Overview

If you’re a homeowner worried about high energy bills and feeling constrained by bad credit, know that there are still pathways to embrace solar energy. Exploring specialized financing options can make a significant difference. Consider:

- Power Purchase Agreements (PPAs)

- Leasing arrangements

- Community energy initiatives that don’t heavily rely on credit scores

These options can empower you to take control of your energy future.

Many lenders and programs are designed with your needs in mind, including:

- Government incentives

- PACE funding

These initiatives aim to provide accessible solutions for those facing financial challenges, allowing you to transition to renewable energy without the burden of credit concerns. Imagine the relief of lowering your energy costs while contributing to a sustainable future.

We understand that taking the first step can feel daunting, but together we can explore these opportunities. By reaching out, you can gain the support and guidance necessary to navigate these options and find the best fit for your situation. Every journey towards energy independence begins with a single step, and we’re here to walk alongside you.

Introduction

Navigating the world of solar financing can feel overwhelming, especially for homeowners facing credit challenges. We understand that the rising costs of energy bills can be a significant concern. As the demand for clean energy solutions increases, grasping how credit influences financing options is essential.

This article explores vital strategies for:

- Evaluating personal credit situations

- Discovering specialized financing avenues

- Understanding the costs tied to solar installations

By providing practical insights and actionable steps, we aim to empower those with less-than-perfect credit to embrace sustainable energy solutions without the weight of financial burdens. Whether it’s uncovering community solar programs or seeking advice from local experts, together we can create a comprehensive roadmap to achieving energy independence.

Let’s work towards a brighter, more sustainable future.

Assess Your Credit Situation

To effectively evaluate your financial situation for renewable energy financing, it’s important to start by obtaining a copy of your report from the major financial bureaus: Equifax, Experian, and TransUnion. This report provides a comprehensive perspective on your financial history and current status, which is essential for making informed decisions. Once you have your report, check your score. While most solar loans require a minimum score of 650, some lenders may accept scores as low as 600, which raises the question of whether I can get solar panels with bad credit, offering options for those who might feel discouraged by their financial past.

We understand that negative marks on your financial report, such as late payments or defaults, can be concerning. Addressing these issues can significantly improve your score over time. Consider implementing strategies recommended by financial advisors, such as making timely payments and reducing outstanding debts. As Oscar Wilde wisely remarked, ‘A man who settles his debts promptly is quickly overlooked,’ reminding us of the importance of maintaining sound financial practices.

Furthermore, calculating your debt-to-income (DTI) ratio is crucial, as lenders often assess this alongside your score. A lower DTI indicates better financial health and can enhance your chances of securing favorable financing terms, which is something we all strive for.

In 2025, the average score in the U.S. is projected to be around 710. Knowing your position in relation to this standard is vital. Additionally, statistics indicate that a notable portion of renewable energy loans necessitate a score above 650, making it essential to proactively evaluate your financial standing. For those encountering financial difficulties, a practical and supportive option is to ask, can I get solar panels with bad credit by exploring community energy initiatives. These programs allow individuals to enroll in a nearby renewable energy farm and receive rewards on their electricity bill without the need for upfront costs or credit assessments. This offers a convenient way to benefit from sustainable energy while alleviating financial stress.

Ultimately, it is crucial to explore various funding alternatives and obtain multiple estimates to discover the best offer for your unique situation. By following these measures, you can enhance your chances for renewable energy funding, even if your borrowing history isn’t perfect. Together, we can navigate these challenges and work towards a more sustainable future.

