Overview

Homeowners often grapple with rising energy bills, and it’s common to feel overwhelmed by these costs. The Hawaii Solar Tax Credit for 2024 provides a beacon of hope, offering significant financial relief. This tax credit presents a 35% rebate on installation costs, making the transition to solar energy more attainable than ever. By understanding eligibility requirements and leveraging both state and federal incentives, you can maximize your savings and embrace the benefits of solar energy.

Imagine the peace of mind that comes with energy independence. By adopting solar solutions, you’re not just reducing your bills; you’re also contributing to a more sustainable future. Together, we can navigate this journey and ensure you receive all the benefits available to you.

If you’re considering this path, know that support is just a call away. Let’s work together to explore how the Hawaii Solar Tax Credit can transform your energy experience and help you achieve your goals. Your journey towards sustainable living begins now.

Introduction

As homeowners in Hawaii face the challenge of soaring energy costs, the commitment to renewable energy becomes increasingly vital. The Hawaii Solar Tax Credit 2024 offers a wonderful opportunity to alleviate some of this burden, providing a tax rebate of up to 35% on photovoltaic systems. We understand that navigating the evolving landscape of solar incentives can be daunting. How can you ensure that you fully benefit from these opportunities, especially with potential legislative changes and common misconceptions looming?

The rising energy bills can feel overwhelming, but there is hope. Embracing solar energy not only helps reduce your expenses but also paves the way toward energy independence. Imagine a future where your energy source is sustainable and your bills are manageable. Together, we can explore how these incentives can work for you, guiding you through the process and addressing any concerns you may have.

Let’s work towards a brighter, more sustainable future. By taking advantage of the Hawaii Solar Tax Credit, you can make a significant step towards reducing installation costs while contributing to a cleaner environment. It’s common to feel uncertain about making such a transition, but rest assured, you are not alone in this journey. We are here to support you every step of the way.

Hawaii Solar Tax Credit Overview: Key Benefits for Homeowners

Are you feeling overwhelmed by rising energy bills? The Hawaii Solar Tax Credit 2024 offers a significant financial incentive for homeowners like you who are considering renewable power systems. This credit allows property owners to receive a tax rebate of up to 35% of installation expenses, capped at $5,000 per system. By significantly lowering the initial costs of photovoltaic installations, the Hawaii solar tax credit 2024 makes solar energy more accessible and encourages a broader transition to renewable resources across our beautiful state.

Imagine the long-term savings on your utility bills while supporting sustainable living practices in Hawaii. As more homeowners recognize the financial benefits of solar power, adoption rates for residential installations continue to rise, aided by the Hawaii solar tax credit 2024, contributing to Hawaii’s ambitious goal of generating 100% of its energy from renewable sources by 2045. You can further enhance your savings by combining state and federal incentives, including the .

Additionally, the Honolulu Property Tax Exemption for Renewable Resources offers a 100% waiver on property taxes for upgrades, making solar power even more appealing. While you explore these incentives, it’s also essential to consider the initial costs associated with batteries. While they provide valuable energy storage benefits, they can impact your total investment.

We understand that navigating the incentive application process can be daunting. Consulting local energy companies can provide tailored solutions to meet your specific needs, ensuring you fully leverage the economic and environmental benefits of solar systems. If you’re interested in solar-powered heaters, understanding the installation processes and product specifications is crucial for making informed decisions. Together, we can work towards a brighter, more sustainable future.

