Overview

We understand that many homeowners are concerned about rising energy bills and are seeking effective solutions. The article focuses on how you can afford solar panels through various incentive programs provided by federal, state, and local authorities. These incentives, such as the federal investment tax credit and local rebates, significantly reduce installation costs. This makes renewable energy not only more accessible but also financially beneficial for you as a property owner. Together, we can explore how these options can lead to energy independence and a more sustainable future. Let’s work towards making your home a part of this positive change.

Introduction

As homeowners, it’s common to feel overwhelmed by rising energy bills and the quest for sustainable living. We understand that making the switch to renewable energy can seem daunting, but solar panel incentives shine a light on a path forward. These financial benefits, including tax credits and rebates, not only ease the initial costs of solar installations but also empower you to make eco-conscious choices without straining your budget. With the federal Solar Investment Tax Credit and various state-specific programs available, understanding the landscape of these incentives is essential for anyone considering a transition to solar energy.

This article will explore the myriad of available incentives, eligibility criteria, and the application process, equipping you with the knowledge needed to navigate your solar journey effectively. Together, we can unlock significant savings and contribute to a greener future. By harnessing these opportunities, you can take a meaningful step towards energy independence, all while knowing that support and guidance are just a call away.

Understand Solar Panel Incentives and Their Importance

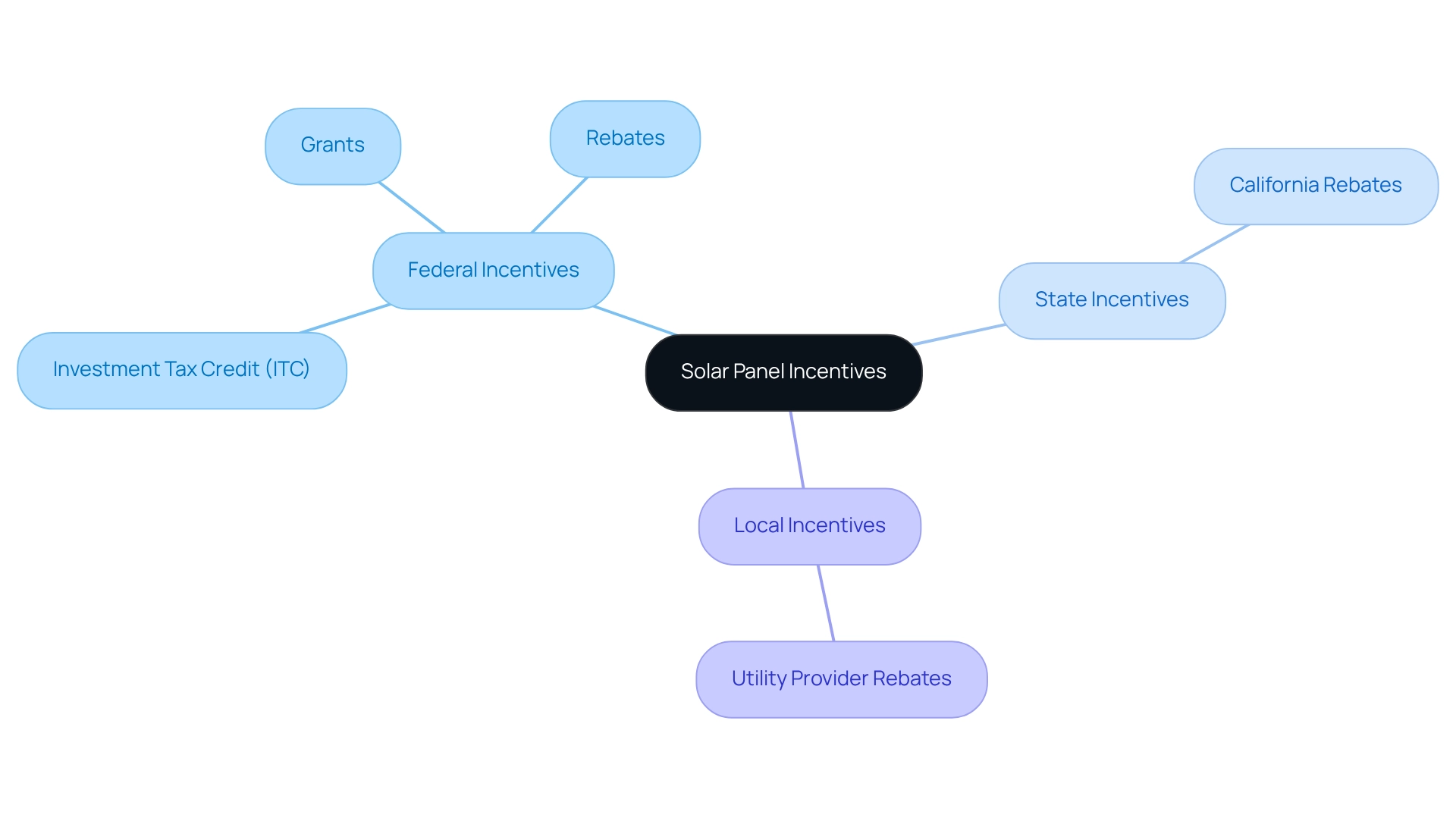

Are you feeling overwhelmed by rising energy bills? The benefits of photovoltaic panels provide essential financial advantages that can alleviate your concerns, particularly when utilizing the guide to affording solar panels with incentive programs from federal, state, and local authorities aimed at promoting renewable power use. These incentives, such as tax credits, rebates, and grants, are essential in the guide to affording solar panels with incentive programs, as they significantly lower the initial costs associated with panel installations. For example, the federal investment tax credit (ITC) allows property owners to deduct a substantial portion of their installation expenses from their federal taxes, effectively alleviating the financial burden of transitioning to renewable power. This tax credit is particularly beneficial for eco-conscious homeowners eager to invest in sustainable energy solutions.

