Overview

As a homeowner, you may be feeling the weight of rising energy bills and searching for solutions that not only ease your financial burden but also contribute to a sustainable future. While leasing solar panels is an option many consider, it’s important to understand that this typically does not qualify you for the federal investment tax credit (ITC). This incentive is generally reserved for those who own their solar energy systems. However, some leasing companies might provide incentives that mimic tax benefits, which can be a silver lining.

We understand that navigating these options can be overwhelming, but it’s crucial to review your lease agreements carefully. By doing so, you can uncover any potential financial advantages that might be available to you. Remember, you are not alone in this journey; many homeowners are exploring the benefits of solar energy and striving for greater energy independence. Together, we can work towards a solution that not only meets your needs but also aligns with your values.

If you have questions or need guidance, please reach out to your provider. They can offer support and help you understand the full scope of your options. Your path to energy independence is within reach, and we are here to help you every step of the way.

Introduction

As the world shifts towards sustainable energy solutions, we understand that many homeowners are concerned about rising energy bills and the impact on their budgets. Solar tax credits have emerged as a key incentive, offering a nurturing pathway for those looking to invest in renewable energy. The Residential Clean Energy Credit allows individuals to deduct a significant portion of their solar installation costs from federal taxes, making solar power more accessible and affordable. With the current credit set at 30% until 2032, this is a unique opportunity for homeowners to reduce their financial burden while contributing to a greener future.

It’s common to feel overwhelmed when navigating the complexities of eligibility, claiming procedures, and potential pitfalls. This article delves into the essentials of solar tax credits, offering a comprehensive guide to understanding their importance, determining eligibility, and successfully claiming the benefits. Together, we can maximize savings and enhance sustainability, ensuring that the transition to solar energy is not just a dream, but a reality that supports both your financial goals and the well-being of our planet.

Understand Solar Tax Credits and Their Importance

We understand that managing energy bills can be a significant concern for homeowners. Starting in 2025, renewable energy tax incentives, particularly the Residential Clean Energy Incentive, allow you to subtract 30% of your renewable installation expenses from federal taxes, leading to the question: if you lease solar panels do you get a tax credit? This substantial funding alleviates the initial financial burden associated with photovoltaic panel installation, making sustainable energy options more attainable for you.

These incentives not only lead to personal savings but also play a crucial role in encouraging the adoption of renewable energy, thereby promoting ecological sustainability. Many homeowners are curious about if you lease solar panels do you get a tax credit, which they have successfully leveraged through the Residential Clean Energy Incentive to lower their installation costs, sparking increased interest in renewable solutions.

A recent analysis indicates that the investment tax incentive will remain at 30% until 2032, gradually decreasing until its expiration in 2035. This timeline encourages property owners to invest sooner to maximize their savings. Additionally, the ability to carry forward any unused tax benefits each year until the ITC concludes in 2034 makes renewable energy investments even more appealing. This feature allows you to utilize any remaining benefits in future tax years, further reducing your overall installation costs.

By understanding and utilizing these tax incentives, you can significantly lower installation expenses, making renewable power not only a sustainable choice but also a financially savvy one, particularly if you lease solar panels do you get a tax credit. Beyond tax incentives, you can explore various renewable energy solutions, such as Tesla home chargers and efficient battery options, which enhance your panel systems. These technologies not only boost resource efficiency but also contribute to long-term sustainability.

To fully harness the benefits of , consider different strategic approaches. Specialist insights underscore the tactical importance of these incentives in today’s energy landscape, highlighting their value in fostering residential renewable adoption. Together, we can navigate these opportunities for a more sustainable future.

Determine Eligibility for Leasing Solar Panel Tax Credits

We understand that navigating the world of can be overwhelming, especially when considering if you lease solar panels do you get a tax credit. It’s important for homeowners to know that the federal investment tax incentive (ITC) typically applies only to those who own their power systems.

If you lease solar panels, do you get a tax credit? If you’ve signed a lease or a power purchase agreement (PPA), claiming the ITC may not be an option for you. However, some leasing companies do offer incentives that can resemble tax benefits. To ensure you’re fully informed, we encourage you to review your lease agreement and consult with your leasing provider about any potential benefits available to you.

Additionally, it’s common for renters to feel unsure about their options. We recommend looking into local government initiatives or incentives that might provide financial aid or rebates for renewable energy solutions. By exploring these avenues, you can enhance your access to eco-friendly energy options and contribute to a sustainable future. Together, we can work towards making renewable energy more accessible for everyone.