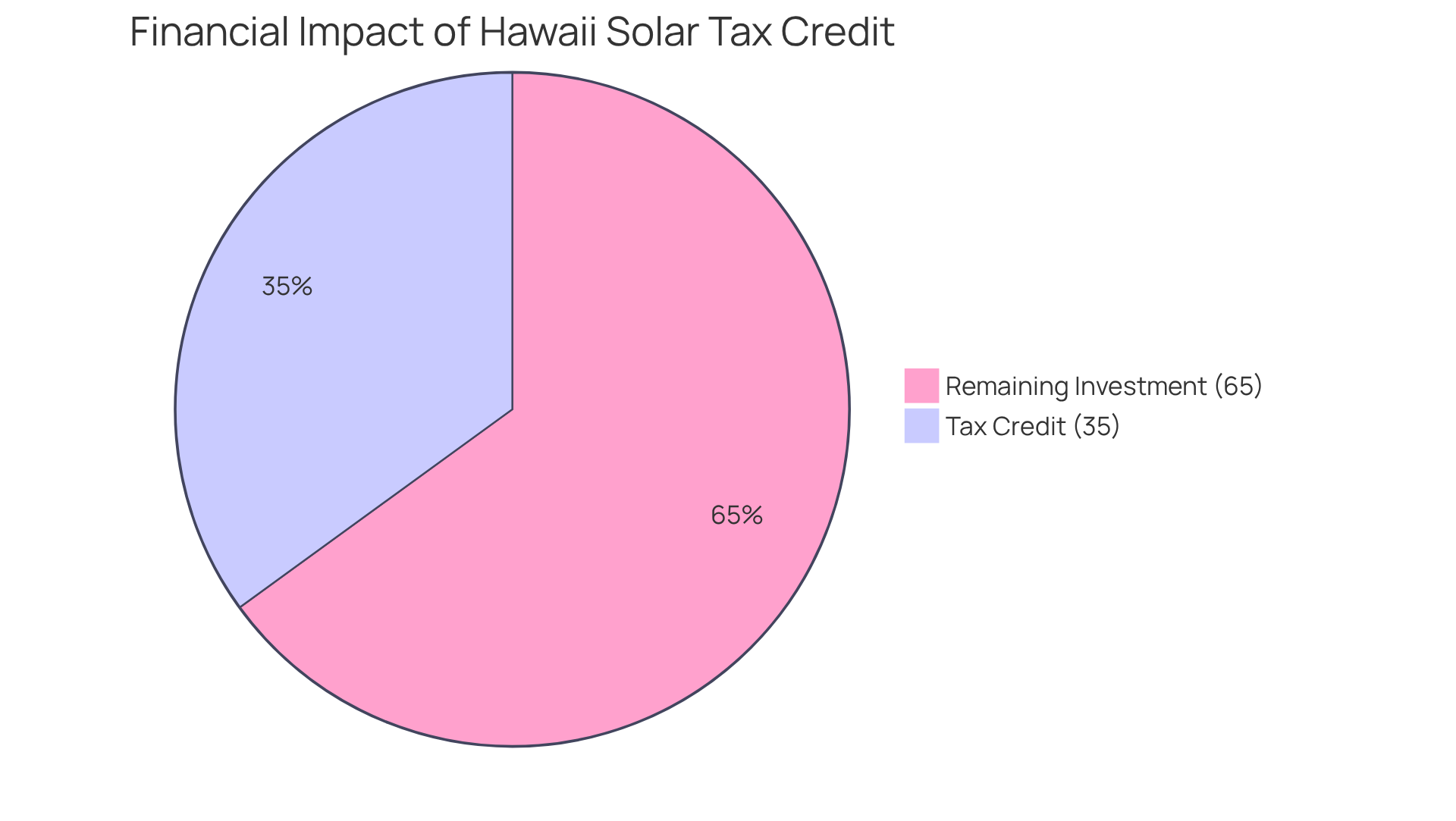

2024 Tax Credit Rate: Understanding the 35% Solar Tax Credit

In 2024, we understand that many homeowners in Hawaii are concerned about rising energy bills. The Hawaii solar tax credit 2024 offers a nurturing solution with an enticing 35% deduction for those investing in photovoltaic systems. For every dollar spent, you can reduce your state income taxes by 35 cents, significantly enhancing your financial return on larger systems.

The highest allowance is capped at $5,000 for systems of 5 kW or greater, making it especially beneficial for those looking to make significant renewable energy investments. Homeowners can expect average savings of approximately $1,500 annually after installation, underscoring the value of this supportive tax incentive.

Financial specialists emphasize that utilizing the Hawaii solar tax credit 2024, which provides a 35% solar tax incentive, can lead to substantial long-term savings, particularly as energy expenses in Hawaii remain among the highest in the nation. By fully embracing this financial resource, you not only contribute to a sustainable future but also enjoy significant financial benefits.

It’s worth noting that any unused benefits can be transferred to subsequent years, offering flexibility for those with limited tax liability in the installation year. Together, let’s explore how this opportunity can empower you towards and a brighter, greener future.

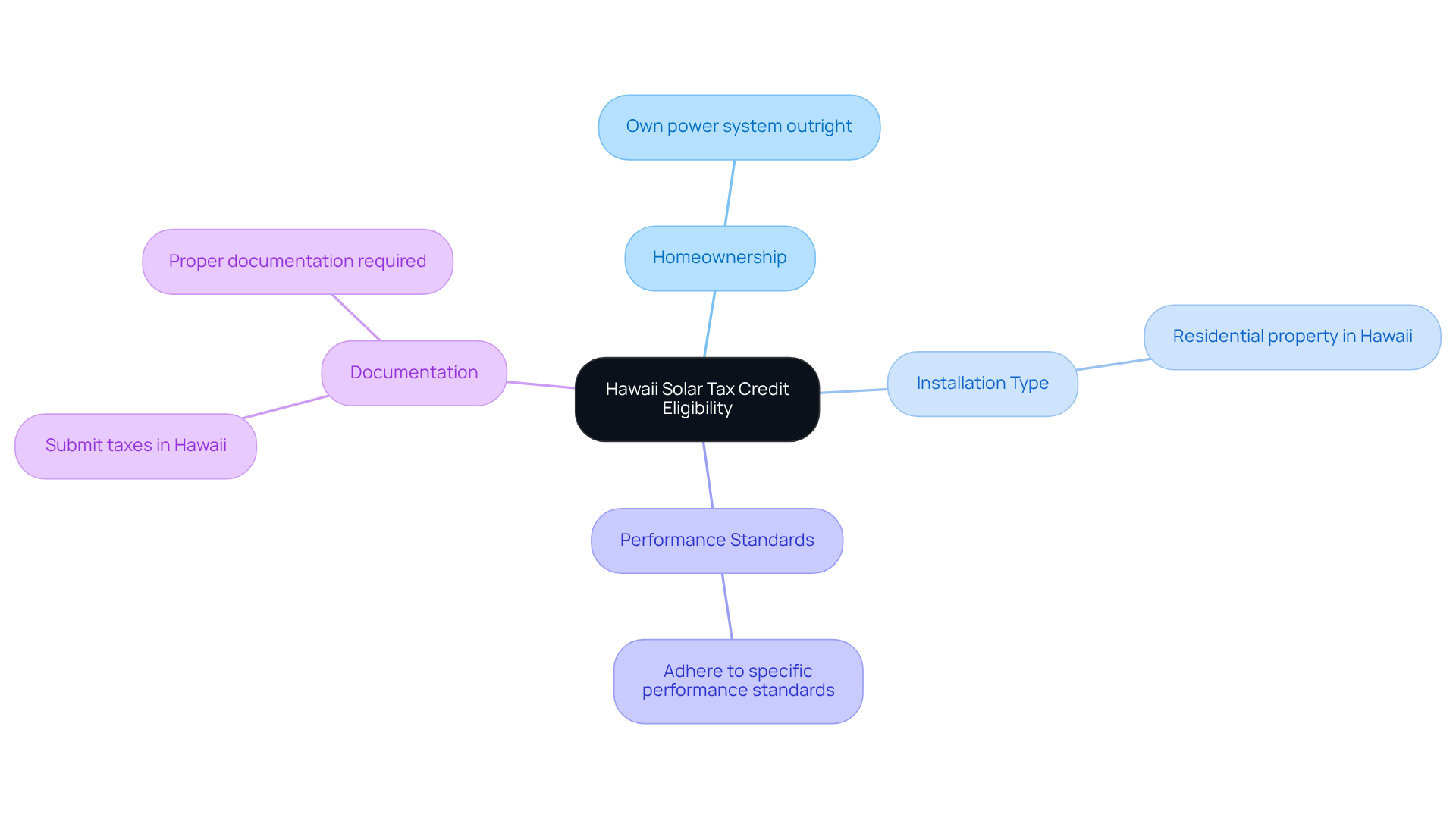

Eligibility Requirements: Who Can Claim the Hawaii Solar Tax Credit?

