Overview

We understand that navigating the world of solar energy can feel overwhelming, especially when it comes to financing options. Many homeowners worry about their credit scores, and it’s common to feel uncertain about whether you qualify for solar panels. Typically, a credit score of around 650 is needed to secure financing, but don’t worry—some lenders may accept scores as low as 600. If you have a score above 700, you could unlock even better financing options.

The benefits of a higher credit score extend beyond mere qualification; they can lead to lower interest rates and more favorable loan terms. This can significantly impact the overall cost of your solar panel installation and the potential savings on your energy bills. Imagine the peace of mind that comes with knowing you’re making a smart investment in your home and the environment.

Together, we can explore how solar energy can not only reduce your bills but also provide you with energy independence. If you’re ready to take the next step towards a sustainable future, we’re here to support you every step of the way. Let’s work towards making your solar dreams a reality!

Introduction

In the quest for sustainable energy, we understand that navigating the financial landscape surrounding solar panel installations can feel overwhelming, especially regarding credit scores. As you consider transitioning to solar energy, the requirements set by lenders can significantly influence your options and costs.

It’s common to feel discouraged, particularly if traditional financing routes necessitate a minimum credit score that may not reflect your true potential. However, there is good news: the evolving solar financing market offers a variety of alternatives designed to broaden access to renewable energy.

From government-backed programs to innovative financing solutions, this article delves into the intricate relationship between credit scores and solar financing. Together, we can empower you to make informed decisions that align with your financial capabilities and sustainability goals.

Let’s explore how you can take meaningful steps toward energy independence.

Understanding Credit Score Requirements for Solar Panel Financing

Understanding the financial requirements for funding photovoltaic panels is essential for homeowners concerned about rising energy bills. Lenders typically require a minimum credit rating of around 650, which raises the question of what credit score do you need to get solar panels, reflecting the borrower’s financial reliability. While some may accept ratings as low as 600, those trying to determine what credit score do you need to get solar panels often find that scores above 700 enjoy more favorable loan conditions, including lower interest rates. This distinction is crucial for homeowners exploring , as it significantly influences their funding options and overall costs.

For renters in Long Beach, grasping these credit score prerequisites is equally important, especially with numerous government initiatives and incentives available to facilitate access to renewable technology. As we approach 2025, the landscape of renewable energy funding continues to evolve, presenting alternative loan choices that can assist homeowners with less-than-ideal credit. Options like credit unions, home equity loans, and support from green banks are becoming increasingly viable, broadening access to renewable technology for those who may have faced challenges in the past. Additionally, PACE funding is available in California, offering more pathways for homeowners looking to finance their renewable energy systems.

These funding alternatives not only promote the adoption of solar power but also underscore the importance of understanding financial requirements throughout the funding process. As homeowners consider their options, it’s important to understand what credit score do you need to get solar panels, since a higher credit score can lead to better loan terms, ultimately making solar energy more affordable and accessible. Experts suggest that maintaining a good credit score is beneficial for securing optimal funding solutions, leading to questions about what credit score do you need to get solar panels, thereby reinforcing the link between credit health and energy independence. Furthermore, understanding the differences between refinancing and reamortization can significantly impact the financial journey, providing homeowners with clearer insights into their choices. This comprehensive understanding is vital for making informed decisions regarding renewable energy funding, particularly for environmentally conscious renters in Long Beach. Together, we can navigate these options and work towards a sustainable future.