Explore Specialized Financing Options

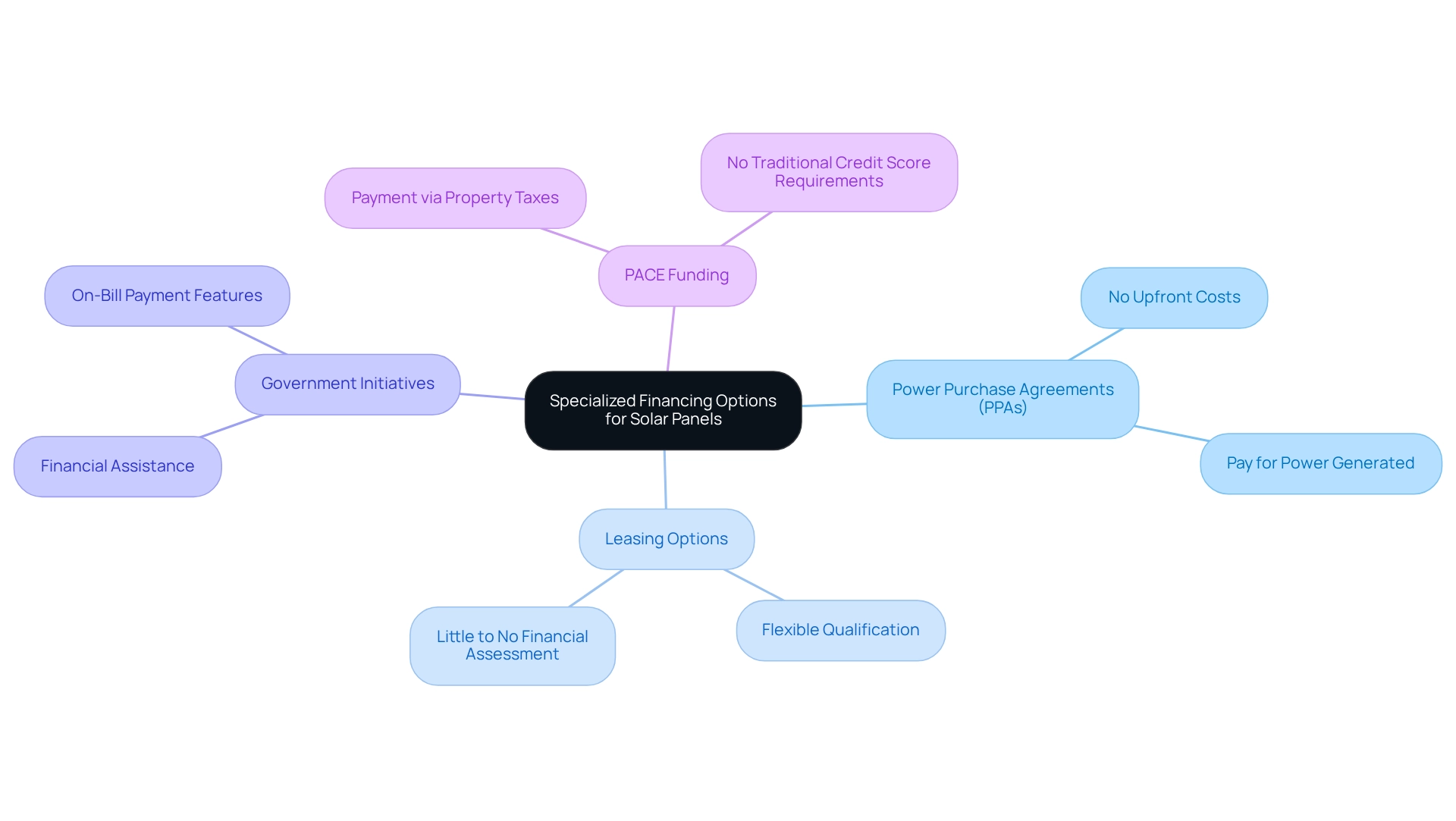

If you’re a homeowner worried about rising energy bills, you may be asking yourself, can I get solar panels with bad credit, as exploring renewable energy funding alternatives can feel daunting, especially if you have a less-than-perfect financial history. However, there are specialized pathways available that can help you navigate these challenges. Consider looking into lenders who offer financing for renewable energy systems with flexible qualification standards, particularly those who can help you if you are wondering, ‘can I get solar panels with bad credit’. This approach opens up opportunities for funding solutions that might otherwise seem out of reach.

Power Purchase Agreements (PPAs) and leasing options also present viable alternatives. These arrangements typically do not require extensive financial assessments, allowing homeowners to install solar panels with little to no upfront costs. Instead of paying for the system itself, you can simply compensate for the power generated. This model has become increasingly popular among those eager to embrace renewable energy without the weight of financial constraints. As more homeowners recognize the benefits—such as potentially lower utility costs and increased property value—PPAs are gaining traction.

Additionally, government initiatives and incentives are designed to support low-income families or those facing credit challenges. These programs can provide financial assistance, making renewable energy sources more accessible. Notably, on-bill payment features can help low- and moderate-income households transition to clean alternatives, further expanding the choices available to you.