We understand that many homeowners are concerned about and are seeking sustainable solutions. To address these worries, the Hawaii solar tax credit 2024 offers a valuable opportunity for those looking to invest in solar energy. To qualify, homeowners must own their power system outright, which means leased systems or those financed through power purchase agreements (PPAs) do not meet the criteria. The installation must occur on a residential property in Hawaii and adhere to specific performance standards.

It’s common to feel overwhelmed by the process, but it’s essential to know that a significant portion of property owners can benefit from this tax incentive. This can provide a meaningful motivation for individuals seeking energy independence and a more sustainable lifestyle. To successfully obtain the benefit, homeowners are required to submit their taxes in Hawaii. Tax professionals often highlight that proper documentation and adherence to state regulations are crucial for maximizing benefits from the Hawaii Solar Tax Credit 2024.

Together, we can navigate this process, ensuring you receive the support and guidance you need to make the most of this opportunity. Let’s work towards a brighter, more sustainable future for our homes and communities.

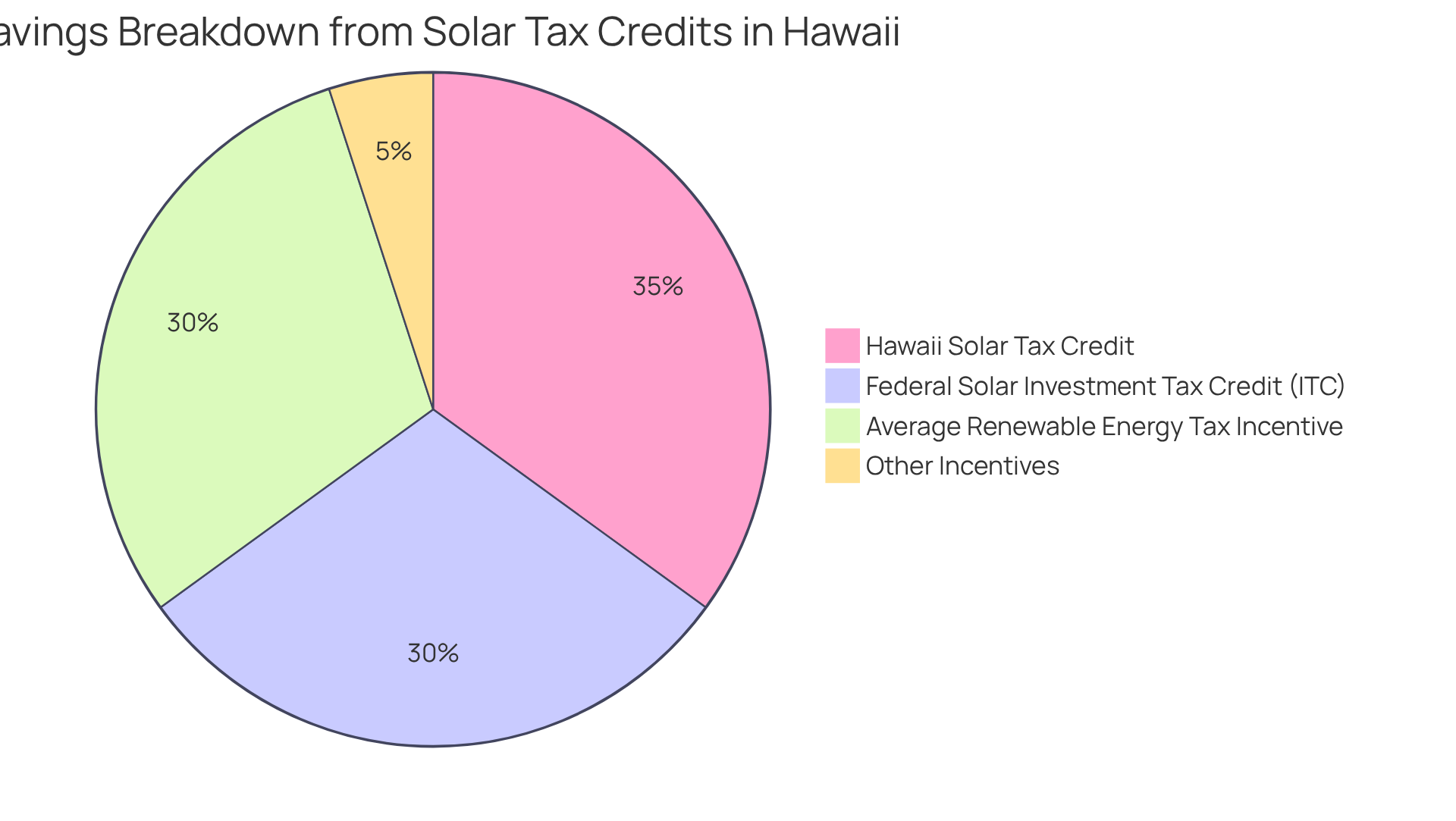

Combining Incentives: Leveraging the Federal Solar Investment Tax Credit (ITC)

Homeowners in Hawaii often worry about rising energy bills, and there’s a way to ease that burden. By merging the Hawaii solar tax credit 2024 with the Federal Solar Investment Tax Benefit (ITB), which currently offers a 30% reduction on installation costs, you can significantly enhance your savings. Imagine saving up to 65% on installation expenses!