Claim Your Tax Credit: A Step-by-Step Guide

Navigating the process of claiming your solar tax credit can feel overwhelming, but we’re here to guide you through it with care and understanding. To help you take advantage of the financial incentives available, please follow these steps:

- Gather Documentation: Start by collecting all relevant receipts and documentation related to your installation, including invoices from your provider. This ensures you have all necessary information at hand, making the process smoother.

- Fill out IRS Form 5695: This form is essential for determining . You can easily access it on the IRS website or through tax preparation software.

- Fill Out the Form: On Form 5695, report the total expense of in Part I. For 2025, remember to calculate your funding amount based on the current percentage, which is set at 30%. This step is crucial for maximizing your benefits.

- Include the Form with Your Tax Return: Attach Form 5695 to your federal tax return (Form 1040) when filing. It’s wise to retain copies of all documents for your records to avoid any discrepancies. Keep in mind that Form 5695 must be filed annually with your federal income tax return, typically due on April 15th of the following year.

- Consult : If you find yourself uncertain or facing complex situations, reaching out to a tax professional can provide the support you need. Their expertise can guide you through the nuances of the tax code, ensuring you maximize your benefits and comply with all regulations. As Rockerbox Tax Solutions states, “Together, we can work towards a more sustainable and financially savvy future.”

By following these steps, you can effectively navigate the process of claiming your renewable energy tax benefits. Remember, you’re not alone in this journey; together, we can ensure you take full advantage of the available financial incentives, paving the way for a more sustainable future.