Looking ahead to 2025, the eligibility for this tax credit has expanded to include battery storage systems and other renewable energy components, making it even more appealing. Local utility providers also contribute by offering rebates for energy installations, which can lead to additional savings. Currently, California leads the nation in harnessing renewable energy, boasting over 2,500 utility-scale power facilities. This achievement highlights the success of these initiatives in promoting energy expansion and underscores the state’s commitment to sustainable practices.

Real-world examples illustrate the financial benefits of these incentives. Homeowners can follow a guide to affording solar panels with incentive programs, which combines the federal solar tax credit with state and local benefits to achieve significant savings. However, it’s important to understand how local incentives may impact the overall installation cost and the federal tax credit amount as outlined in the guide to affording solar panels with incentive programs. The case study titled ‘Interaction of Federal Tax Credit with State and Local Benefits’ reveals that while merging these advantages can result in substantial financial gains, property owners should remain mindful of the complexities involved.

Experts agree that the extension of the ITC under the Inflation Reduction Act of 2022 marks a pivotal moment for the renewable energy sector. Daniel Stakleff noted that this extension represents a major victory for the Solar Energy Industries Association (SEIA) and the broader renewable energy community, emphasizing the importance of these benefits in enhancing residential adoption rates, which serves as a guide to affording solar panels with incentive programs. By taking advantage of these benefits, environmentally conscious homeowners can make informed decisions about transitioning to photovoltaic power, ensuring they maximize their savings and investment in sustainable resources. Understanding the is crucial for anyone considering renewable solutions, as it can lead to significant long-term financial rewards and contribute to a more sustainable future. Moreover, for Long Beach tenants, exploring options like community renewable programs can provide access to sustainable energy solutions without the need for direct installation, further enhancing the availability of eco-friendly alternatives. Together, we can work towards a greener future.

Explore Available Federal, State, and Local Incentives

In 2025, many property owners are understandably concerned about rising energy bills and are contemplating renewable resources. Fortunately, a guide to affording solar panels with incentive programs provides a variety of incentives that make installations more economical.