For instance, if you’re considering a photovoltaic system valued at $20,000, you could potentially receive $13,000 in tax benefits, substantially reducing your out-of-pocket costs. The average renewable energy tax incentive is around $6,544, which represents 30% of the typical system expense, providing a clearer view of the savings available to you.

As Dr. Paul Leu, Ph.D., insightfully points out, with the Hawaii solar tax credit 2024 and the federal tax credit, you can reclaim 30% of your system’s cost if installed before 2032, and many states offer additional incentives. This financial encouragement not only makes renewable energy more accessible but also inspires homeowners to invest in sustainable alternatives, leading to long-term savings on utility bills.

We understand that grasping the size and efficiency of residential photovoltaic panels can be daunting. However, under the 200% rule, homeowners can install systems that produce more energy than they consume, maximizing both economic and environmental benefits. Together, we can navigate this journey toward and create a brighter, more sustainable future.

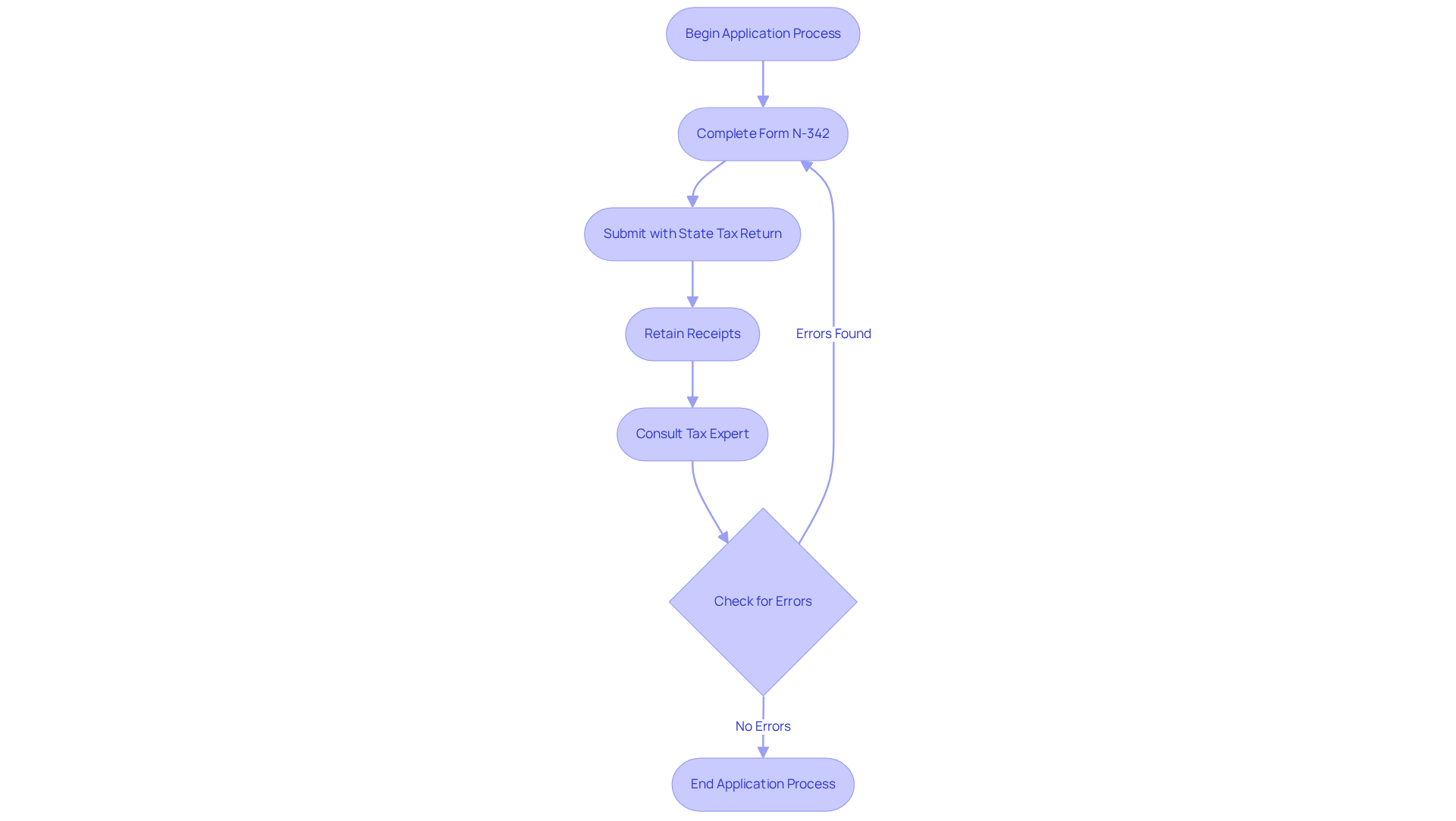

Application Process: Steps to Claim the Hawaii Solar Tax Credit

We understand that navigating the world of tax credits can be overwhelming, especially when it comes to your energy bills. To successfully claim the Hawaii solar tax credit 2024, homeowners need to complete Form N-342 and submit it alongside their state tax return. This form requires comprehensive details about your solar installation, including associated costs and system specifications. It’s crucial to retain all receipts and documentation related to the installation, as these may be necessary for verification purposes. Seeking advice from a tax expert is strongly advised to ensure you’re adhering to all regulations and optimizing the potential benefits available to you.

It’s common to feel anxious about making mistakes in this process. Frequent errors often involve not supplying full details on the form or overlooking essential documentation, which can postpone or endanger your claim. However, homeowners have reported that thorough preparation and a solid understanding of the form can significantly streamline the application process, leading to successful claims.

Tax experts stress the importance of precision when completing Form N-342, particularly for those seeking the Hawaii solar tax credit 2024, as even small mistakes can lead to complications or diminished benefits. Additionally, it’s reassuring to know that unused tax credits can carry over to future years, providing you with flexibility in your tax planning. Together, we can navigate this process with confidence and ease, ensuring you make the most of your .