The Role of Credit Scores in Solar Financing Options

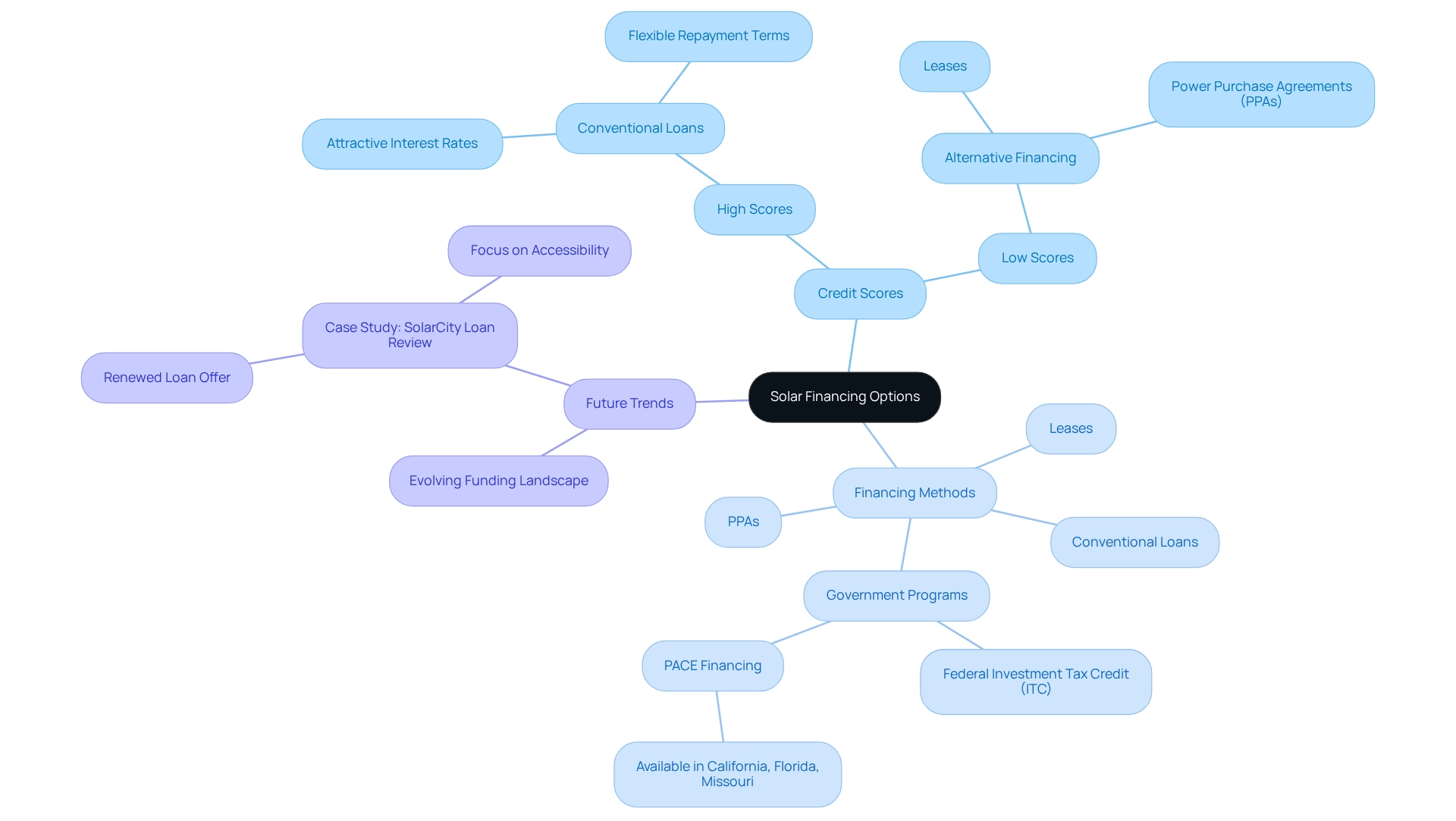

We understand that navigating the world of funding for photovoltaic panel installations can be overwhelming, particularly regarding what credit score do you need to get solar panels. Homeowners with elevated ratings often qualify for conventional energy loans, which come with attractive interest rates and flexible repayment terms. For instance, those with scores above 700 frequently secure loans at reduced rates, making the transition to renewable energy more affordable and accessible.

Home Run Financing exemplifies this with its low, fixed rates, showcasing the benefits of a strong financial history. However, if your credit score is lower, it’s common to feel uncertain about what credit score do you need to get solar panels and your funding choices. You may need to explore alternative methods such as leases or power purchase agreements (PPAs), which typically have less stringent requirements than understanding what credit score do you need to get solar panels.

Looking ahead to 2025, the landscape of renewable energy funding is evolving. Options like PACE funding are becoming available in states such as California, Florida, and Missouri, providing more pathways for homeowners to support their renewable energy projects without the pressure of high credit score standards. It’s essential to consistently review your financial reports, as this practice can help identify potential errors that might affect your loan eligibility, ensuring you can secure the most favorable loan conditions.

Moreover, government initiatives aimed at promoting renewable energy usage can offer financial benefits that further ease the burden of initial costs. Programs like the Federal Investment Tax Credit (ITC) allow homeowners to deduct a significant portion of from their federal taxes, enhancing the accessibility of solar power.

A recent case study on SolarCity’s reintroduction of a loan payment option highlights the growing focus on making solar funding more accessible. This renewed offering aims to provide more options for homeowners, particularly those with varying credit profiles. The case study illustrates that such initiatives can lead to greater accessibility, enabling you to explore your funding choices more effectively. By understanding these dynamics, you can select the optimal path for your energy investment while maximizing potential savings. Together, we can work towards a more sustainable future.

Comparing Credit Score Requirements Across Solar Financing Methods

When considering financing alternatives for renewable energy, it’s essential to understand the rating prerequisites for various options. Many homeowners worry about what credit score do you need to get solar panels when they seek assistance. Many people ask what credit score do you need to get solar panels, as conventional energy loans typically require a minimum rating of around 650, although some lenders might accept scores as low as 600. However, there’s good news: leases for renewable energy and Power Purchase Agreements (PPAs) often have more flexible criteria, which leads to the question of what credit score do you need to get solar panels, enabling homeowners with lower financial ratings to access these energy solutions. Moreover, government-supported initiatives, such as FHA loans, can feature even lower qualification requirements, enhancing accessibility for a diverse group of homeowners.

