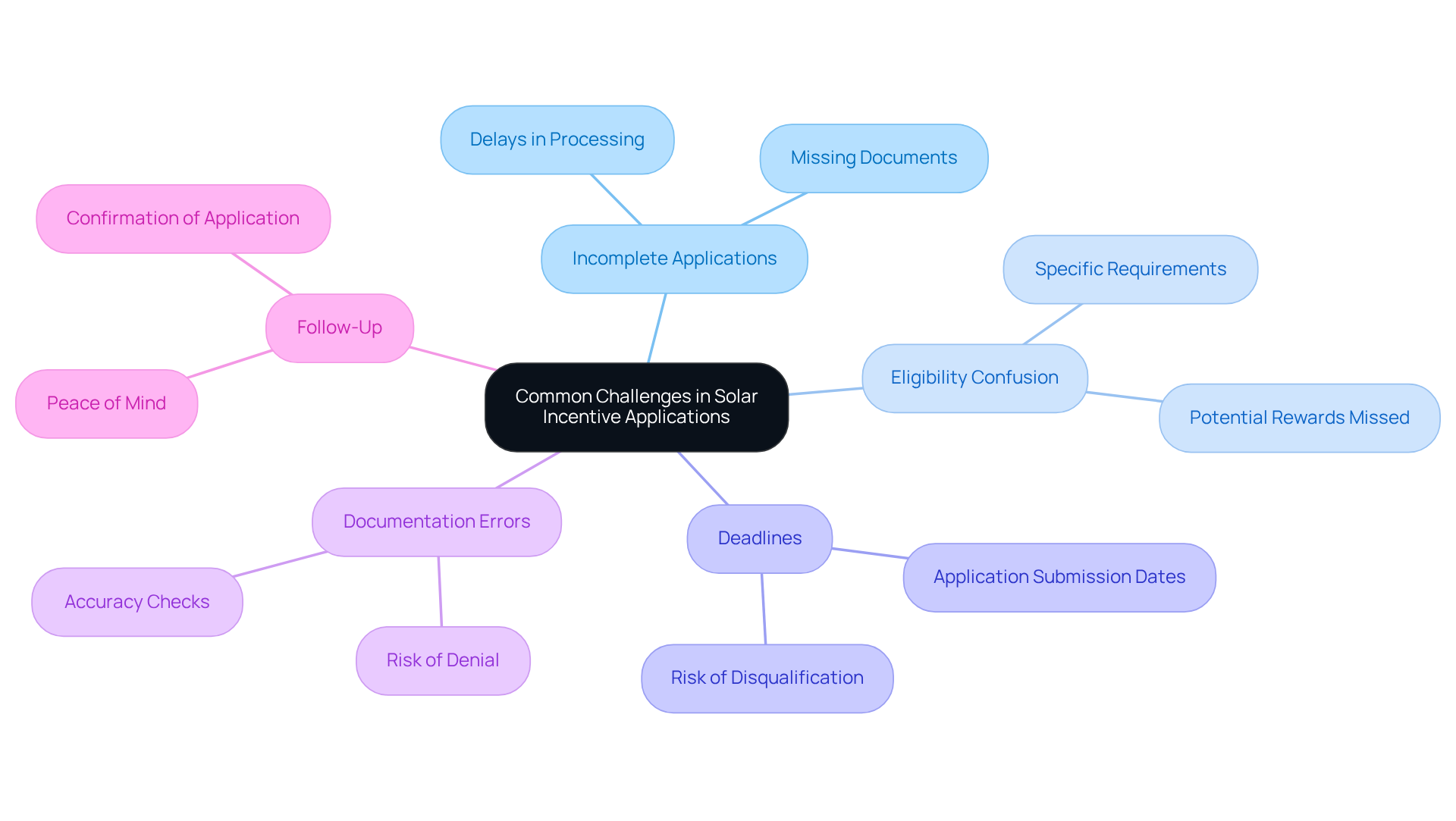

Homeowners often encounter several common challenges that can hinder their success when applying for the 2023 solar incentive program. We understand that navigating this process can feel overwhelming, but addressing these concerns can lead to a rewarding outcome:

- Incomplete Applications: It’s crucial to submit all required documents. Missing information can significantly delay the processing of your application, which can be frustrating.

- Eligibility Confusion: Carefully review the eligibility criteria for each benefit. Many programs have specific requirements that must be met to qualify, and we want to ensure you don’t miss out on potential rewards.

- Deadlines: Stay informed about application deadlines. Delayed submissions may result in disqualification from important rewards, and we know how disappointing that can be.

- Documentation Errors: Thoroughly . Simple errors can result in delays or even denials of your application, which can be disheartening.

- Follow-Up: If you haven’t received confirmation of your application, proactively follow up with the relevant agency to ensure it was received and is being processed. This step can provide peace of mind.

In 2023, a substantial portion of applications for the 2023 solar incentive program were noted as incomplete, highlighting the necessity of care in the application procedure. By being organized and proactive, property owners can navigate these challenges more effectively, increasing their chances of successfully claiming renewable energy benefits. Additionally, understanding the economic and environmental benefits of solar heating systems can further motivate homeowners to pursue these incentives. Together, let’s make the transition to eco-friendly energy solutions not only possible but appealing, as we work towards energy independence and a sustainable future.

Conclusion

The 2023 solar incentive program presents a wonderful opportunity for homeowners who are eager to lower their energy costs while embracing sustainable practices. By taking the time to understand the various incentives available—such as the significant federal tax credit and state-specific rebates—homeowners can make informed decisions that not only enhance their financial stability but also positively impact the environment.

We understand that navigating the world of solar incentives can feel overwhelming. Key insights from the article remind us of the importance of being proactive in exploring these opportunities and effectively managing the application process. From determining eligibility to gathering necessary documentation and submitting applications, every step is vital in maximizing the benefits. It’s common to encounter challenges, such as incomplete applications and documentation errors, but addressing these issues can significantly increase your chances of successfully claiming these valuable rewards.

Ultimately, transitioning to solar energy supports your individual financial goals while contributing to a broader movement toward sustainable living. Embracing the 2023 solar incentive program is not just a smart financial decision; it is a heartfelt commitment to a greener future. Together, we encourage you to take action now, explore the resources available, and seize the opportunity to invest in renewable energy, paving the way for a more sustainable tomorrow.