Financial Impact: How the Tax Credit Reduces Solar Installation Costs

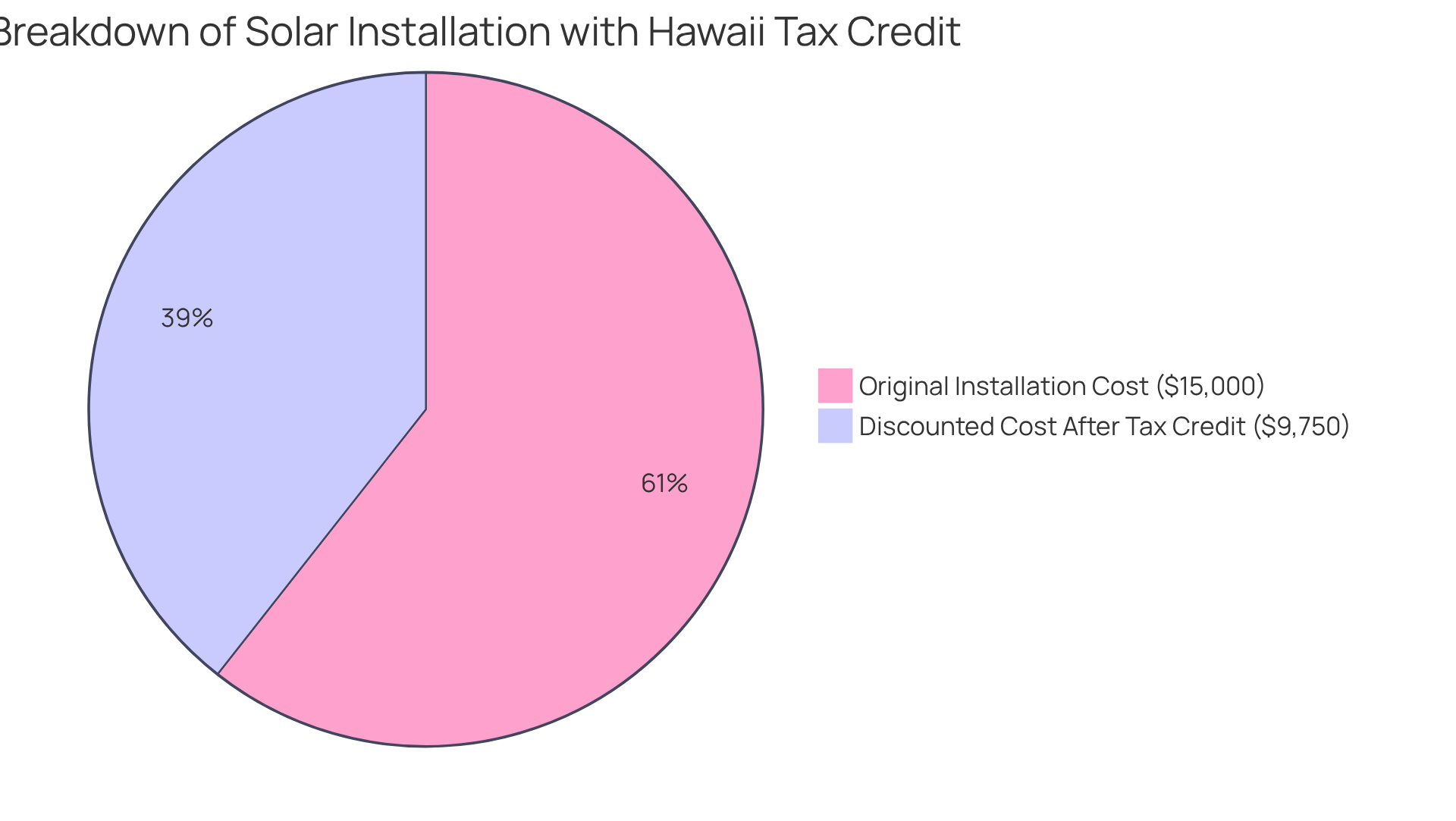

We understand that the rising costs of energy can be a significant concern for homeowners in Hawaii, which is why the Hawaii solar tax credit 2024 is important. The Hawaii solar tax credit 2024 provides a compassionate solution to alleviate this financial burden associated with photovoltaic system installations. By providing a generous 35% discount on installation expenses, homeowners can significantly lower their initial investment, making the transition to renewable power a more feasible choice. For example, a photovoltaic setup valued at $15,000 would essentially cost just $9,750 after utilizing this valuable tax incentive.

This substantial reduction not only improves access to renewable resources but also decreases the payback period for your investment, allowing you to recover your expenses more swiftly. With Hawaii’s average electricity costs hovering around 44.24 cents per kWh, the provided by the Hawaii solar tax credit 2024 are crucial in encouraging the adoption of renewable power solutions throughout the state.

Moreover, case studies have shown that homeowners who have taken advantage of this tax incentive have realized significant savings on their utility bills, illustrating the long-term advantages of transitioning to renewable sources. By grasping the cost advantages of photovoltaic panels compared to conventional electricity, you can make well-informed choices that optimize your savings and enhance your energy self-sufficiency. Together, we can work towards a sustainable future that not only benefits your wallet but also the environment.