As we look to 2025, the landscape of solar funding is continually evolving, with community solar projects emerging as a promising option. These initiatives may have varying credit score requirements, with some not imposing any at all, thus offering additional pathways for participation. Furthermore, PACE funding is available in California, Florida, and Missouri, providing yet another avenue for homeowners seeking financial support. We understand that the debt-to-income (DTI) ratio is crucial in loan approval; maintaining a lower DTI can significantly improve eligibility for renewable energy funding. This makes it essential for homeowners to manage their debts effectively. As highlighted in the case study titled ‘The Impact of Debt-to-Income Ratio on Loan Approval,’ a lower DTI can enhance the likelihood of securing a loan for renewable energy.

Additionally, as Sam Wigness explains, reamortizing or recasting a loan involves making a lump sum payment toward to reduce monthly payments. This can be a strategic decision for homeowners looking to improve their payment conditions.

By evaluating across renewable energy options, leases, and creative funding approaches, homeowners can make informed choices that align with their financial situations. Together, we can enable a smoother transition to sustainable energy practices, fostering a brighter future for all.

Impact of Credit Scores on Solar Panel Costs and Savings

We understand that managing energy bills can be a significant concern for homeowners. The impact of borrowing ratings on solar panel expenses and savings is indeed considerable when considering what credit score do you need to get solar panels. Property owners with strong financial ratings often qualify for loans with lower interest rates, leading to reduced monthly payments and overall financing costs. For instance, when considering what credit score do you need to get solar panels, a borrower with above 700 may secure a loan at an interest rate around 6%, while someone with a score below 650 could face rates exceeding 10%. This difference can greatly influence the total cost of an energy system and the potential savings on utility bills. It’s crucial for eco-conscious homeowners to grasp these financial implications.

Furthermore, closing costs associated with loans can also affect overall funding. For example, closing costs for a $350,000 mortgage can reach $17,500, underscoring the importance of securing favorable loan terms. By improving an individual’s financial rating, one can access better financing conditions, thereby enhancing the financial viability of renewable energy investments. Financial specialists emphasize that maintaining a solid financial history, including timely payments on utility and phone bills, can positively influence what credit score do you need to get solar panels. As noted by Experian, consistent payment behavior may help homeowners understand what credit score do you need to get solar panels and secure improved loan options for energy solutions. This practice allows individuals to identify errors and take corrective actions, positively impacting their ratings and loan eligibility.

Besides financial ratings, it’s beneficial for property owners to assess the cost comparison between photovoltaic panels and conventional electricity, as well as the potential advantages of incorporating Tesla home chargers into their energy systems. By understanding these factors, homeowners can make informed decisions that not only enhance their financial situation but also contribute to a more sustainable future. Together, we can work towards a greener, more energy-independent lifestyle.

Exploring Alternative Financing Options for Low Credit Scores

Homeowners who may feel discouraged by poor ratings need not lose hope when exploring renewable energy options. There are several alternative funding solutions available through Powercore Electric that can help. Our energy leases and power purchase agreements (PPAs) provide flexibility in financial requirements, which is important for understanding what credit score do you need to get solar panels, allowing individuals with lower credit scores to access customized renewable technology. In contrast, the DoubleGreen loan provides a different approach, allowing interest to accrue starting on day 61, with no payments required for the first three billing cycles. This can significantly ease the financial burden during the transition to renewable energy.

Moreover, Property Assessed Clean Energy (PACE) financing presents another viable option. This allows homeowners to fund renewable energy installations through property taxes, which can be particularly beneficial for those facing financial challenges. Some lenders have developed tailored programs aimed at individuals with low financial ratings, but it’s crucial to understand what credit score do you need to get solar panels, as these options may come with higher interest rates. Nevertheless, they still offer a pathway to adopting renewable energy.

As Advisor Solar aptly states, ‘Solar energy should be accessible to everyone, regardless of credit score.’ This highlights the importance of inclusive funding for renewable energy. By exploring these alternatives, homeowners can not only embrace renewable energy but also align with broader financial and environmental goals. Case studies reveal that one of the primary aims of residential energy installations is to significantly reduce electricity costs. We encourage homeowners to collaborate with , like Powercore Electric, to gain a comprehensive understanding of their anticipated savings, factoring in both funding and utility expenses. By leveraging these financing options, homeowners can effectively navigate credit challenges and invest in sustainable energy solutions. Together, we can work towards a greener future.

Conclusion

We understand that navigating the world of credit scores and solar financing can feel overwhelming for homeowners eager to invest in renewable energy. It’s important to know that while traditional solar loans often require a minimum credit score of around 650, there are alternative financing options available.

- Leases

- Power purchase agreements

- Government-backed programs

These options can provide access for those with lower credit scores, allowing you to explore diverse options that fit your unique financial situation.

Maintaining a healthy credit score not only opens doors to better financing terms but also significantly impacts the overall costs associated with solar panel installations. A higher credit score can lead to lower interest rates, which reduces monthly payments and increases potential savings on energy bills. We encourage homeowners to regularly monitor their credit reports and manage debts effectively, as these practices can enhance eligibility for more favorable financing solutions.

Ultimately, the key takeaway is that transitioning to solar energy should not be hindered by credit challenges. With a variety of financing options available, you can still pursue your sustainability goals. By being informed and proactive, together we can navigate the financial landscape of solar energy, making decisions that align with your financial capabilities while contributing to a more sustainable future.