Overview

We understand that navigating the world of energy bills can be overwhelming. That’s why the article outlines four essential steps to access government assistance for solar panels, which include:

- Understanding eligibility requirements

- Gathering necessary documentation

- Completing application forms

- Evaluating financial benefits

By emphasizing available federal tax credits, state incentives, and local utility programs, the article provides a clear roadmap for homeowners to secure financial support for their solar energy investments. Together, we can explore these opportunities and work towards achieving energy independence, ensuring a brighter and more sustainable future for your home.

Introduction

In a world that increasingly prioritizes sustainability and renewable energy, the transition to solar power offers an exciting opportunity for homeowners seeking relief from rising energy bills. We understand that navigating the financial aspects of solar panel installations can feel daunting, but government assistance programs are here to help. These programs, ranging from federal tax credits to state-specific incentives, are designed to ease the financial burden associated with your solar investment, making it more accessible and viable.

It’s common to feel overwhelmed by the various eligibility criteria and application processes involved. This article aims to guide you through the essential aspects of government assistance for solar panels, helping you determine your eligibility, apply for incentives, and evaluate the financial benefits of embracing solar energy.

As the demand for clean energy continues to grow, understanding these valuable resources becomes crucial for anyone looking to harness the power of the sun. Together, we can explore how going solar not only benefits your wallet but also contributes to a sustainable future for our planet.

Understand Government Assistance Programs for Solar Panels

Understanding Government Assistance Programs for Solar Panels

We understand that navigating the world of energy bills can be overwhelming, especially for those who are eco-conscious and eager to make a positive impact. Fortunately, there is government help for solar panels, which is designed to alleviate some of these financial burdens and offers a range of benefits to homeowners like you. Here are some key programs that can help you on your journey to energy independence:

- Federal Solar Investment Tax Credit (ITC): Did you know that you can deduct 30% of the installation costs of solar panels from your federal taxes? This incentive is crucial for reducing the overall economic impact of investing in renewable energy, provided your system is operational within the tax year.

- California Solar Incentives: In 2025, California continues to offer various monetary incentives for photovoltaic installations. These include rebates and tax credits that can significantly lower your upfront costs. The California Public Utilities Commission has allocated $280 million for the Residential Solar and Storage Equity program, aimed at enhancing access to renewable power, particularly for low-income families. However, it’s important to note that new net metering regulations have reduced compensation for surplus photovoltaic power by 75%, affecting earnings from approximately 30 cents to roughly 8 cents per kilowatt. As Ben Zientara highlighted, the introduction of NEM 3.0 in 2023 has brought about significant regulatory changes for photovoltaic sources in California.

- Local Utility Programs: Many utility companies offer rebates or incentives for customers who install photovoltaic panels. We encourage you to check with your local utility providers for specific offerings that can further enhance your savings.

- Low-Income Assistance Programs: Several initiatives are dedicated to helping low-income households access renewable power solutions, often through grants or subsidized installations. A case study titled “Is It Worth Going Solar in California?” illustrates how these initiatives can greatly assist low-income families, ensuring that financial barriers do not prevent them from enjoying the benefits of clean energy.

Exploring these programs can be made easier through government websites or local renewable organizations, which typically provide detailed guides on government help for solar panels and other available incentives. Understanding these options is essential for homeowners looking to transition to renewable power while maximizing their financial advantages. Together, we can work towards a more sustainable future, ensuring that everyone has the opportunity to benefit from clean energy solutions.