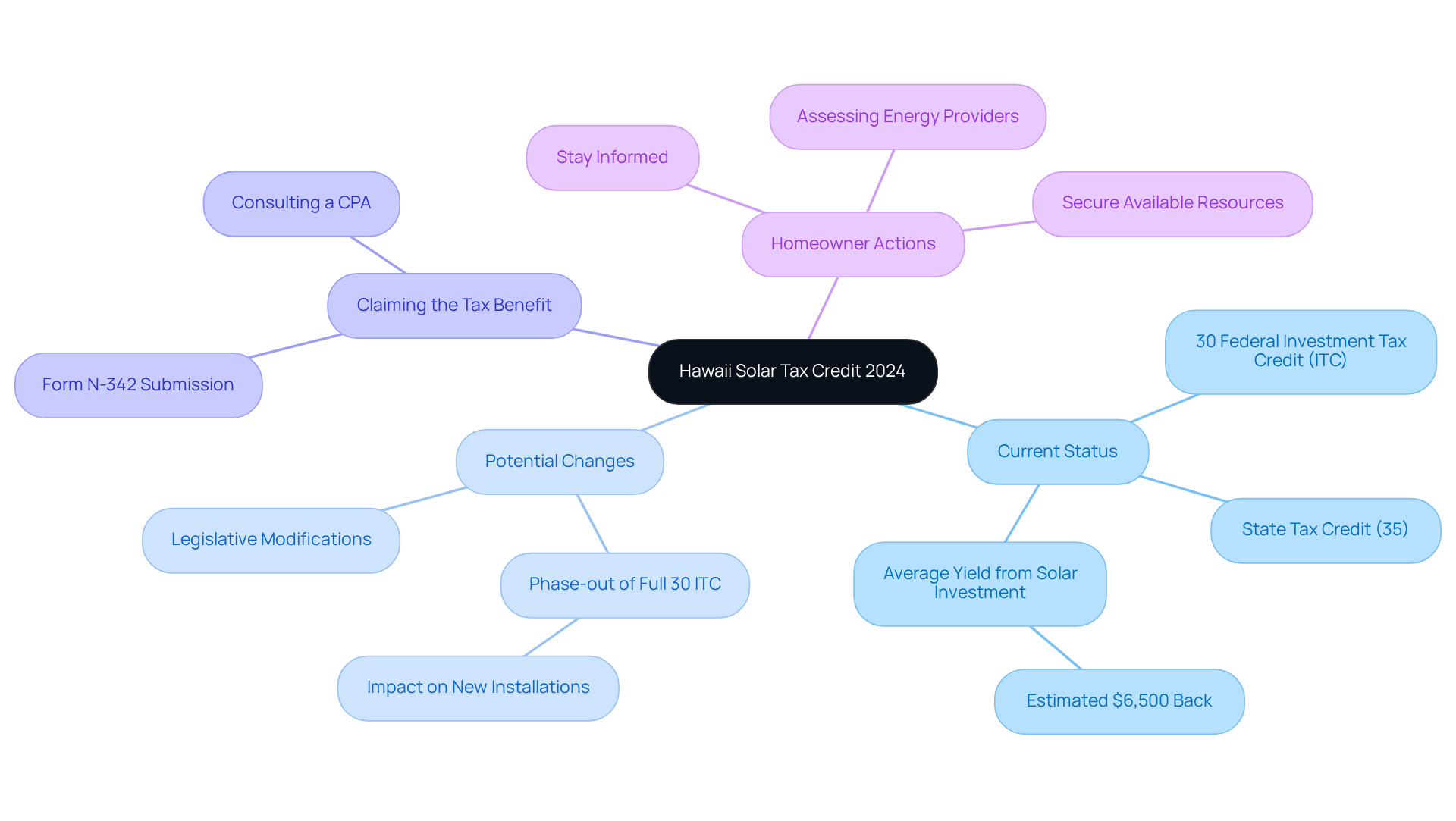

Expiration and Renewal: What to Know About the Future of the Hawaii Solar Tax Credit

We understand that rising energy bills can be a source of concern for many homeowners. The Hawaii Solar Tax Credit 2024 is currently in effect, providing a valuable opportunity for those looking to invest in renewable energy solutions. However, ongoing discussions about the Hawaii Solar Tax Credit 2024 warrant your attention. Tax incentives like the Hawaii Solar Tax Credit 2024 are vulnerable to legislative modifications, which can significantly impact the economic viability of your renewable energy investments. Recent proposals suggest a potential phase-out of the full 30% federal Investment Tax Credit (ITC) by the end of 2025, which could reduce the incentive for new installations.

It’s common to feel uncertain about these changes, but staying alert about any suggested alterations or renewals to the tax incentive is crucial. These changes could directly influence your ability to optimize savings on renewable energy projects. Taking swift action to secure available resources is vital, especially considering that the average yield from these assets can reach around $6,500 for an average photovoltaic system investment.

To claim the state tax benefit, homeowners must submit with their Hawaii tax return. Staying informed and proactive will ensure that you can take full advantage of the current incentives before any alterations take effect. Furthermore, assessing different energy service providers is essential to discovering the best value for your investments in renewable energy solutions. Together, we can navigate these changes and work towards a more sustainable and independent energy future.