At the federal level, (ITC) allows property owners to deduct 30% of their installation costs from federal taxes for the next ten years. This significant reduction in expense can motivate more homeowners to invest in renewable energy, leading to considerable savings over time.

In California, the California Solar Initiative offers additional rebates that vary based on the size of the energy system installed, further enhancing affordability. Local energy providers in Stockton, such as Pacific Gas and Electric (PG&E), also have their own rebate programs that can complement state benefits.

For instance, property owners participating in these programs can expect average savings of up to $29,077 over the lifespan of their solar panels, after recouping their initial investment. To maximize these savings, we recommend using our guide to affording solar panels with incentive programs that helps property owners explore specific state and local options tailored to their needs. Resources like the Database of State Incentives for Renewables & Efficiency (DSIRE) provide valuable information on available benefits in their areas.

Additionally, obtaining a complimentary estimate from approved installers can help homeowners efficiently navigate their options. By utilizing the guide to affording solar panels with incentive programs, property owners can transition to sustainable energy solutions while enjoying significant financial benefits.

As Ryan Suchsland, a Residential Energy Consultant, emphasizes, it’s essential for residents to establish trust with energy providers when making these important decisions. Together, we can work towards a more sustainable future, ensuring that your energy choices reflect both your values and your financial goals.

Determine Eligibility for Solar Incentives

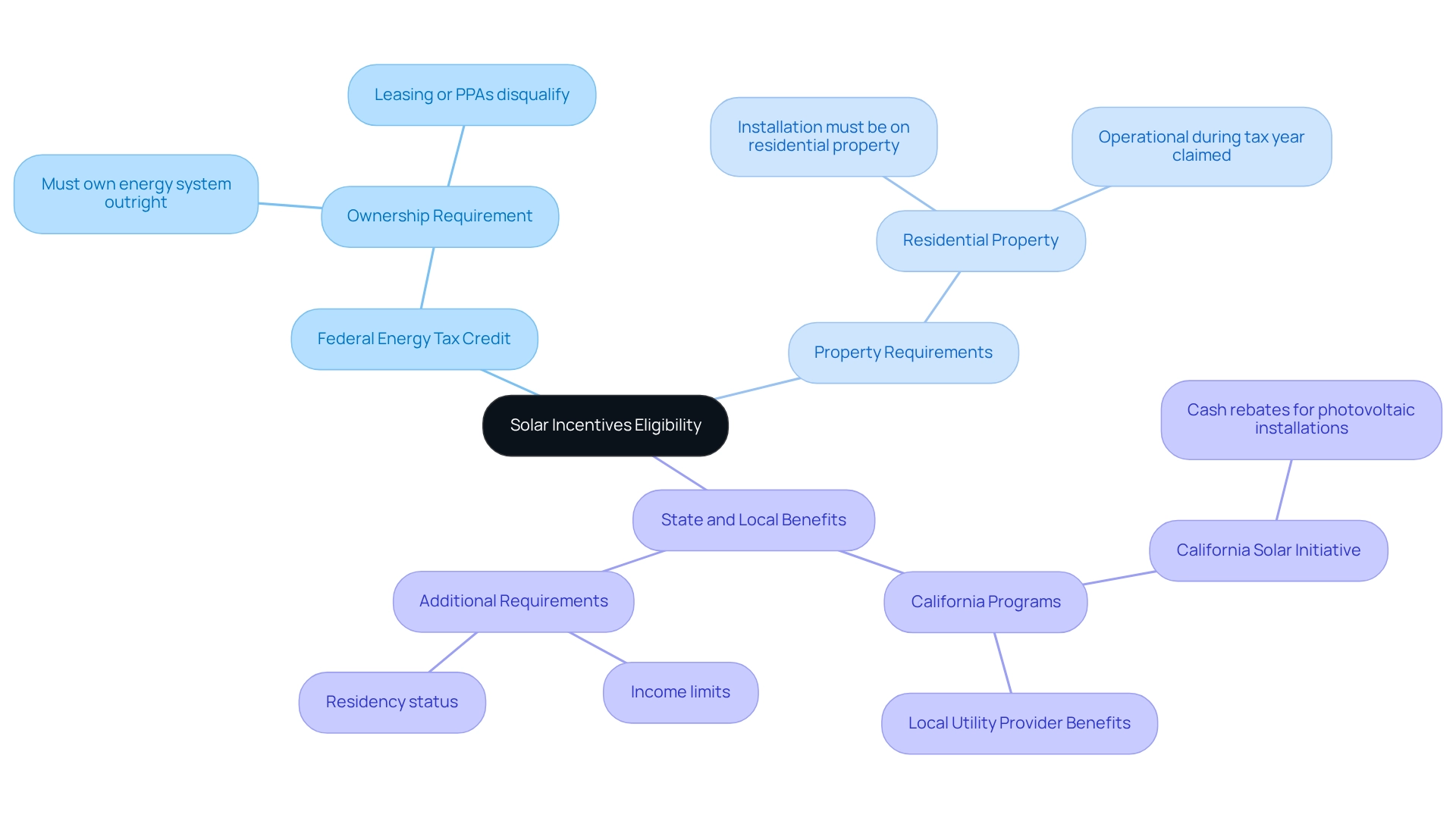