Determine Your Eligibility for Solar Incentives

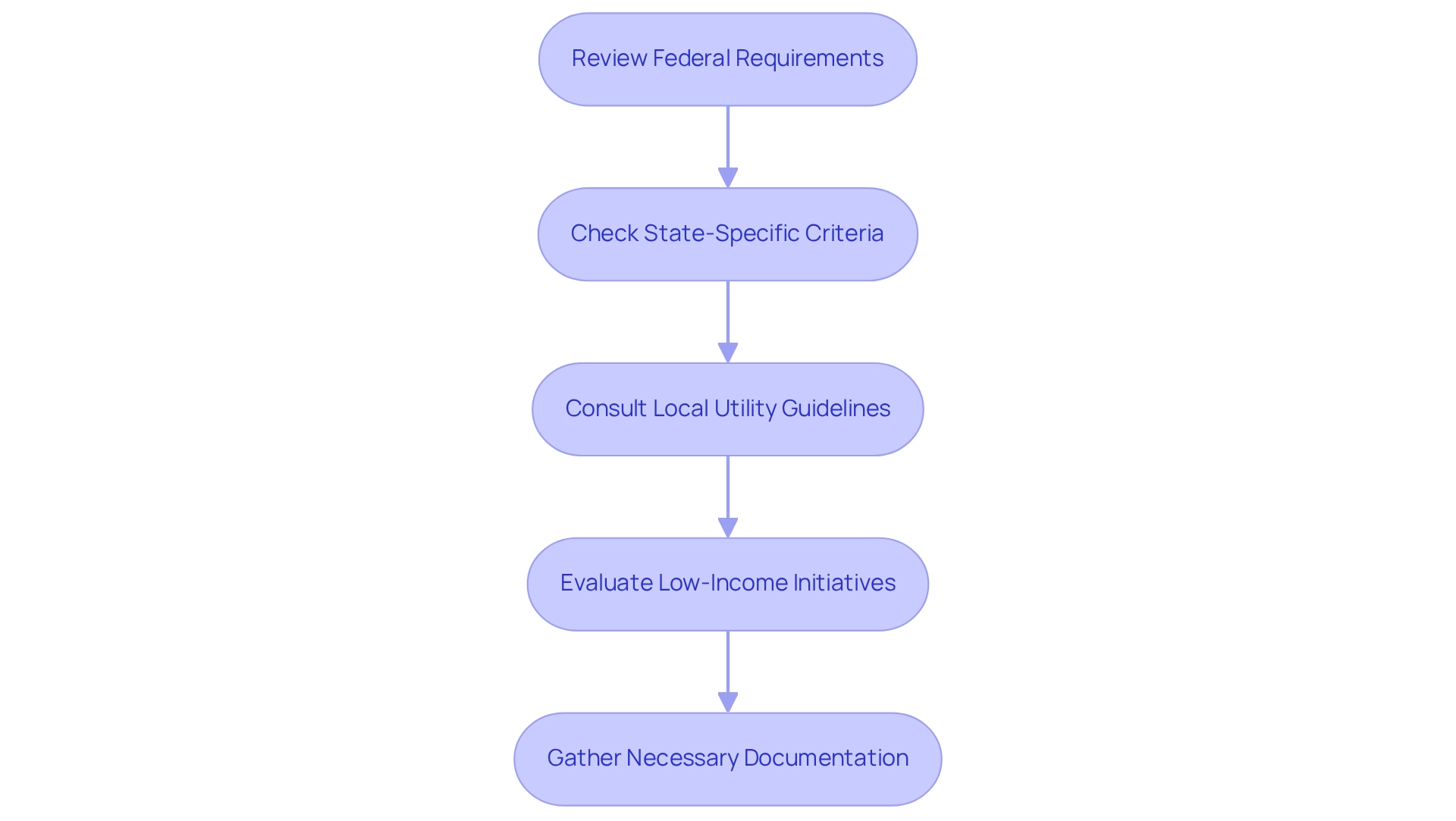

Are you feeling overwhelmed by rising energy bills? You’re not alone. Many homeowners share this concern, and it’s important to know that there are options, such as government help for solar panels, available to help you regain control. To assess your eligibility for government help for solar panels and other renewable energy incentives, follow these essential steps:

- Review Federal Requirements: To qualify for the Investment Tax Credit (ITC), it’s crucial to own your energy system outright—leases or power purchase agreements do not qualify. Additionally, ensure that your system is installed and operational within the tax year for which you are claiming the credit. This step is vital for maximizing your benefits.

- Check State-Specific Criteria: Each state has unique eligibility requirements for solar incentives. These may include income limits, property types, or specific installation standards for government help for solar panels. Familiarizing yourself with California’s criteria, for instance, can help ensure compliance and pave the way for potential savings.

- Consult Local Utility Guidelines: Utility companies often have their own eligibility criteria for rebates or incentives. It’s advisable to reach out to your utility provider or visit their website for detailed information on available programs. They can be a valuable resource in your journey toward energy independence.

- Evaluate low-income initiatives qualifications, as there may be government help for solar panels available to assist your household. Eligibility for these programs typically depends on your income levels relative to the area median income, and accessing this assistance can make a significant difference.

To streamline the application process, gather necessary documentation such as proof of income, property ownership, and installation contracts. This preparation will enable a smoother experience when applying for energy incentives. Remember, together we can work towards a more sustainable future, and we’re here to support you every step of the way.