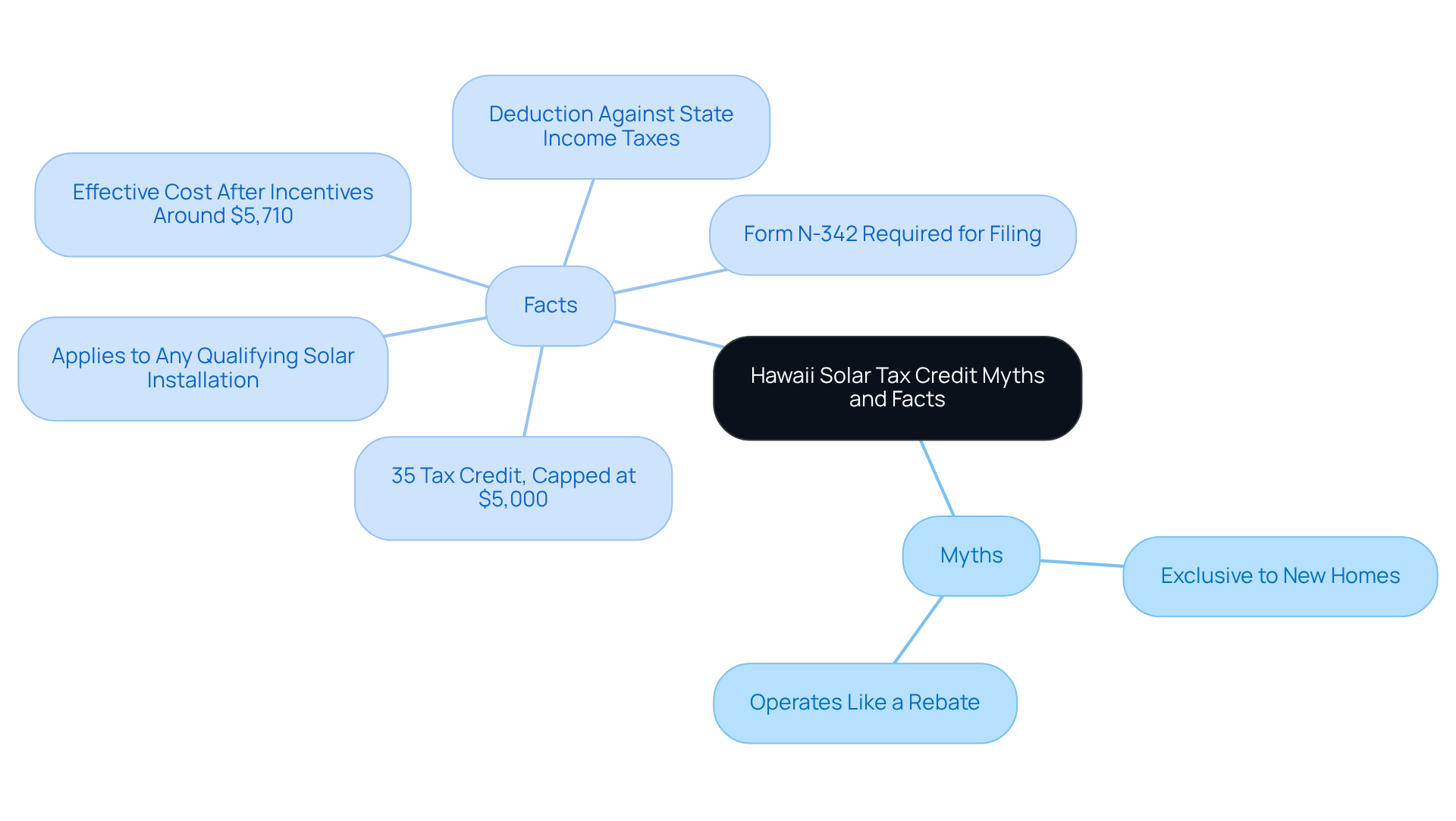

Myths and Facts: Debunking Common Misconceptions About the Tax Credit

We understand that many homeowners may feel overwhelmed by the complexities surrounding the Hawaii solar tax credit 2024. Misleading myths can often cloud the true benefits of the Hawaii solar tax credit 2024, preventing you from fully reaping its rewards. For instance, it’s a common misconception that the tax benefit is exclusive to new homes; however, it actually applies to any qualifying solar installation on residential properties, regardless of their age. Another prevalent myth is that this tax incentive operates like a rebate. In reality, the Hawaii solar tax credit 2024 serves as a deduction against state income taxes, which reduces the amount you owe instead of providing cash back.

The Hawaii Solar Tax Incentive offers a generous 35% rebate on installation expenses, capped at $5,000. When you consider the federal and state tax incentives, the actual cost of installations in Hawaii can drop to around $5,710. To take advantage of the Hawaii solar tax credit 2024, you’ll need to file using Form N-342 with your state tax return. By understanding these essential details and consulting with a tax expert, you can confidently navigate the tax incentive landscape and maximize your savings on renewable investments.

Together, we can work towards a more sustainable future, ensuring that you not only reduce your energy bills but also contribute positively to the environment. If you have any questions or need further assistance, please don’t hesitate to reach out. Your journey towards starts here.

Resources and Support: Where to Find Help with the Hawaii Solar Tax Credit

Homeowners often feel overwhelmed by rising energy bills and the complexities of renewable energy options. Fortunately, assistance with the Hawaii solar tax credit 2024 is readily available through the Hawaii State Department of Taxation’s website, which provides a wealth of comprehensive information and downloadable forms essential for the application process. Local solar installation firms, such as Powercore Electric, play a crucial role in this journey, often offering expert advice that helps homeowners navigate the intricacies of obtaining tax incentives and understanding how solar panels can benefit their homes. Consulting with tax experts who specialize in renewable incentives can further empower homeowners, ensuring they maximize their benefits and grasp the nuances of the tax rebate application.

Given Hawaii’s notably higher utility costs due to its remoteness and reliance on imported resources, leveraging the Hawaii solar tax credit 2024 has never been more important. Property owners are encouraged to request on-site consultations with installation contractors. This not only provides a clearer understanding of the setup process but also highlights the financial advantages of investing in renewable energy, which can lead to significant savings on utility expenses. By utilizing these resources, homeowners can simplify the process and enhance the financial benefits of investing in renewable power, including storage solutions and home protection through roofing enhancements. Together, we can work towards a more sustainable future, ensuring that your home is both .