Another remarkable option to consider is Property Assessed Clean Energy (PACE) funding. This innovative program enables homeowners to finance renewable energy installations through property taxes, effectively sidestepping traditional credit score requirements. By aligning payments with property value, this approach not only encourages the adoption of renewable sources but also ensures affordability.

As the clean power sector continues to grow—reporting over 3.5 million jobs in 2023, with clean technology positions expanding more than twice as fast as jobs in the overall U.S. economy—the importance of accessible funding options cannot be overstated. Furthermore, over 1.5 million Americans have discovered trustworthy local energy firms, highlighting the increasing acceptance and availability of renewable solutions. By exploring these specialized funding options, you can determine if you can get solar panels with bad credit, enabling you to take meaningful steps toward energy independence and sustainability. Together, we can work towards a brighter, cleaner future.

Understand the Costs Involved

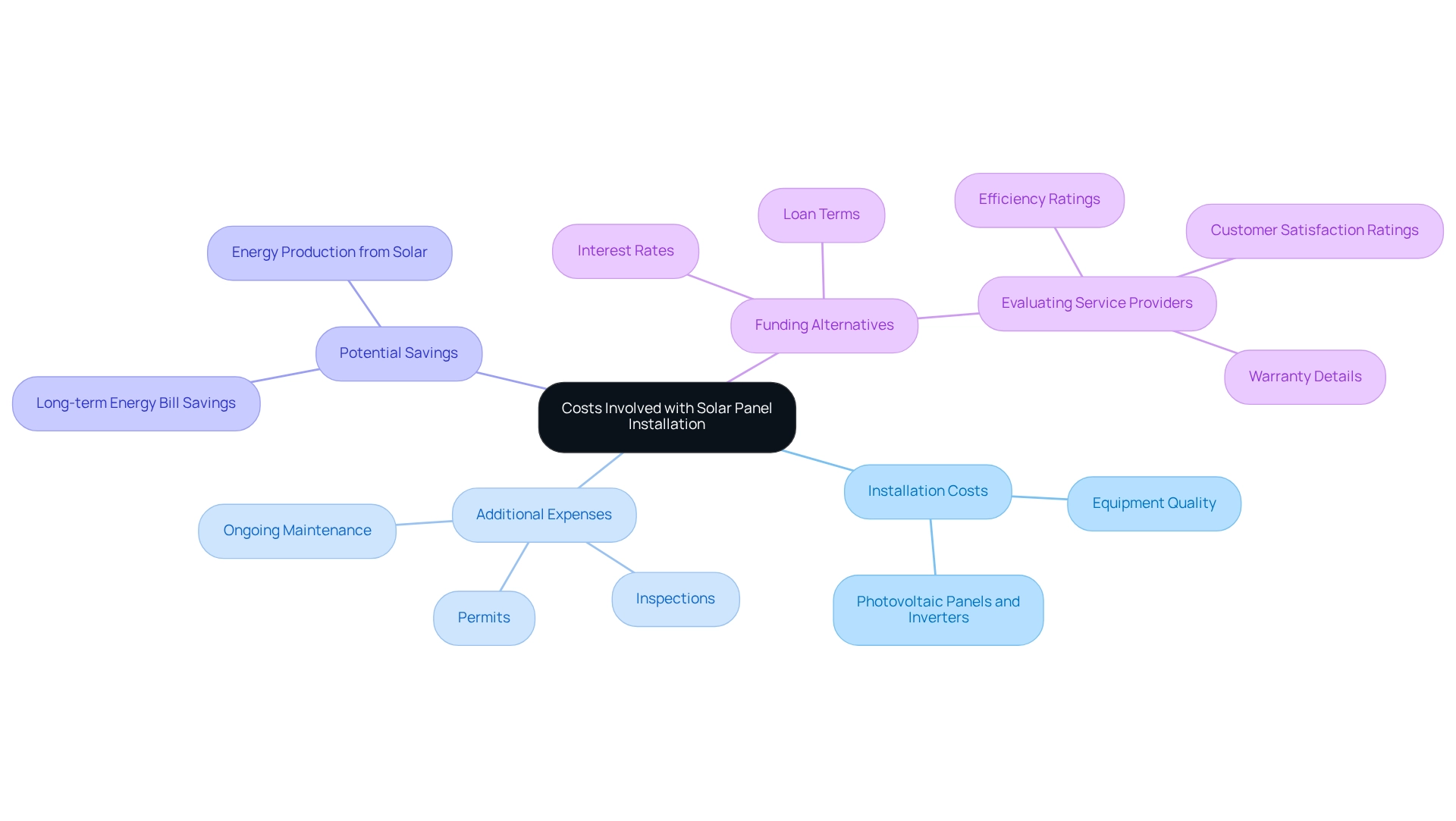

Understanding the expenses associated with panel installation is vital for homeowners, especially for those asking, can I get solar panels with bad credit? To start, we recommend obtaining estimates from various energy providers to ensure a competitive assessment of installation costs. In California, the average installation cost for residential photovoltaic panels in 2025 will be influenced by several factors, including equipment quality and efficiency. Notably, photovoltaic panels and inverters account for approximately 21% of the total cost of residential installations, highlighting the importance of balancing quality with cost-effectiveness.