As a homeowner, you may often find yourself worried about rising energy bills and the impact they have on your budget. To ease these concerns, it’s essential to understand the eligibility standards for renewable energy benefits, which serve as a guide to affording solar panels with incentive programs, as these standards can vary between programs. Here are some key requirements to consider:

- Federal Energy Tax Credit: Homeowners must own their energy system outright; leasing or entering into power purchase agreements (PPAs) typically disqualifies them.

- Property Requirements: The installation must be on a residential property and operational during the tax year for which the credit is claimed.

- State and Local Benefits: Additional requirements may include income limits or residency status, which can vary significantly.

In California, there are various programs designed to support both renters and homeowners in Long Beach, promoting the adoption of renewable energy solutions. For instance, the California Solar Initiative offers cash rebates for photovoltaic installations, while local utility providers may present extra benefits. We understand that navigating these options can feel overwhelming, but it’s crucial for homeowners to carefully examine the eligibility requirements for each benefit program they are considering as outlined in the guide to affording solar panels with incentive programs. This diligence ensures adherence to all essential conditions.

It’s also important to highlight that most renewable energy benefits necessitate submitting , which is a key element of eligibility. Consulting with a renewable energy installation specialist can provide clarity on these requirements and streamline the application process. By doing so, property owners can maximize their advantages from available rewards. Together, we can effectively maneuver through the realm of renewable energy benefits, making informed choices regarding energy investments that contribute to long-term sustainability and efficiency. Remember, you’re not alone in this journey; support is available to help you achieve energy independence.