Conclusion: The Importance of the Hawaii Solar Tax Credit for Sustainable Living

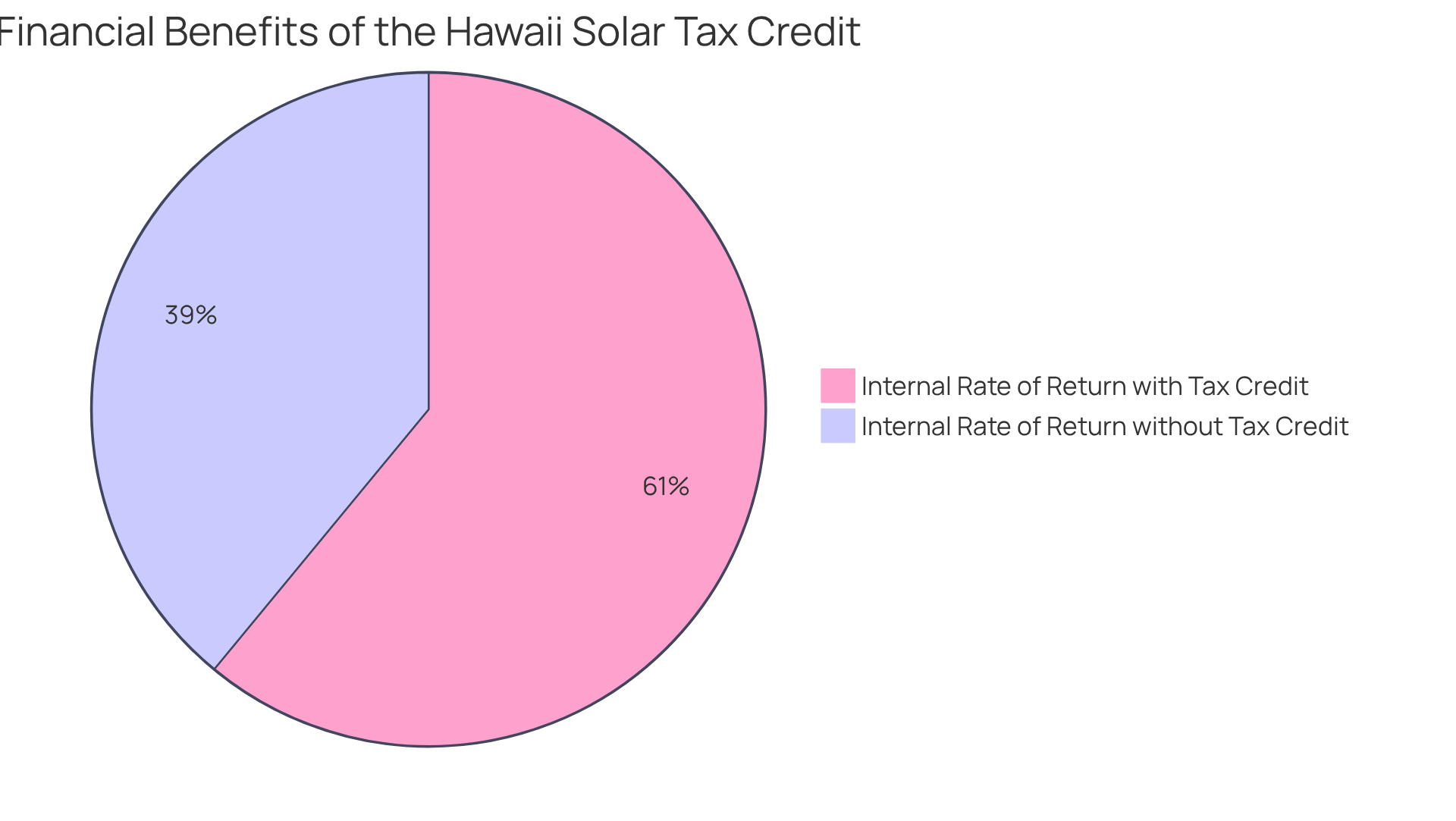

We understand that can be a significant concern for homeowners in Hawaii. The Hawaii solar tax credit 2024 plays a crucial role in addressing this issue by making solar power more accessible and affordable. By significantly reducing installation costs, this tax incentive not only encourages the use of renewable resources but also supports individual households in their journey toward energy independence. This aligns beautifully with Hawaii’s ambitious clean power goals, fostering a sustainable future for all.

Consider this: the internal rate of return for typical households benefiting from the state tax credit is about 25%, compared to just 16% without it. This stark difference highlights the financial advantages of embracing solar energy. As Rocky Mould, Executive Director of the Hawaiʻi Solar Association, emphasizes, financial incentives like the Hawaii solar tax credit 2024 are vital for facilitating Hawaii’s transition to a more resilient, renewable power system.

Moreover, understanding the dimensions of residential solar panels and their benefits under the 200% rule empowers homeowners to make informed choices about their energy solutions. However, it’s important to recognize that low-to-moderate income households often face challenges in accessing these subsidies, which can limit their participation in this clean energy movement.

As we collectively transition to solar energy, we contribute to a powerful movement toward a more sustainable future for our islands. Together, we can reinforce the significance of these financial incentives in achieving our long-term environmental goals. Let’s work towards a brighter, cleaner future—one where every homeowner can thrive.

Conclusion

As you navigate the challenges of rising energy costs, the Hawaii Solar Tax Credit 2024 emerges as a significant opportunity for homeowners like you, seeking to embrace a more sustainable way of living. With a generous tax rebate of up to 35% on installation expenses, this incentive not only makes solar energy more financially accessible but also aligns beautifully with Hawaii’s ambitious renewable energy goals. By taking advantage of this credit, you can empower yourself to make strides toward energy independence, ultimately contributing to a cleaner, greener future for our islands.

Throughout this article, we’ve explored how this tax credit, when paired with federal incentives, can lead to remarkable savings on solar installations. We understand that the eligibility requirements may seem daunting, but rest assured, many homeowners can benefit. While the application process can be complex, it is navigable with the right resources and expert guidance. Understanding the financial impact of the tax credit—its ability to reduce installation costs and enhance long-term savings—is crucial for making informed decisions about your renewable energy investments.

As Hawaii continues its journey toward a sustainable future, the importance of the Hawaii Solar Tax Credit cannot be overstated. It serves as a catalyst for change, encouraging homeowners to adopt renewable energy solutions that not only benefit their finances but also our environment. By actively engaging with available resources and staying informed about potential changes to these incentives, you can play a vital role in this transformative movement. Together, we can work toward a future where sustainable energy is not just a goal, but a reality for every household. Let’s embrace this opportunity and take meaningful steps towards a brighter, more sustainable tomorrow.