In addition to the base installation costs, it’s crucial to consider additional expenses such as permits, inspections, and ongoing maintenance. These often-overlooked costs can significantly affect your overall budget, making it essential to include them in your financial calculations. We understand that hidden costs can sometimes catch homeowners off guard, which is why having a comprehensive understanding of all potential expenses is vital.

To evaluate the return on investment (ROI) for photovoltaic panels, consider calculating potential savings on energy expenses. For instance, California sourced nearly 40% of its electricity from sunlight on March 11, showcasing the potential for substantial savings. Homeowners should also factor in the costs related to renewable energy installations, including interest rates and loan terms, to determine if they can get solar panels with bad credit, as these can impact the overall affordability of the system. A thorough assessment of funding alternatives is critical to determine if can I get solar panels with bad credit, as it can greatly influence the long-term financial benefits of renewable energy.

Moreover, assessing service providers can help homeowners discover the best value in renewable power solutions. By researching and evaluating different companies, you can ensure that you are making informed decisions aligned with your financial goals. For example, consider analyzing the efficiency ratings, warranty details, and customer satisfaction ratings of various panel brands. As Andrew Blake wisely noted, “Solar power is bound to be in our future. There’s a kind of inevitability about it.” By thoughtfully evaluating these factors and following a concise step-by-step guide for installation, homeowners can make educated choices about their energy investments, ensuring they maximize their savings while transitioning to sustainable energy solutions.