Follow the Application Process for Solar Incentives

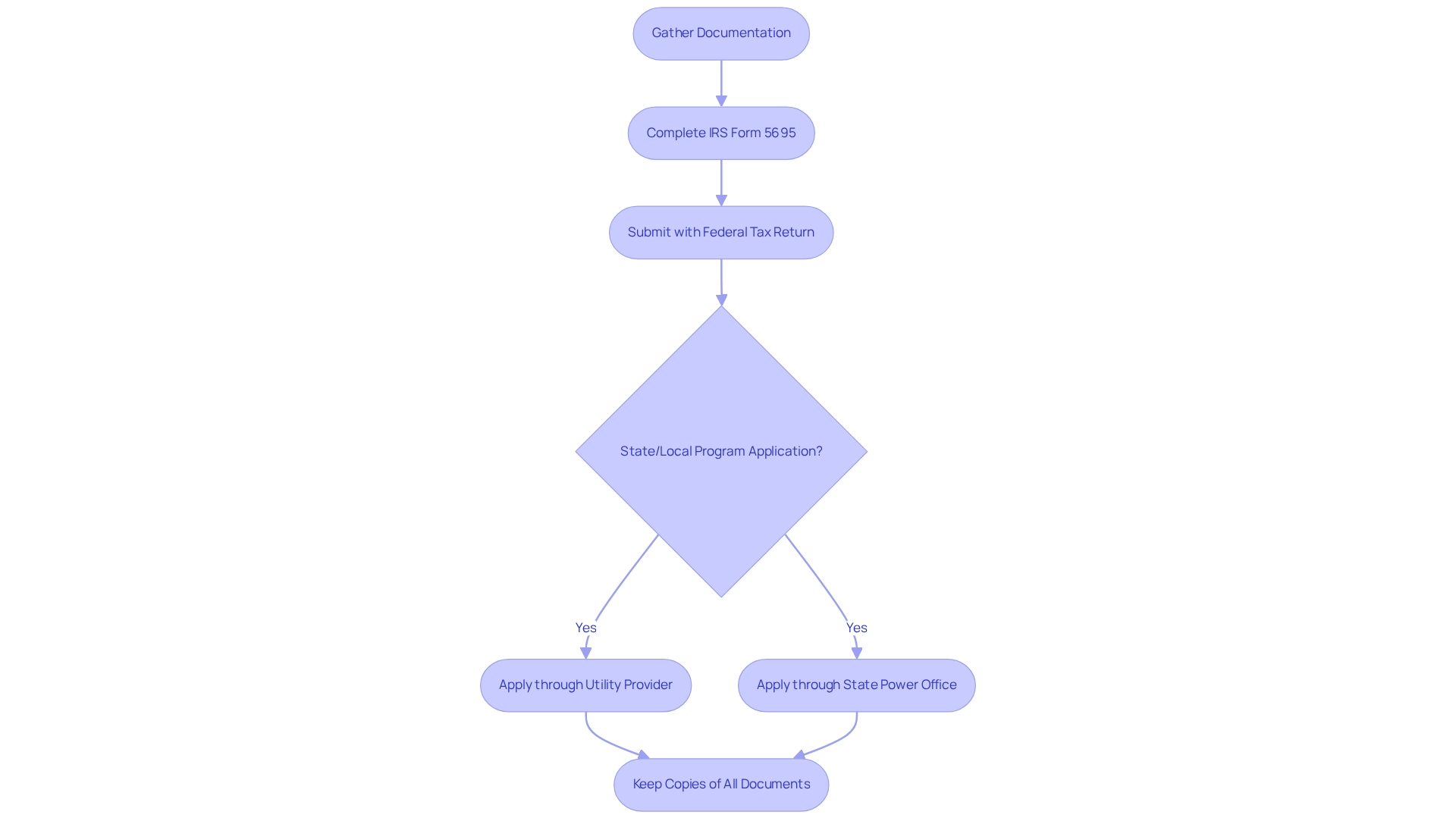

Navigating the application process for renewable energy incentives can feel overwhelming, but with a guide to affording solar panels with incentive programs, it’s a journey that offers significant benefits for environmentally conscious property owners like you. To start, gather all essential documentation, such as receipts for your energy system purchase and installation, along with any required forms. If you’re looking into the federal renewable energy tax credit, completing IRS Form 5695 is crucial, as it helps calculate your credit based on the total expense of your energy system. Remember, this form needs to be submitted with your federal tax return.

In regions like Bakersfield, state and local benefits may have different application processes. Some programs require you to apply directly through your utility provider or state power office. It’s common to feel a bit lost in the details, but meticulously following the specific instructions for each program is vital to ensure compliance. Keeping copies of all submitted documents and communication for your records can also provide peace of mind.

Statistics show that 78% of installers expect increased sales in 2025, reflecting a rising interest in renewable power solutions. This trend may inspire you to explore photovoltaic installations, especially since a guide to affording solar panels with incentive programs can significantly improve the financial feasibility of these projects. Different motivators, such as tax credits, cash rebates, and performance-based rewards, act as a guide to affording solar panels with incentive programs, significantly lowering installation expenses and making renewable energy more attainable for you. Successful applications for federal and state energy incentives often rely on thorough preparation and an understanding of the requirements.