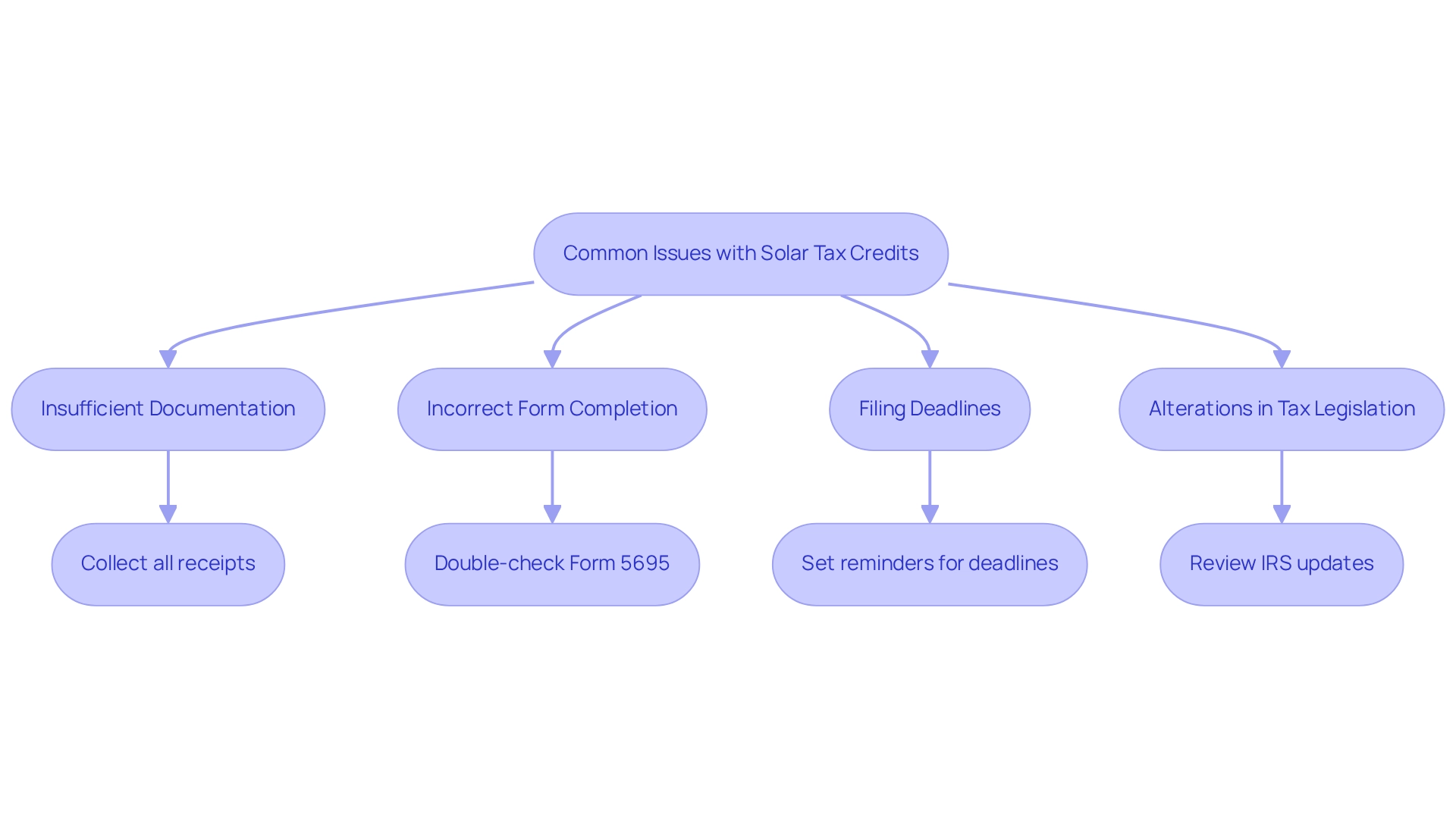

Troubleshoot Common Issues with Solar Tax Credits

Renters in Long Beach, we understand that seeking to claim tax credits for renewable energy can present specific challenges that complicate the process. Here are some common issues you might face, along with actionable steps to navigate them effectively:

- Insufficient Documentation: It’s vital to collect all required receipts and paperwork related to your energy lease. Missing documents can delay or prevent your claim from being processed. Consider keeping a dedicated folder for all solar-related paperwork to stay organized.

- Incorrect Form Completion: Ensure that Form 5695 is accurately filled out. Simple errors can lead to rejection, so double-checking is essential. If you’re uncertain about any part, don’t hesitate to seek help from a tax expert knowledgeable about . Leasing solar panels can lead to eligibility confusion about whether, if you lease solar panels do you get a tax credit, affecting your qualification for tax incentives. Consulting your leasing company or a tax professional can clarify this and help you avoid potential pitfalls. Understanding your lease agreement is crucial to determine if you lease solar panels do you get a tax credit.

- Filing Deadlines: Be mindful of tax filing deadlines. Submitting your claim late can result in losing the benefit, so staying organized and aware of these dates is important. Setting reminders can help ensure you don’t miss any crucial deadlines.

- Alterations in Tax Legislation: Tax regulations may shift, affecting your eligibility or the portion of the benefit available. Regularly reviewing the IRS website or seeking advice from a tax expert can keep you informed about any changes that could impact your claim.

Comprehending these typical concerns is essential for Long Beach renters to effectively claim tax credits associated with renewable energy. By proactively tackling these challenges together, you can enhance your prospects of gaining financial rewards from your energy investments. Additionally, embracing solar energy not only contributes to personal savings but also supports environmental sustainability, creating a win-win for eco-conscious homeowners.

Conclusion

The insights presented highlight the significant financial advantages of solar tax credits, particularly the Residential Clean Energy Credit, which allows homeowners to deduct 30% of their solar installation costs from federal taxes. We understand that investing in solar energy can feel daunting, but this incentive not only eases that initial investment but also serves as a catalyst for broader adoption of renewable energy solutions. With the timeline for this credit extending until 2032, we encourage homeowners to act promptly to maximize their savings and contribute to a sustainable future.

Understanding eligibility is crucial, especially for those who lease solar panels. While the federal solar investment tax credit primarily benefits owners, many leasing companies may offer alternative incentives. Homeowners must carefully review their agreements and seek additional local government programs that can provide financial assistance. This ensures that even renters can explore viable options for accessing solar energy.

Successfully claiming the tax credit requires diligence in documentation and adherence to IRS procedures. It’s common to feel overwhelmed by the complexities, but by following the outlined steps and consulting tax professionals when needed, homeowners can navigate this process effectively. Addressing common issues, such as documentation errors and eligibility confusion, further enhances the chances of successfully reaping the benefits of solar investments.

In conclusion, embracing solar energy through the available tax credits not only supports individual financial goals but also plays a vital role in fostering environmental sustainability. Together, we can take informed steps towards solar investment, contributing to a cleaner planet while enjoying significant savings. The time to act is now—let’s seize the opportunity to invest in a greener future.