Apply for Government Assistance for Solar Panels

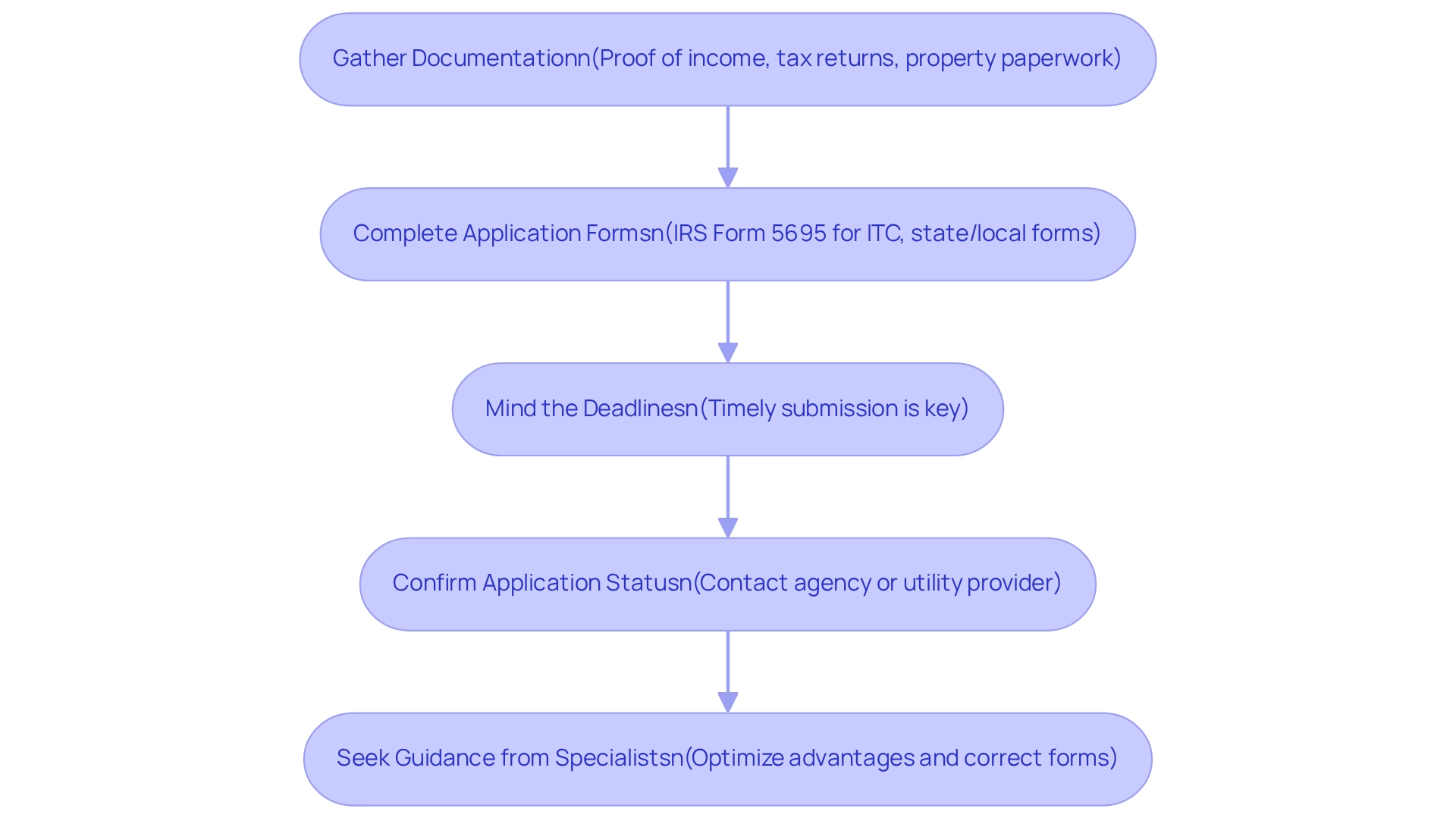

Are you feeling overwhelmed by rising energy bills? You’re not alone in this concern, and there is a path toward relief through government help for solar panels. By following these essential steps, you can take control of your energy costs and embrace a sustainable future.

- First, gather the required documentation. Compile necessary documents such as proof of income, tax returns, and property-related paperwork. This documentation is crucial for verifying eligibility and ensuring a smooth application process.

- Next, complete the application forms. Each aid initiative has specific application forms. For the Investment Tax Credit (ITC), you will need to fill out IRS Form 5695 when filing your taxes. For state or local initiatives, visit their official websites to download the necessary forms.

- Be mindful of deadlines when submitting your applications. Some programs require applications to be submitted within a certain timeframe after installation, so timely submission is key to securing your benefits.

- After submitting your application, it’s common to feel anxious about the outcome. Reach out to the relevant agency or utility provider to confirm receipt and inquire about the status of your application. This proactive approach can help identify and resolve any potential issues early on.