As energy policy expert Ben Zientara points out, the recent shutdowns of major firms like SunPower have understandably made prospective clients more cautious about renewable energy companies. This highlights the importance of selecting a trustworthy installer. By following the outlined steps in the guide to affording solar panels with incentive programs and ensuring you meet all necessary criteria, you can effectively reduce installation costs and move towards a more sustainable future. Together, we can make a meaningful impact on .

Evaluate the Financial Impact of Going Solar

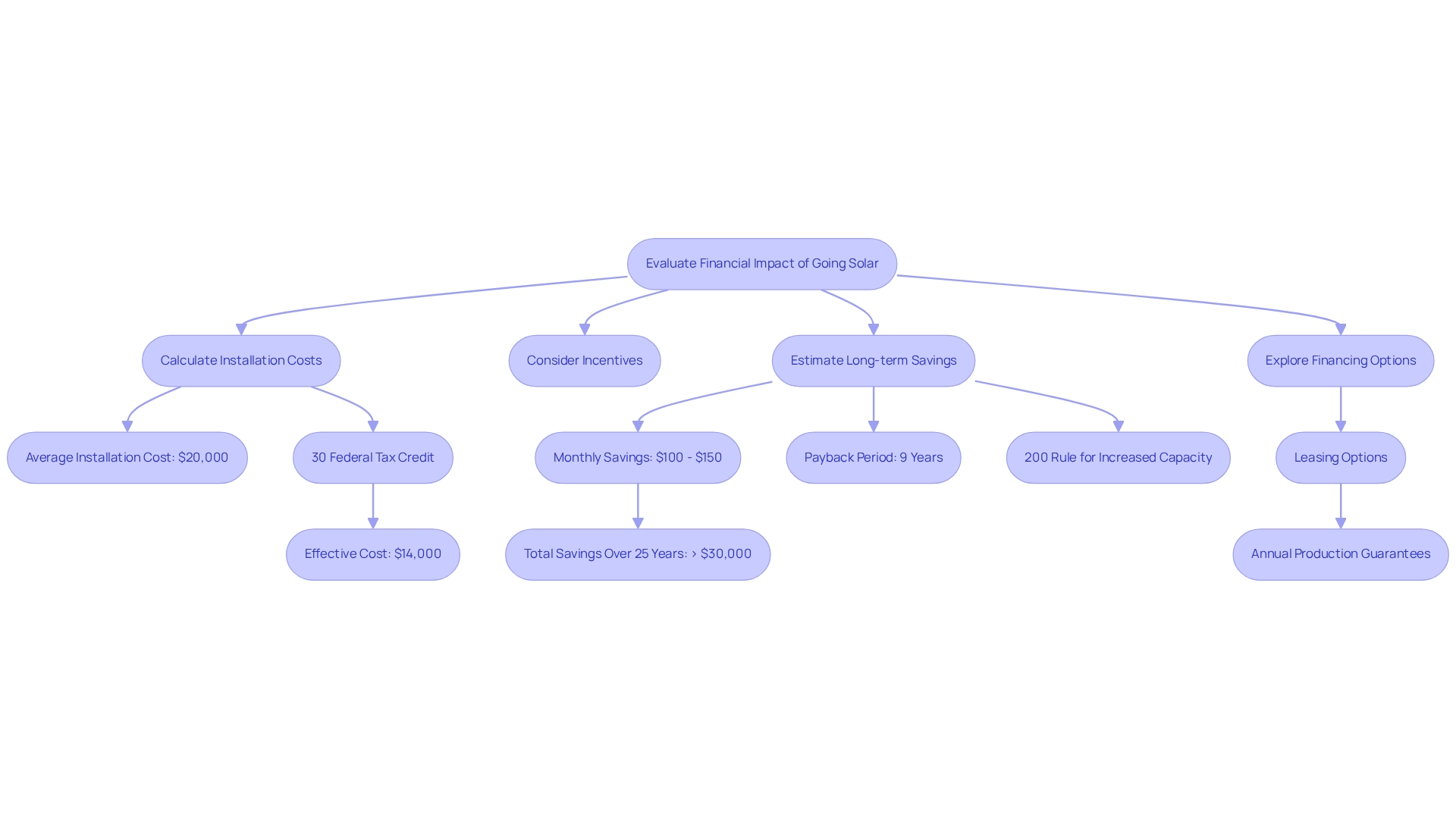

Assessing the financial impact of renewable energy is crucial for homeowners who are considering this sustainable choice. We understand that the initial costs can be daunting, so start by calculating the total installation expense, which in California averages around $20,000 in 2025.

Fortunately, homeowners can refer to a guide to affording solar panels with incentive programs to significantly reduce this upfront cost by leveraging available incentives, such as the 30% federal tax credit, bringing the effective cost down to approximately $14,000.

Now, let’s think about the long-term savings on electricity bills. Homeowners can anticipate saving between $100 to $150 each month, depending on local utility rates and the size of their power system. Over a typical lifespan of 25 years, these savings can accumulate to a substantial amount, potentially exceeding $30,000.

Moreover, the typical payback period for photovoltaic systems without a battery is around 9 years, which is advantageous compared to the national average of about 11 years. This makes these panels a valuable investment in California, as highlighted by energy policy analyst Ben Zientara. Additionally, such installations can increase property value, offering further financial advantages. Studies show that residences equipped with renewable power systems sell for an average of 4.1% more than similar homes lacking such systems, resulting in a rise in equity. This aspect is especially significant for environmentally-conscious property owners seeking to optimize their investment.

For those considering financing alternatives, renewable energy leases provide a different option. Homeowners can pay a monthly charge for renewable power without owning the equipment, making it accessible even for those who cannot afford a cash purchase. While leases typically match the average electric bill, they are becoming less popular due to the availability of better financing options that allow for ownership and greater long-term savings.