Consult with Solar Experts

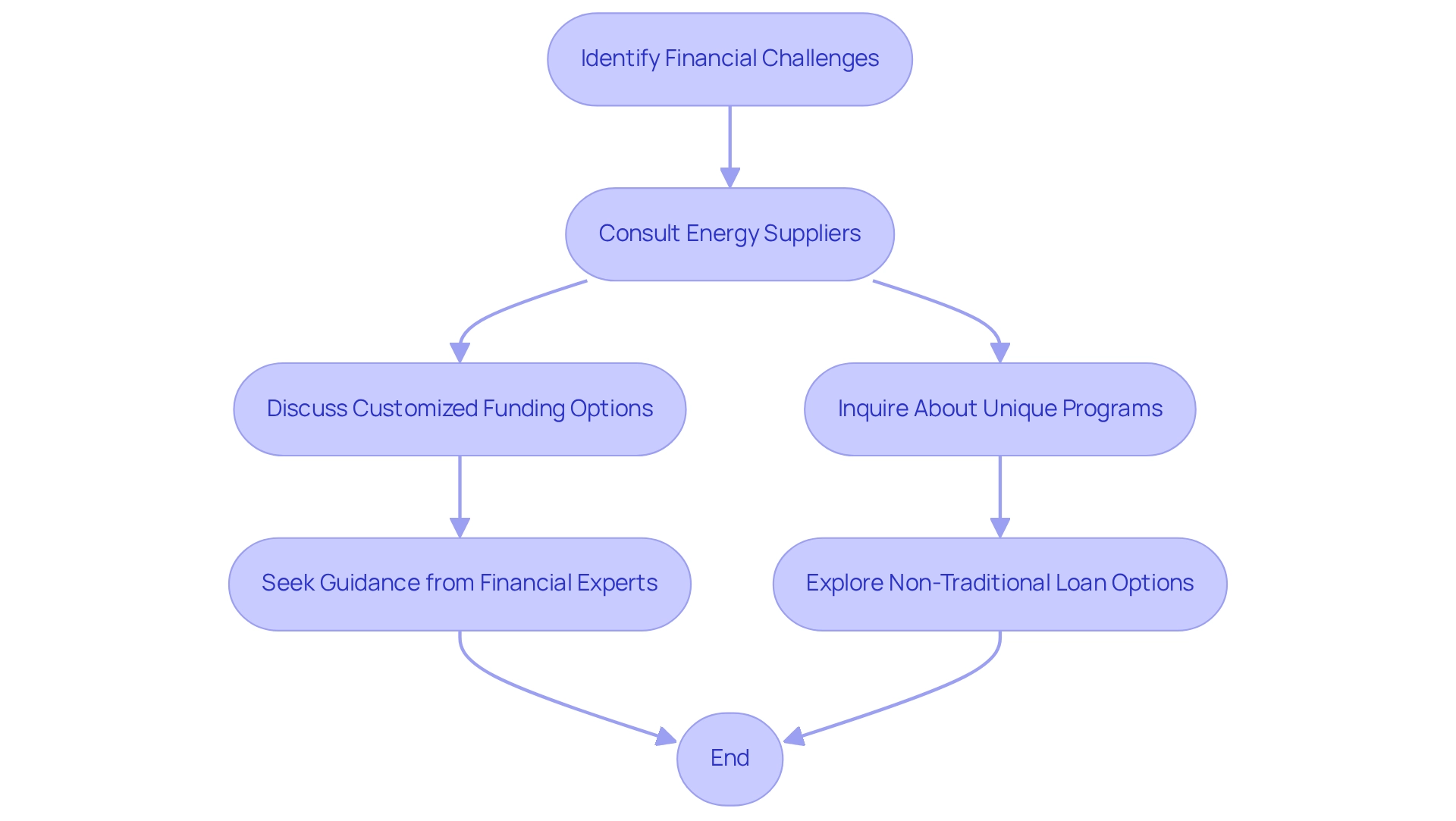

If you’re a homeowner grappling with financial challenges, you may ask, can I get solar panels with bad credit, as interacting with nearby energy suppliers can be a vital step toward relief. Consider arranging meetings to openly discuss your situation; this can lead to exploring customized funding options that may be available to you.

Many energy firms have experience working with clients who face similar financial hurdles, making them valuable resources for guidance. Have you inquired about any unique programs or partnerships these suppliers might have with lenders that can assist those asking, ‘can I get solar panels with bad credit’? A significant number of energy providers are now offering flexible funding solutions that consider factors beyond traditional evaluations, allowing you to find out if you can get solar panels with bad credit, making renewable energy more accessible for you.

As the U.S. renewable energy sector continues to grow, boasting over 50 GW of online module production capacity by early 2025, the array of funding options available to you is expanding. During your consultation, don’t hesitate to ask for a detailed breakdown of the funding options. This should encompass terms, interest rates, and any potential hidden fees that could impact your overall investment.

Furthermore, it’s wise to seek advice from a licensed financial or tax expert who can provide tailored guidance on solar loans and financing. By taking these proactive steps, you can navigate the financing landscape more effectively and discover solutions that align with your financial situation.

Homeowners with less-than-perfect credit may ask, can I get solar panels with bad credit, and exploring non-traditional loan options, such as those offered by credit unions or green banks, can unveil valuable alternatives. Together, we can find a path toward energy independence and a brighter financial future.

Conclusion

Evaluating your personal credit situation is the first essential step for homeowners like you who are considering solar financing. By understanding credit reports and scores, you can identify areas for improvement and explore financing options tailored to your unique circumstances. If you face credit challenges, community solar programs and flexible loan options can provide pathways to clean energy without the burden of upfront costs.

Specialized financing avenues, such as Power Purchase Agreements and Property Assessed Clean Energy financing, broaden your possibilities. These options not only eliminate the need for stringent credit checks but also align payments with your property value, making solar energy more accessible. As the clean energy sector continues to thrive, it’s crucial to leverage these innovative solutions together to achieve energy independence.

Understanding the costs involved in solar installations is equally important. You must consider installation expenses, potential hidden costs, and the long-term savings associated with solar energy. By conducting thorough research and obtaining multiple quotes, you can make informed decisions that align with your financial goals.

Engaging with local solar experts is a valuable strategy for navigating the complexities of solar financing. These professionals can provide tailored advice and connect you with financing options that accommodate your credit situation. By taking proactive steps and utilizing available resources, you can confidently embark on your journey towards sustainable energy solutions, ensuring a brighter and more financially secure future for yourself and your family.