- Furthermore, consider seeking guidance from an installation specialist or advisor. They can help optimize your advantages and ensure that your applications are filled out correctly.

In 2025, the IRS Form 5695 application process remains essential for claiming the renewable energy tax credit, which can greatly lower your total expenses. Additionally, initiatives such as the Low-Income Community Tax Credit Adder offer extra monetary incentives, providing an additional 10%-20% on investment tax credits for eligible projects. Together, we can advance equity and access in energy solutions. By utilizing these resources, homeowners can effectively navigate the realm of energy incentives, particularly government help for solar panels, and make informed choices about their energy solutions.

As Jamie Smith points out, “Community energy is when multiple parties or ‘subscribers’ share in the power and financial advantages of a renewable system.” This method can be especially advantageous for individuals who may lack the resources to install photovoltaic panels on their own properties. Moreover, to qualify for the domestic content bonus, at least 45% of the total cost of the manufactured components must be made in the U.S., increasing to 55% in 2027. Understanding these requirements can assist homeowners in making informed choices regarding their energy investments. Together, let’s work towards a more sustainable and energy-independent future.

Evaluate the Financial Benefits of Installing Solar Panels

Evaluating the financial benefits of installing photovoltaic panels can feel overwhelming, but understanding a few key factors can make this process easier for you.

Initial Costs vs. Long-Term Savings: It’s essential to weigh the total installation costs against the anticipated savings on your electricity bills throughout the system’s lifespan. Homeowners like you can save over $100,000 in just 25 years, making solar energy a compelling investment. Many case studies highlight how these savings are achievable under the 200% rule, which allows for enhanced power production and efficiency.

Tax Credits and Incentives: Don’t forget to consider the 30% federal tax credit and any state or local incentives available through government help for solar panels and other renewable energy programs. These financial supports, such as government help for solar panels, can significantly lower your initial costs, making renewable energy more accessible and affordable, especially for those of you who are eco-conscious and eager to maximize your investment. This potential increase in property value is crucial for homeowners planning to sell in the future, as renewable energy installations can enhance market appeal. In fact, properties with solar systems have been shown to appreciate by up to 4%.

Power Autonomy: Imagine the advantages of reducing your reliance on the grid, which can help shield you from rising utility costs. This independence not only fosters economic stability but also aligns with a more sustainable lifestyle, resonating with homeowners dedicated to environmental stewardship.

Environmental Impact: While the environmental benefits may not translate directly into monetary advantages, they can serve as a significant motivator for many homeowners. Transitioning to photovoltaic energy promotes a cleaner planet and reflects eco-conscious values, making it a responsible choice. The reduction in carbon footprint is often a compelling reason for many to invest in renewable energy.

Installation Method Considerations: The choice of installation method—be it rooftop, ground, or carport—can greatly affect both your costs and the efficiency of your energy system. Selecting the right installation approach based on your property’s configuration and energy needs can optimize both expense and effectiveness, ensuring you get the most out of your solar investment.

By thoughtfully considering these elements, including insights from case studies related to the 200% rule, you can gain a clearer understanding of the financial implications of your solar investment. Solar energy is often viewed as a risk-free investment due to its significant financial returns and environmental advantages, further enhancing its appeal. Together, we can navigate this journey towards a more sustainable future.

Conclusion

We understand that rising energy costs can be a significant concern for homeowners, and the transition to solar energy offers a wealth of opportunities to address this issue while contributing to environmental sustainability. By exploring various government assistance programs, such as the Federal Solar Investment Tax Credit and state-specific incentives, you can navigate the financial landscape of solar installations with confidence. These programs not only reduce upfront costs but also make solar energy more accessible, particularly for low-income households.

Determining your eligibility for these incentives is essential. Familiarizing yourself with federal and state requirements, consulting local utility guidelines, and exploring low-income assistance options can help you maximize your benefits. While the application process may seem detailed, it can be streamlined with proper documentation and timely submissions, ensuring you take full advantage of the financial incentives available.

Evaluating the financial benefits of solar panels reveals a compelling case for investment. The potential for significant long-term savings, increased property value, and enhanced energy independence underscores the economic advantages of going solar. Additionally, the environmental impact bolsters the appeal, aligning your financial gains with a commitment to sustainability.

In conclusion, embracing solar energy is not just a smart financial decision; it’s a step towards a more sustainable future. By leveraging available government assistance programs and understanding the financial implications, you can confidently invest in solar power. Together, we can pave the way for a greener planet while enjoying the benefits of reduced energy costs. Now is the time to harness the power of the sun and make a positive impact on both your personal finances and the environment.