It’s advisable for property owners to seek yearly production guarantees when evaluating leasing agreements to ensure they obtain value from their investment. In summary, by carefully calculating installation expenses, considering the guide to affording solar panels with incentive programs, and estimating possible savings, property owners can make informed choices about their investments, ultimately leading to substantial financial benefits.

Additionally, homeowners should consider the 200% Rule, which allows for based on their energy needs, further enhancing the financial viability of solar installations. Together, we can navigate this journey towards energy independence and sustainability.

Conclusion

We understand that managing energy bills can be a significant concern for many homeowners. Solar panel incentives play a pivotal role in making renewable energy not only accessible but also affordable. By exploring the various federal, state, and local incentives available, you can significantly reduce the upfront costs associated with solar installations. The federal Solar Investment Tax Credit, along with state-specific rebates and grants, offers substantial savings, empowering eco-conscious homeowners like you to invest in sustainable energy solutions without financial strain.

It’s common to feel overwhelmed by eligibility requirements, as they vary by program. To maximize your benefits, it’s essential to ensure you meet the specific criteria. While the application process is straightforward, it does require careful attention to detail and compliance with each program’s guidelines. By gathering the necessary documentation and understanding the application steps, you can successfully navigate the path to solar energy adoption.

Evaluating the financial impact of transitioning to solar is essential for your peace of mind. With potential savings on electricity bills and increased property value, the long-term benefits are truly compelling. By taking the time to analyze installation costs, leverage available incentives, and consider financing options, you can make informed decisions that lead to significant financial gains.

Together, let’s embrace solar energy through the available incentives. This not only contributes to your personal savings but also promotes a sustainable future for our planet. By taking advantage of these opportunities, you can play a crucial role in the transition to renewable energy, paving the way for a greener planet while enjoying the financial rewards of your investments.